Chrysler 2005 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

216 Fiat S.p.A. Financial Statements at December 31, 2005 - N otes to the Financial Statements

03 Fiat S.p.A.

N otes to the Financial Statements

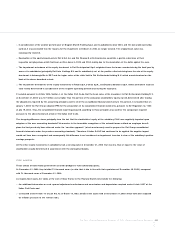

ACCO UN TIN G PRIN CIPLES AN D METHO DS

The statutory financial statements at D ecember 31, 2005, which

include the Balance Sheet, the Income Statement and the N otes

to the financial statements, have been prepared in compliance with

the provisions of the Italian Civil Code and provide the additional

information required by CO N SO B.

As envisaged in Legislative D ecree N o. 127/1991 the Group has

prepared consolidated financial statements.

The valuation criteria used, which are illustrated below, are consistent

with those used in the past fiscal year and comply with the provisions

of Article 2426 of the Italian Civil Code.

In particular:

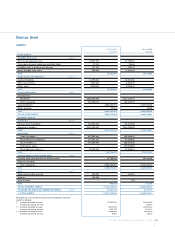

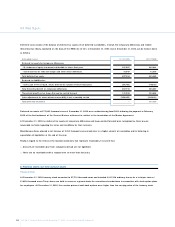

Balance Sheet

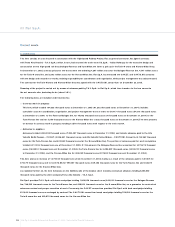

Intangible fixed assets

Start-up and expansion costs consist of costs incurred in connection

with capital increases.They are capitalised on the basis of their estimated

useful life.They are amortised on a straight-line basis over five years.

Trademarks are recorded at a value that reflects only the costs

incurred for their realisation and the administrative procedure for

their registration.To ensure a conservative valuation, this amount

is amortised on a straight-line basis over three years.

The other intangible fixed assets are represented by costs expected

to benefit future periods and are amortised systematically over the

period to be benefited.

Property, plant and equipment

Property, plant and equipment is recorded at acquisition cost plus

directly attributable charges.As indicated in a separate schedule,

the value of some of these assets includes the inflation adjustments

required under the pertinent laws. Improvement costs are added

to the value of the assets in question only when they permanently

increase their value or useful life. Depreciation is computed on a

straight-line basis at rates deemed adequate in view of the estimated

useful life of the assets. For assets acquired during the fiscal year,

the annual depreciation is taken at half the regular rate.The cost of

maintenance and repairs is charged directly to income when incurred.

Financial fixed assets

Financial fixed assets include equity investments and other securities.

Equity investments are stated in the balance sheet at their historical

cost and, more exactly, on the basis of the costs incurred or, when

business operations are transferred, at the values set forth in the

respective contracts in accordance with the appraisals required

by law, determined by the LIFO method with annual adjustments.

As shown in a separate schedule, some of these assets have been

adjusted for inflation, as required by the pertinent laws.

Equity investments in companies that show a permanent impairment

in value are written down accordingly.

If in subsequent fiscal years the reasons for these adjustments are

no longer valid, the writedowns are reversed. N o reversals are made

for writedowns recognised prior to the effective date of Legislative

Decree N o. 127/1991.

O ther securities include securities shown at their net purchase price,

adjusted for the accrual of any premium or discount earned or

incurred upon issuance or purchase, because the securities, which are

pledged to fund scholarship grants, are not held for trading purposes.

Inventories

Inventories include contract work in progress and advances to

suppliers.

W ork in progress relates to long-term contracts (contracts signed

between Fiat and Treno Alta Velocità – T.A.V. S.p.A. in connection with

the High-Speed Railway Project, described in N ote 4) and is valued

on the basis of the respective production cost.

Amounts received from the client company T.A.V. S.p.A. while work is

in progress are treated as a form of financing and are included among

the liabilities under advances, while those paid to the subcontracting

consortia are booked under inventories – advances to suppliers.

Revenues are booked when the work is actually delivered and

accepted by customers.

Treasury stock

Treasury stock is valued at the lower of its purchase cost (calculated

using the LIFO method in annual instalments) and its market value, or