IHOP 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

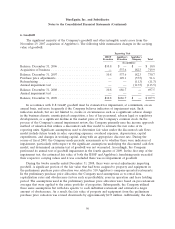

6. Goodwill (Continued)

used to estimate the capitalization rate in the preliminary allocation was based in part on industry data,

the reporting of which lagged the actual timing by several months. Once data on capitalization rates

being utilized in late November 2007 became available, the Company updated the capitalization rate

assumptions accordingly. As a result of this additional information on capitalization rates the estimated

fair value of property and equipment was revised downwards approximately $14 million. The

corresponding offset to these revisions was an increase to goodwill of $91.5 million, net of deferred

taxes, recorded in 2008.

After the revisions to the estimated purchase price allocation, the goodwill arising from the

acquisition of Applebee’s totaled $811.5 million, of which $124.8 million was assigned to Applebee’s

company-operated restaurant reporting unit (the ‘‘Company unit’’) and $686.7 million to Applebee’s

franchise reporting unit (the ‘‘franchise unit’’). Consistent with the Company’s intent to franchise the

significant majority of the company-operated Applebee’s restaurants acquired on November 29, 2007,

the Company determined the fair value of the Company unit for purposes of assigning goodwill to be

the estimated sales value of the restaurants, the value that a market participant would have paid to

purchase the restaurants on the day following the acquisition. The fair value of the Company unit was

based on a multiple of approximately six times the operating cash flow for the trailing twelve months of

the company unit. This multiple was supported by actual refranchising transactions negotiated within a

month after the acquisition. The fair value of the franchise unit was determined using a discounted

cash flow based on forecast royalty revenues from the franchise operations. These fair values, which

reconciled to the overall purchase price paid to acquire Applebee’s, were then used to assign goodwill

between the reporting units as the excess of the estimated fair value of over the carrying value (as of

November 29, 2007) of each reporting unit. The goodwill resulting from this acquisition is not expected

to be deductible for tax purposes.

During 2008 the Company completed several refranchising transactions involving components of

the Company unit (see Note 4, Assets Held For Sale). The goodwill of the Company unit was reduced

by $11.3 million for the goodwill allocated to these restaurants.

In performing the 2008 annual impairment test of goodwill, the Company concluded the remaining

goodwill allocated to the Company unit was fully impaired and an impairment charge of $113.5 million

was recorded (see Note 17, Impairment and Closure Charges).

97