IHOP 2009 Annual Report Download - page 75

Download and view the complete annual report

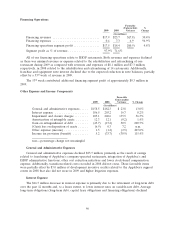

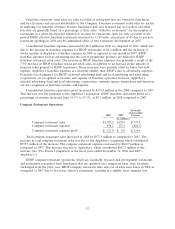

Please find page 75 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.same-store sales for company-operated stores had decreased slightly compared with the same period of

the prior year, the Company was in the process of implementing several initiatives designed to improve

the same-store sales and did not believe there had been enough time to adequately assess the

effectiveness of those initiatives; (iii) while economic data confirmed that the U.S. economy had been

recessionary since December of 2007, there was still considerable uncertainty as to the depth and

duration of the slowdown, and although Applebee’s year-to-date same-store sales were lower than the

prior period, Applebee’s decline had been less than its competitors, such that the Company believed its

internal forecasts of same-store sales growth were achievable; and (iv) the Company’s net book value

was in excess of its market capitalization throughout the third quarter ended September 30, 2008, and

while the market capitalization did decline below the Company’s net book value subsequent to

September 30, 2008, by the October 31, 2008 date of filing its Form 10-Q for the Quarterly Period

ending September 30, 2008, the Company’s net book value was in excess of its market capitalization.

In the fourth quarter of 2008, the Company completed its annual test for impairment of goodwill.

We utilized a discounted cash flows model of the income approach to assess the fair value of our three

reporting units, the IHOP franchised restaurants unit (‘‘IHOP unit’’), Applebee’s company-operated

restaurants unit (‘‘Applebee’s company unit’’) and Applebee’s franchised restaurants unit (‘‘Applebee’s

franchise unit’’). The impairment test of goodwill of the two Applebee’s units which hold the significant

majority of the total goodwill was performed as of October 31, 2008. The impairment test of the

goodwill of the IHOP unit was performed as of December 31, 2008, the date as of which the analysis

has been performed in prior years.

The first step of the impairment test compared the fair value of each of our reporting units to

their carrying value. Significant assumptions used to determine fair value under the discounted cash

flows model include future trends in sales, operating expenses, overhead expenses, depreciation, capital

expenditures and changes in working capital along with an appropriate discount rate. Additional

assumptions were made as to proceeds to be received from future franchising of company-operated

restaurants. Based on this first step, we concluded that the fair value of the IHOP unit and the

Applebee’s franchise unit was in excess of their respective net carrying values and no impairment of

goodwill was warranted. However, the fair value of the Applebee’s company unit was less than the net

carrying value of its assets assigned, requiring the second step of the impairment test. In performing the

second step of the impairment test we concluded that the goodwill allocated to the Applebee’s

company unit was fully impaired and an impairment charge of $113.5 million was recorded. No tax

benefit is associated with the impairment of goodwill.

During the fourth quarter of 2008 the commercial real estate market continued to weaken, the

credit markets continued to be constrained, economic forecasts were uncertain as to how long the

recessionary period would last, and the company’s stock price declined. The Company revised the

significant assumptions underlying the discounted cash flows model and updated its impairment analysis

of the Applebee’s franchise unit. The Company determined the fair value of the Applebee’s franchise

unit was in excess of its carrying value as of December 31, 2008.

In addition, the Company performed an impairment test of its indefinite-lived intangible assets,

primarily the Applebee’s tradename assigned in the purchase price allocation. We utilized the relief

from royalty method under the income approach to determine the fair value of the tradename. We

determined the fair value of the tradename as of December 31, 2008 was less than the carrying value.

An impairment charge of $44.1 million was recorded with a tax benefit of $17.3 million associated with

the charge.

Impairment and closure charges in 2007 included the impairment of long lived assets for three

restaurants closed in 2007, and impairment losses on two restaurants in which the reacquisition values

exceeded the historical resale values. The decision to close or impair the restaurants in 2007 was a

result of a comprehensive analysis that examined restaurants not meeting minimum return on

56