IHOP 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

3. Receivables (Continued)

and 8.77% per annum at December 31, 2009 and 2008, respectively, and are collateralized by the

franchise. The term of an equipment lease contract coincides with the term of the corresponding

restaurant building lease. Equipment lease contracts are due in equal weekly installments, primarily

bear interest averaging 10.15% and 10.11% per annum at December 31, 2009 and 2008, respectively,

and are collateralized by the equipment. Where applicable, franchise fee notes, equipment contracts

and building leases contain cross-default provisions wherein a default under one constitutes a default

under all. There is not a disproportionate concentration of credit risk in any geographic area.

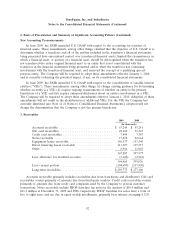

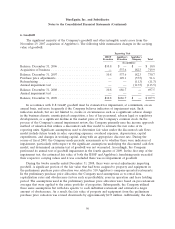

The following table summarizes the activity in the allowance for doubtful accounts:

Allowance for Doubtful Accounts

(In thousands)

Balance at December 31, 2006 ........................................... $1,359

Provision ......................................................... 2,039

Charge-offs ....................................................... (399)

Balance at December 31, 2007 ........................................... 2,999

Provision ......................................................... 1,280

Charge-offs ....................................................... (1,548)

Recoveries ........................................................ 210

Balance at December 31, 2008 ........................................... 2,941

Provision ......................................................... 1,645

Charge-offs ....................................................... (1,279)

Recoveries ........................................................ 115

Balance at December 31, 2009 ........................................... $3,422

4. Assets Held For Sale

The Company classifies assets as held for sale and ceases the depreciation of the assets when there

is a plan for disposal of the assets and those assets meet the held for sale criteria as defined in

U.S. GAAP. Reacquired franchises, property and equipment and other assets held for sale are

accounted for on the specific identification basis.

Reacquired franchises

For reacquired franchises, the Company records the franchise and equipment at the lower of

(1) the sum of the franchise receivables and costs of reacquisition, or (2) the estimated net realizable

value at the reacquisition date. Pending the sale of such franchise, the carrying value is amortized

ratably over the remaining life of the asset or lease, and the estimated net realizable value is evaluated

in conjunction with our impairment evaluation of long-lived assets. There was $469,000 in reacquired

franchises and equipment included in assets held for sale at December 31, 2009 and none at

December 31, 2008.

93