IHOP 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

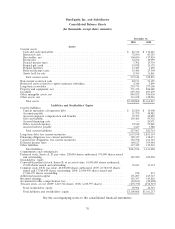

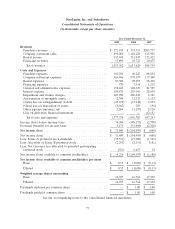

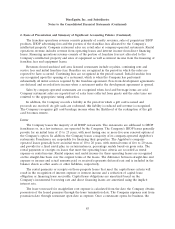

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Operations

(In thousands, except per share amounts)

Year Ended December 31,

2009 2008 2007

Revenues

Franchise revenues ................................. $ 372,198 $ 353,331 $205,757

Company restaurant sales ............................ 890,020 1,103,228 125,905

Rental income .................................... 133,845 131,347 132,422

Financing revenues ................................. 17,899 25,722 20,475

Total revenues ................................... 1,413,962 1,613,628 484,559

Costs and Expenses

Franchise expenses ................................. 102,256 96,243 88,054

Company restaurant expenses ......................... 766,466 978,197 117,448

Rental expenses ................................... 97,303 98,057 98,402

Financing expenses ................................. 370 7,314 1,215

General and administrative expenses .................... 158,469 182,239 81,597

Interest expense ................................... 186,473 203,141 28,654

Impairment and closure charges ........................ 105,094 240,630 4,381

Amortization of intangible assets ....................... 12,306 12,132 1,132

(Gain) loss on extinguishment of debt ................... (45,678) (15,242) 2,223

(Gain) loss on disposition of assets ..................... (6,947) 259 (98)

Other expense (income), net .......................... 1,266 (1,185) 2,128

Loss on derivative financial instrument ................... — — 62,131

Total costs and expenses ........................... 1,377,378 1,801,785 487,267

Income (loss) before income taxes ........................ 36,584 (188,157) (2,708)

Provision (benefit) for income taxes ...................... 5,175 (33,698) (2,228)

Net income (loss) .................................... $ 31,409 $ (154,459) $ (480)

Net income (loss) .................................... $ 31,409 $ (154,459) $ (480)

Less: Series A preferred stock dividends ................... (19,531) (19,000) (1,561)

Less: Accretion of Series B preferred stock ................. (2,291) (2,151) (181)

Less: Net (income) loss allocated to unvested participating

restricted stock .................................... (351) 6,417 34

Net income (loss) available to common stockholders .......... $ 9,236 $ (169,193) $ (2,188)

Net income (loss) available to common stockholders per share

Basic ........................................... $ 0.55 $ (10.09) $ (0.13)

Diluted ......................................... $ 0.55 $ (10.09) $ (0.13)

Weighted average shares outstanding

Basic ........................................... 16,917 16,764 17,232

Diluted ......................................... 16,917 16,764 17,232

Dividends declared per common share .................... — $ 1.00 $ 1.00

Dividends paid per common share ....................... — $ 1.00 $ 1.00

See the accompanying notes to the consolidated financial statements.

77