Chrysler 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 Reporton Operations Financial Review of the Group

01 Report on Operations

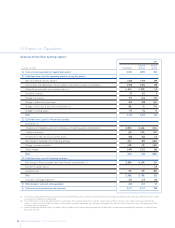

BALANCE SHEET OF THE GROUP AT DECEMBER 31, 2005

At December 31, 2005 total assets amounted to 62,454 million euros, substantially in line with the figure of 62,522 million euros

at December 31, 2004.

During the year non-current assets increased by 438 million euros. In particular, increases were reported in “Intangible assets” (+365 million

euros), mainly due to the euro/dollar translation impact on CNH goodwill, in “Property, plant and equipment” (+1,569 million euros), largely

attributable to the consolidation of the powertrain operations in Fiat Auto following the unwinding of the joint ventures with General Motors,

and in “Leased assets” (+514 million euros), as a result of the consolidation of Leasys activities.These increases were offset by the decrease

(-1,692 million euros) in “Equity investments and other fixed assets”, mainly due to the abovementioned unwinding of the joint ventures

(approximately 1.2 billion euros in carrying value at December 31, 2004) and the sale of the investment in Italenergia Bis (carrying amount

of 856 million euros) at the beginning of September, and a decrease in deferred tax assets (-298 million euros).

Receivables from financing activities at December 31, 2005 amounted to 15,973 million euros with a decrease of 1,525 million euros

from December 31, 2004. If the following are excluded:

adecrease of approximately 2.4 billion euros due to the deconsolidation of certain Iveco financial services companies, which were sold

in the first half of 2005 following the set-up of the Iveco Finance Holdings joint-venture with Barclays;

adecrease of approximately 0.6 billion euros in financial receivables from associated companies, mainly due to the mentioned consolidation

of Leasys;

the positiveeffect of foreign currency translation differences amounting to approximately 1.4 billion euros (mainly relating to CNH activities);

and the writedowns made of approximately130 million euros,

the residual change consisted of an increase of approximately250 million euros. The higher levels of activity at CNH and Fiat Auto, and

the related increase in the loans provided to the dealer network and end-customers, were offset by the reduction in factoring activities with

Fiat Auto suppliers and the collection of other financial receivables.

Working capital, net of the items connected with sales of vehicles with buy-back commitments, is negative by 249 million euros, a 191 million

euro increase with respect to December 31, 2004, when it was negativeby 440 million euros.

Net Inventories grew by 647 million euros.The increase is attributable for approximately 480 million euros to foreign currency translation

differences (mainly appreciation of the dollar against the euro) and the consolidation of the powertrain operations of the former joint-venture

with GM.The remaining increase of approximately 170 million euros is mainly attributable to the Production Systems Sector due to lower

advances received for contract work in progress and new contracts in consequence of stiffer competition on the market.

(in millions of euros) At 12.31.2005 At 12.31.2004 Change

Inventories (1) 7,133 6,486 647

Trade receivables 4,969 5,491 -522

Trade payables (11,777) (11,697) -80

Other receivables/(payables), Accruals and deferrals (2) (574) (720) 146

Working capital (249) (440) 191

(1) “Inventories” are shown net of the value of vehicles sold with buy-back commitments by Fiat Auto.

(2) ”Other payables” included in the balance of “Other receivables/(payables), Accruals and deferrals”, exclude amounts due to customers corresponding to the buy-back price due upon expiration of

the related contracts and the amount of the fees paid in advance by customers for vehicles sold with buy-back commitments, which is equal to the difference at the date of signing the contract

between the sales price and the buy-back price and which is allocated over the term of the entire agreement.

The overall decrease in trade receivables totalled 522 million euros and is essentially attributable to an increase in sales of receivables

without recourse.