IHOP 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

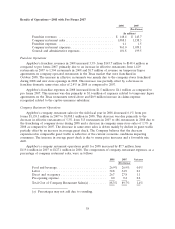

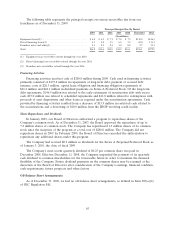

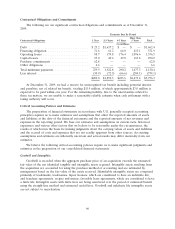

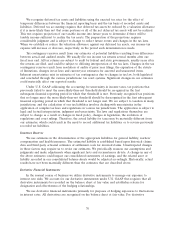

The following table represents the principal receipts on various receivables due from our

franchisees as of December 31, 2009:

Principal Receipts Due By Period

2010 2011 2012 2013 2014 Thereafter Total

(In millions)

Equipment leases(1) ........................... $6.8 $6.9 $7.1 $7.4 $7.9 $110.4 $146.5

Direct financing leases(2) ........................ 4.1 4.8 5.5 6.5 7.4 83.0 111.3

Franchise notes and other(3) ...................... 5.3 2.9 2.4 1.0 0.8 2.7 15.1

Total ..................................... $16.2 $14.6 $15.0 $14.9 $16.1 $196.1 $272.9

(1) Equipment lease receivables extend through the year 2029.

(2) Direct financing lease receivables extend through the year 2024.

(3) Franchise note receivables extend through the year 2016.

Financing Activities

Financing activities used net cash of $208.8 million during 2009. Cash used in financing activities

primarily consisted of $173.8 million in repayments of long-term debt, payment of accrued debt

issuance costs of $20.3 million, capital lease obligation and financing obligation repayments of

$16.2 million and $24.1 million in dividend payments on Series A Preferred Stock. Of the long-term

debt repayments, $146.9 million was related to the early retirement of securitzation debt with excess

cash, $15.0 million was related to scheduled repayments and $11.8 million related to redemptions with

proceeds of asset dispositions and other items as required under the securitization agreements. Cash

provided by financing activities resulted from a decrease of $15.9 million in restricted cash related to

the securitizations and a borrowing of $10.0 million from the IHOP revolving credit facility.

Share Repurchases and Dividends

In January 2003, our Board of Directors authorized a program to repurchase shares of the

Company’s common stock. As of December 31, 2007, the Board approved the repurchase of up to

7.2 million shares of common stock. The Company has repurchased 6.3 million shares of its common

stock since the inception of the program at a total cost of $280.0 million. The Company did not

repurchase shares in 2009. In February 2009, the Board of Directors cancelled the authorization to

repurchase any additional shares under this program.

The Company had accrued $0.2 million as dividends for the Series A Perpetual Preferred Stock as

of January 3, 2010, the close of fiscal 2009.

The Company’s most recent quarterly dividend of $0.25 per common share was paid in

December 2008. Effective December 11, 2008, the Company suspended the payment of its quarterly

cash dividend to common shareholders for the foreseeable future in order to maximize the financial

flexibility of the Company. Future dividend payments on the common shares may be resumed at the

discretion of the Board of Directors after consideration of the Company’s earnings, financial condition,

cash requirements, future prospects and other factors.

Off-Balance Sheet Arrangements

As of December 31, 2009, we had no off-balance sheet arrangements, as defined in Item 303(a)(4)

of SEC Regulation S-K.

65