IHOP 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

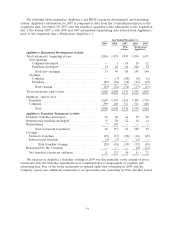

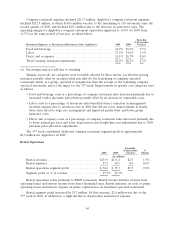

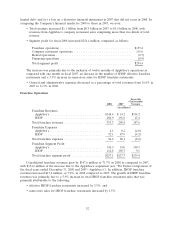

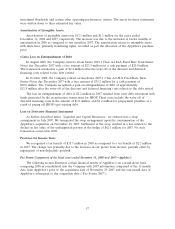

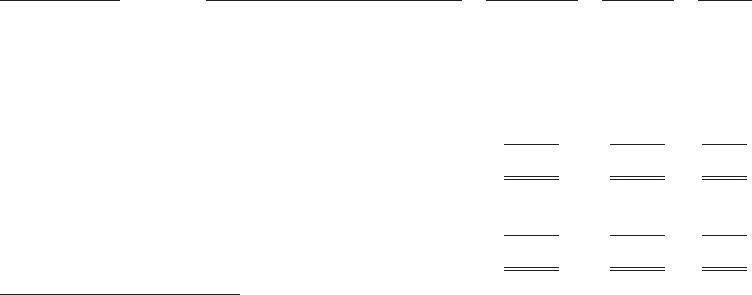

Gain on Extinguishment of Debt

During 2009 and 2008, we recognized the following gains on the early retirement of debt:

Face Amount

Transaction Date Instrument Retired Cash Paid Gain(1)

(In millions)

March, 2009 Class A-2-II-X ........... $ 78.4 $ 49.0 $26.4

May, 2009 Class A-2-II-A ........... 35.2 24.3 9.6

June, 2009 Class A-2-II-X ........... 15.6 12.1 2.8

November, 2009 Class A-2-II-X ........... 53.4 46.5 5.3

December, 2009 Class A-2-II-X ........... 17.0 15.0 1.6

Total 2009 .............. $199.6 $146.9 $45.7

August, 2008 Class A-2-II-X ........... $ 23.5 $ 20.0 $ 2.4

October, 2008 Class A-2-II-X ........... 35.2 20.0 12.8

Total 2008 .............. $ 58.7 $ 40.0 $15.2

(1) After write-off of the discount and deferred financing costs related to the debt retired.

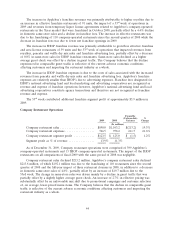

The Company intends to continue to dedicate a portion of excess cash flow towards opportunistic

debt retirement. However, the difference between the face amount of debt retired and the amount we

have paid has decreased over time and it is likely that gains on future extinguishments of debt, as a

percentage of the face amount retired, will be smaller than the average gain recognized in 2008 and

2009, if they occur at all.

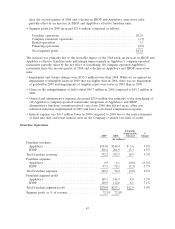

(Gain) Loss on Disposition of Assets

The Company recognized a gain on disposition of assets of $6.9 million in 2009, primarily related

to the franchising of seven Applebee’s restaurants in the New Mexico market and sale of a parcel of

land held by IHOP.

Other Expense (Income)

In 2009, other items of income and expense netted to an expense of $1.3 million compared to

income of $1.2 million in 2008. The primary reason for the change was lower interest income resulting

from significantly lower interest rates on U.S. Treasury-based investments.

Provision for Income Taxes

We recognized a tax provision of $5.2 million in 2009 as compared to a tax benefit of $33.7 million

in 2008. The change was primarily due to the increase in our pretax book income. The 2009 effective

tax rate of 14.1% applied to pretax book income was lower than the statutory Federal tax rate of 35%

primarily due to tax credits and changes in tax rates, state tax laws and unrecognized tax benefits,

partially offset by state income taxes and changes in the tax asset valuation allowance. The tax credits

are primarily FICA tip and other compensation-related tax credits associated with Applebee’s company-

owned restaurant operations and credits associated with the Applebee’s Restaurant Support Center in

Lenexa, Kansas.

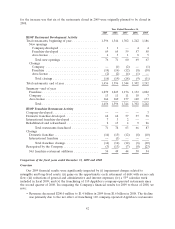

Comparison of the fiscal years ended December 31, 2008 and 2007

Our 2008 financial results were significantly impacted by (i) the inclusion of twelve months of

Applebee’s operations as compared with one month in fiscal 2007; (ii) impairment charges related to

goodwill, intangible assets and real property; (iii) increased interest expense on $2.3 billion worth of

51