Chrysler 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

Fiat Group Consolidated Financial Statements at December 31, 2005 - N otes to the Consolidated Financial Statements

a currency other than the functional currency of the entity entering

into that transaction and the foreign currency risk will affect the

consolidated financial statements.The amendment also specifies that

if the hedge of a forecast intragroup transaction qualifies for hedge

accounting, any gain or loss that is recognised directly in equity in

accordance with the hedge accounting rules in IAS 39 must be

reclassified into income statement in the same period or periods

during which the foreign currency risk of the hedged transaction

affects consolidated income statement.The Group already adopt this

approach.

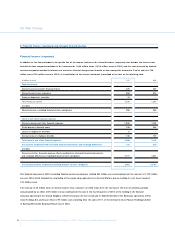

In June 2005, the IASB issued the final amendment to IAS 39 -

Financial Instruments: Recognition and M easurement to restrict the use

of the option to designate any financial asset or any financial liability

to be measured at fair value through profit and loss (the ‘fair value

option’).The revisions limit the use of the option to those financial

instruments that meet certain conditions.Those conditions are that:

the fair value option designation eliminates or significantly reduces

an accounting mismatch;

a group of financial assets, financial liabilities, or both are managed

and their performance is evaluated on a fair value basis in

accordance with a documented risk management or investment

strategy;and

an instrument contains an embedded derivative that meets

particular conditions.

This amendment to IAS 39 is effective for annual periods beginning

on or after January 1, 2006.The Group is currently assessing the

impact, if any, that this change will have.

In August 2005, the IASB issued IFRS 7 - Financial Instruments:

Disclosures and a complementary amendment to IAS 1-Presentation

of Financial Statements - Capital D isclosures. IFRS 7 requires

disclosures about the significance of financial instruments for an

entity’s financial position and performance.These disclosures

incorporate many of the requirements previously in IAS 32 - Financial

Instruments: Disclosure and Presentation. IFRS 7 also requires

information about the extent to which the entity is exposed to risks

arising from financial instruments, and a description of management’s

objectives, policies and processes for managing those risks.The

amendment to IAS 1 introduces requirements for disclosures about

an entity’s capital.

IFRS 7 and the amendment to IAS 1 are effective for annual periods

beginning on or after January 1, 2007.The Fiat Group early adopted

IFRS 7 for the annual period beginning January 1, 2005: comparative

information for the disclosures required by paragraphs 31-42 of this

Standard are not provided, in accordance with the transition rules

included in paragraph 44.

In August 2005, the IASB issued amended requirements for financial

guarantee contracts, in the form of limited amendments to IAS 39

and IFRS 4.The amendments require that issuers of financial

guarantee contracts include the resulting liabilities in their financial

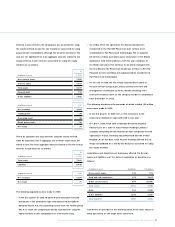

statement, measured as follows:

initially at fair value;

subsequently at the higher of (i) the best estimate of the

expenditure required to settle the present obligation at the balance

sheet date in accordance with IAS 37 - Provisions, Contingent

Liabilities and Contingent Assets and (ii) the amount initially

recognised less, where appropriate, cumulative amortisation

recognised in accordance with IAS 18 - Revenue.

These amendments are effective for annual periods beginning on or

after January 1, 2006. Management is currently assessing the impact,

if any, that these changes will have.

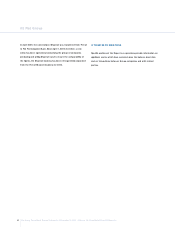

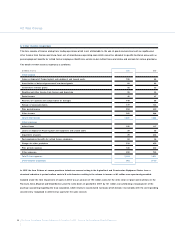

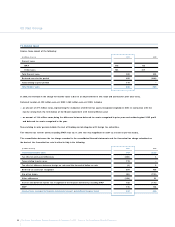

RISK MAN AGEMEN T

Credit risk

The Group’s credit concentration risk is different, as a function of the

activities carried out by the individual sectors and as a function of the

various sales markets in which the Group operates;in both cases,

however, the risk is mitigated by the large number of counterparties

and customers. Considered from a global point of view, however,

there is a concentration of credit risk in trade receivables and

receivables from financing activities, in particular dealer financing and

finance leases in the European Union market for the Fiat Auto and

Commercial Vehicles Sectors, and in N orth America for the

Agricultural and Construction Equipment Sector.

Financial assets are recognised in the balance sheet net of write-downs

for the risk that counterparties will be unable to fulfil their contractual

obligations, determined on the basis of the available information as to

the creditworthiness of the customer and historical data.