IHOP 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

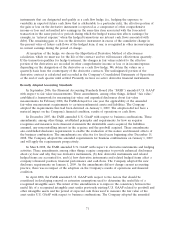

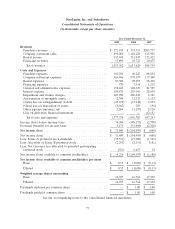

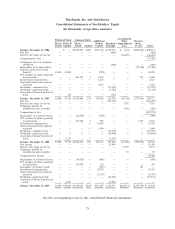

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Stockholders’ Equity

(In thousands, except share amounts)

Accumulated

Preferred Stock Common Stock Additional Other Treasury

Shares Series B Shares Paid-in Retained Comprehensive Stock,

Issued Amount Issued Amount Capital Earnings Loss at cost Total

Balance, December 31, 2006 . . . — $ — 22,818,007 $227 $131,748 $ 358,975 $ (133) $(201,604) $ 289,213

Net loss ............... — — — — — (480) — — (480)

Interest rate swap, net of tax . . — — — — — — (36,605) — (36,605)

Comprehensive loss ........ (37,085)

Cumulative effect of adoption

of FIN 48 ............. — — — — — (489) — — (489)

Repurchase of treasury shares . — — — — — — — (77,020) (77,020)

Issuance of preferred stock

Series B ..............35,000 35,000 — — (750) — — — 34,250

Net issuance of shares pursuant

to stock plans .......... — — 541,657 3 8,925 — — 970 9,898

Stock-based compensation .... — — — — 6,165 — — — 6,165

Tax benefit from stock options

exercised ............. — — — — 3,476 — — — 3,476

Dividends—common stock .... — — — — — (17,293) — — (17,293)

Dividends—preferred stock . . . — — — — — (1,742) — — (1,742)

Accretion of Series B preferred

stock ................ — 181 — — — (181) — — —

Balance, December 31, 2007 . . . 35,000 35,181 23,359,664 230 149,564 338,790 (36,738) (277,654) 209,373

Net loss ............... — — — — — (154,459) — — (154,459)

Interest rate swap, net of tax . . — — — — — — 7,716 — 7,716

Temporary decline in

available-for-sale securities . . — — — — — — (386) — (386)

Comprehensive loss ........ (147,129)

Repurchase of restricted shares . — — (18,274) — (540) — — — (540)

Net issuance of shares pursuant

to stock plans .......... — — 355,560 7 982 — — 1,135 2,124

Stock-based compensation .... — — — — 13,445 — — — 13,445

Tax benefit from stock options

exercised ............. — — — — 1,864 — — — 1,864

Dividends—common stock .... — — — — — (17,370) — — (17,370)

Dividends—preferred stock . . . — — — — — (19,000) — — (19,000)

Accretion of Series B preferred

stock ................ — 2,151 — — — (2,151) — — —

Balance, December 31, 2008 . . . 35,000 37,332 23,696,950 237 165,315 145,810 (29,408) (276,519) 42,767

Net income ............. — — — — — 31,409 — 31,409

Interest rate swap, net of tax . . — — — — — — 8,507 — 8,507

Temporary decline in

available-for-sale securities . . — — — — — — 90 — 90

Comprehensive income ...... 40,006

Repurchase of restricted shares . — — (50,927) — (605) — — — (605)

Net issuance of shares pursuant

to stock plans .......... — — 133,992 1 323 — — — 324

Reissuance of treasury stock . . — — — — (769) — — 769 —

Stock-based compensation .... — — — — 10,710 — — — 10,710

Tax benefit from stock options

exercised ............. — — — — (3,767) — — — (3,767)

Dividends—preferred stock . . . — — — — — (19,531) — — (19,531)

Accretion of Series B preferred

stock ................ — 2,291 — — — (2,291) — — —

Balance, December 31, 2009 . . . 35,000 $39,623 23,780,015 $238 $171,207 $ 155,397 $(20,811) $(275,750) $ 69,904

See the accompanying notes to the consolidated financial statements.

78