Chrysler 2005 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

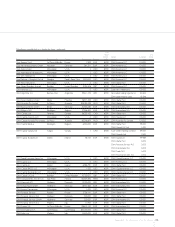

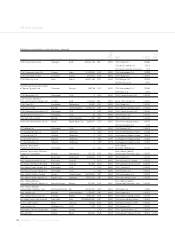

166 Appendix 1 Transition to International Financial Reporting Standards (IFRS)

02 Fiat Group

reduced by 266 million euros by the amount corresponding to the

unrealised intercompany profit in inventory held by SCD R on that

date;this amount did not change significantly at the end of 2004.

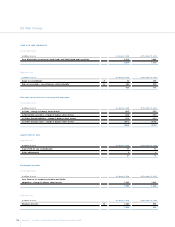

G. Property, plant and equipment

Under Italian GAAP and IFRS, assets included in Property, Plant and

Equipment were generally recorded at cost, corresponding to the

purchase price plus the direct attributable cost of bringing the assets

to their working condition.

Under Italian GAAP, Fiat revalued certain Property, Plant and

Equipment to amounts in excess of historical cost, as permitted or

required by specific laws of the countries in which the assets were

located.These revaluations were credited to stockholders’ equity and

the revalued assets were depreciated over their remaining useful

lives.

Furthermore, under Italian GAAP, the land directly related to

buildings included in Property, Plant and Equipment was depreciated

together with the related building depreciation.

The revaluations and land depreciation are not permitted under IFRS.

Therefore IFRS stockholders’ equity at January 1, 2004 reflects a

negative impact of 164 million euros, related to the effect of the

elimination of the asset revaluation recognised in the balance sheet,

partially offset by the reversal of the land depreciation charged to

prior period income statements.

In the 2004 IFRS income statement, the above-mentioned

adjustments had a positive impact of 14 million euros in 2004 due to

the reversal of the depreciation of revalued assets, net of adjustments

on gains and losses, if any, on disposal of the related assets, and to

the reversal of land depreciation.

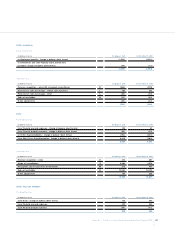

H .W rite-off of deferred costs

Under Italian GAAP, the Group deferred and amortised certain costs

(mainly start-up and related charges). IFRS require these to be

expensed when incurred.

In addition, costs incurred in connection with share capital increases,

which are also deferred and amortised under Italian GAAP, are

deducted directly from the proceeds of the increase and debited to

stockholders’ equity under IFRS.

I. Impairment of assets

Under Italian GAAP, the Group tested its intangible assets with

indefinite useful lives (mainly goodwill) for impairment annually by

comparing their carrying amount with their recoverable amount in

terms of the value in use of the asset itself (or group of assets). In

determining the value in use the Group estimated the future cash

inflows and outflows of the asset (or group of assets) to be derived

from the continuing use of the asset and from its ultimate disposal,

and discounted those future cash flows. If the recoverable amount

was lower than the carrying value, an impairment loss was

recognized for the difference.

W ith reference to tangible fixed assets, under Italian GAAP the

Group accounted for specific write-offs when the asset was no

longer to be used. Furthermore, in the presence of impairment

indicators, the Group tested tangible fixed assets for impairment

using the undiscounted cash flow method in determining the

recoverable amount of homogeneous group of assets. If the

recoverable amount thus determined was lower than the carrying

value, an impairment loss was recognised for the difference.

Under IFRS, intangible assets with indefinite useful lives are tested for

impairment annually by a methodology substantially similar to the

one required by Italian GAAP. Furthermore, development costs,

capitalised under IFRS and expensed under Italian GAAP, are

attributed to the related cash generating unit and tested for

impairment together with the related tangible assets, applying the

discounted cash flow method in determining their recoverable

amount.

Consequently, the reconciliation between Italian GAAP and IFRS

reflects adjustments due to both impairment losses on development

costs previously capitalised for IFRS purposes, and the effect of

discounting on the determination of the recoverable amount of

tangible fixed assets.

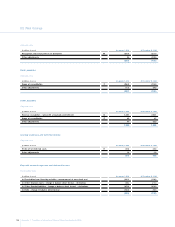

L. Reserves for risks and charges

Differences between Italian GAAP and IFRS refer mainly to the

following items:

Restructuring reserve:the Group provided restructuring reserves

based upon management’s best estimate of the costs to be

incurred in connection with each of its restructuring programs at