IHOP 2009 Annual Report Download - page 92

Download and view the complete annual report

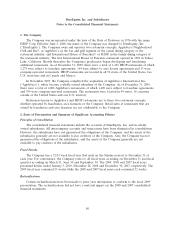

Please find page 92 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2009, the FASB amended U.S. GAAP with respect to the consolidation of variable interest

entities (‘‘VIEs’’). These amendments, among other things, (i) change existing guidance for determining

whether an entity is a VIE; (ii) require ongoing reassessments of whether an entity is the primary

beneficiary of a VIE; and (iii) require enhanced disclosures about an entity’s involvement in a VIE.

The Company will be required to adopt these amendments effective January 1, 2010. Adoption of these

amendments will not result in the identification of additional VIEs. For the VIE the Company has

currently identified (see Note 14 of Notes to the Consolidated Financial Statements), adoption will not

change the determination that the Company is not the primary beneficiary.

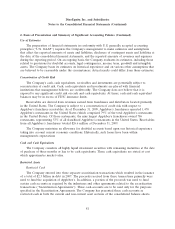

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

We are exposed to financial market risk, including interest rates and commodity prices. We address

these risks through controlled risk management that may include the use of derivative financial

instruments to economically hedge or reduce these exposures. We do not enter into financial

instruments for trading or speculative purposes.

Interest Rate Risk

Our interest income and expense is more sensitive to fluctuations in the general level of U.S.

interest rates than to changes in rates in other markets. Changes in the U.S. interest rates affect the

interest earned on our cash and cash equivalents, restricted cash and investments, and interest expense

on our variable funding notes. Our future investment income may fall short of expectations due to

changes in interest rates.

Investments in fixed interest rate earning instruments carry a degree of interest rate risk. Fixed

rate securities may have their fair market value adversely impacted due to a rise in interest rates. We

currently do not hold any fixed rate investments. As of December 31, 2009 our long-term investments

are comprised primarily of certificates of deposits, mutual funds invested in auction rate securities and

one auction rate security; these investments are included in restricted assets related to the captive

insurance subsidiary. We have classified these investments as available-for-sale. Due to the short time

period between reset dates of the interest rates, there are no unrealized gains or losses associated with

interest rate related to the auction rate securities. The one auction rate security has a contractual

maturity of December 2030. Based on our cash and cash equivalents, restricted cash and long-term

investment holdings as of December 31, 2009, a 1% increase in interest rates would increase our

annual interest income by approximately $1.4 million. A 1% decline in interest rates would decrease

our annual interest income by less than $1.4 million as the majority of our cash and cash equivalents,

restricted cash and long-term investment holdings are currently yielding less than 1%.

On July 16, 2007, we entered into an interest rate swap contract (the ‘‘Swap’’) as a condition of

the acquisition financing with Lehman Brothers Special Financial Inc. (‘‘LBSFI’’), guaranteed by

Lehman Brothers Holdings, Inc. (‘‘LBHI’’). The Swap was intended to hedge our interest payments on

the asset-backed notes that were issued in November 2007 to finance the Applebee’s acquisition. The

Swap sets forth the terms of a five-year interest rate swap in which we would be the fixed rate payer

and LBSFI would be the floating rate payer (the ‘‘Reference Swap’’). The Reference Swap has an

effective date of July 16, 2008, a notional amount of $2.039 billion, a floating rate of LIBOR and a

fixed rate of 5.694%. On November 29, 2007, we terminated the Swap upon the consummation of the

Applebee’s acquisition. The fair value of the Swap was $124.0 million. The fair value of the designated

portion of the Swap amounted to $61.9 million ($38.0 million net of tax effect) and is included as

‘‘Accumulated other comprehensive loss’’ in our consolidated balance sheet. The fair value of the

undesignated portion of the Swap resulted in additional interest expense of $62.1 million for the year

ended December 31, 2007, which was included in our consolidated statement of operations.

73