IHOP 2009 Annual Report Download - page 90

Download and view the complete annual report

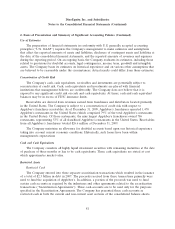

Please find page 90 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.instruments that are designated and qualify as a cash flow hedge (i.e., hedging the exposure to

variability in expected future cash flows that is attributable to a particular risk), the effective portion of

the gain or loss on the derivative instrument is reported as a component of other comprehensive

income or loss and reclassified into earnings in the same line item associated with the forecasted

transaction in the same period or periods during which the hedged transaction affects earnings (for

example, in ‘‘interest expense’’ when the hedged transactions are interest cash flows associated with

debt). The remaining gain or loss on the derivative instrument in excess of the cumulative change in

the present value of future cash flows of the hedged item, if any, is recognized in other income/expense

in current earnings during the period of change.

At inception of the hedge, we choose the Hypothetical Derivative Method of effectiveness

calculation, which we must use for the life of the contract and we will measure effectiveness quarterly.

If the transaction qualifies for hedge treatment, the changes in fair values related to the effective

portion of the derivatives are recorded in other comprehensive income or loss or in income/expense,

depending on the designation of the derivative as a cash flow hedge. We obtain the values on a

quarterly basis from the counterparty of the derivative contracts. The undesignated portion of the

derivative contract is calculated and recorded in the Company’s Consolidated Statements of Operations

at the end of each quarter until settled. Presently we have no active derivative financial instruments.

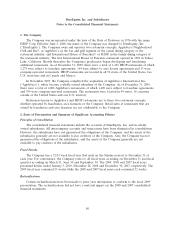

Recently Adopted Accounting Standards

In September 2006, the Financial Accounting Standards Board (the ‘‘FASB’’) amended U.S. GAAP

with respect to fair value measurements. These amendments, among other things, defined ‘‘fair value,’’

established a framework for measuring fair value and expanded disclosures about fair value

measurements. In February 2008, the FASB delayed for one year the applicability of the amended

fair-value measurement requirements to certain nonfinancial assets and liabilities. The Company

adopted the requirements that had been deferred on January 1, 2009. The adoption did not have a

material impact on the Company’s financial condition, results of operations or cash flows.

In December 2007, the FASB amended U.S. GAAP with respect to business combinations. These

amendments, among other things, established principles and requirements for how an acquirer

recognizes and measures in its financial statements the identifiable assets acquired, the liabilities

assumed, any noncontrolling interest in the acquiree and the goodwill acquired. These amendments

also established disclosure requirements to enable the evaluation of the nature and financial effects of

the business combination. The amendments are effective for fiscal years beginning after December 15,

2008. The Company adopted the amended requirements for business combinations on January 1, 2009

and will apply the requirements prospectively.

In March 2008, the FASB amended U.S. GAAP with respect to derivative instruments and hedging

activities. These amendments, among other things, require companies to provide enhanced disclosures

about (a) how and why they use derivative instruments, (b) how derivative instruments and related

hedged items are accounted for, and (c) how derivative instruments and related hedged items affect a

company’s financial position, financial performance and cash flows. The Company adopted the new

disclosure requirements on January 1, 2009. As the amendments did not change current accounting

practice, there was no impact of the adoption on the Company’s results of operations and financial

condition.

In April 2008, the FASB amended U.S. GAAP with respect to the factors that should be

considered in developing renewal or extension assumptions used to determine the useful life of a

recognized intangible asset. The intent of the amendments is to improve the consistency between the

useful life of a recognized intangible asset under previously existing U.S. GAAP related to goodwill and

other intangible assets and the period of expected cash flows used to measure the fair value of the

asset under U.S. GAAP with respect to business combinations. The Company adopted the amended

71