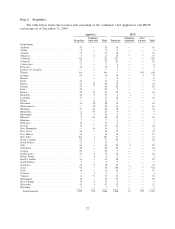

IHOP 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.schedule, in the amounts anticipated or at all, or if future borrowings are not available to us in

amounts sufficient to enable us to pay our indebtedness or to fund our other liquidity needs, our

financial condition and results of operations may be adversely affected. If we cannot generate sufficient

cash flow from operations to make scheduled interest and principal payments on our debt obligations

in the future, we may need to refinance all or a portion of our indebtedness on or before maturity, sell

assets, defer payment of Series A Preferred Stock dividends (and by so doing incur a higher dividend

rate), delay capital expenditures or seek additional equity. If we are unable to refinance our

indebtedness on commercially reasonable terms or at all, or to effect any other action relating to our

indebtedness on satisfactory terms or at all, the indebtedness will be subject to rapid amortization no

later than June 2013 because if the IHOP November 2007 securitization debt goes into rapid

amortization, the IHOP March 2007 securitization debt will go into rapid amortization even if extended

to March 2014. Under rapid amortization, all excess cash flow (after all required payments have been

made) will be deposited in the principal payment account and used to repay principal of the applicable

securitization debt.

Declines in our financial performance could result in additional impairment charges in future periods.

U.S. generally accepted accounting principles require annual (or more frequently if events or changes

in circumstances warrant) impairment tests of goodwill, intangible assets and other long-lived assets.

Generally speaking, if the carrying value of the asset is in excess of the estimated fair value of the

asset, the carrying value will be adjusted to fair value through an impairment charge. Fair values are

primarily estimated using discounted cash flows based on five-year forecasts of financial results that

incorporate assumptions as to same-store sales trends, future development plans and brand-enhancing

initiatives, among other things. Significant underachievement of forecasted results could reduce the

estimated fair value of these assets below the carrying value, requiring non-cash impairment charges to

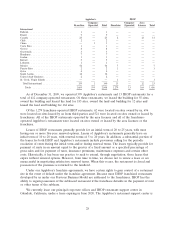

reduce the carrying value of the asset. As of December 31, 2009 our total stockholders’ equity was

$69.9 million. A significant impairment writedown of goodwill, intangible assets or long-lived assets in

the future could result in a deficit balance in stockholders’ equity. While such a deficit balance would

not create an incident of default in any of our contractual agreements, the negative perception of such

a deficit could have an adverse effect on our stock price and could impair our ability to obtain new

financing, or refinance existing indebtedness on commercially reasonable terms or at all.

The restaurant industry is highly competitive, and that competition could lower our revenues, margins

and market share. The performance of individual restaurants may be adversely affected by factors such

as traffic patterns, demographics and the type, number and location of competing restaurants. The

restaurant industry is highly competitive with respect to price, service, location, personnel and the type

and quality of food. Each Applebee’s and IHOP restaurant competes directly and indirectly with a

large number of national and regional restaurant chains, as well as similar styles of businesses. The

trend toward convergence in grocery, deli, and restaurant services may increase the number and variety

of Applebee’s and IHOP restaurants’ competitors. In addition to the prevailing baseline level of

competition, major market players in non-competing industries may choose to enter the food services

market. Such increased competition could have a material adverse effect on the financial condition and

results of operations of Applebee’s or IHOP restaurants in affected markets. Applebee’s and IHOP

restaurants also compete with other restaurant chains for qualified management and staff, and we

compete with other restaurant chains for available locations for new restaurants. Applebee’s and IHOP

restaurants also face competition from the introduction of new products and menu items by

competitors, as well as substantial price discounting, and are likely to face such competition in the

future. Although we may implement a number of business strategies, the future success of new

products, initiatives and overall strategies is highly difficult to predict and will be influenced by

competitive product offerings, pricing and promotions offered by competitors. Our ability to

differentiate the Applebee’s and IHOP brands from their competitors, which is in part limited by the

advertising monies available to us and by consumer perception, cannot be assured. These factors could

reduce the gross sales or profitability at Applebee’s or IHOP restaurants, which would reduce the

18