Chrysler 2005 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

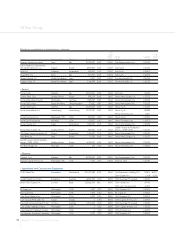

164 Appendix 1 Transition to International Financial Reporting Standards (IFRS)

02 Fiat Group

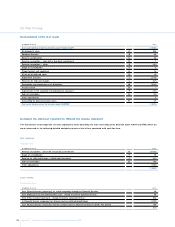

D. Revenue recognition - sales with a buy-back commitment

Under Italian GAAP, the Group recognised revenues from sales of

products at the time title passed to the customer, which was

generally at the time of shipment. For contracts for vehicle sales with

a buy-back commitment at a specified price, a specific reserve for

future risks and charges was set aside based on the difference

between the guaranteed residual value and the estimated realisable

value of vehicles, taking into account the probability that such option

would be exercised.This reserve was set up at the time of the initial

sale and adjusted periodically over the period of the contract.The

costs of refurbishing the vehicles, to be incurred when the buy-back

option is exercised, were reasonably estimated and accrued at the

time of the initial sale.

Under IAS 18 – Revenue, new vehicle sales with a buy-back

commitment do not meet criteria for revenue recognition, because

the significant risks and rewards of ownership of the goods are not

necessarily transferred to the buyer. Consequently, this kind of

contract is treated in a manner similar to an operating lease

transaction. More specifically, vehicles sold with a buy-back

commitment are accounted for as Inventory if they regard the Fiat

Auto business (agreements with normally a short-term buy-back

commitment) and as Property, plant and equipment if they regard

the Commercial Vehicles business (agreements with normally a long-

term buy-back commitment).The difference between the carrying

value (corresponding to the manufacturing cost) and the estimated

resale value (net of refurbishing costs) at the end of the buy-back

period, is depreciated on a straight-line basis over the duration of the

contract.The initial sale price received is accounted for as a liability.

The difference between the initial sale price and the buy-back price is

recognised as rental revenue on a straight-line basis over the

duration of the contract.

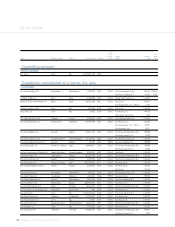

O pening IFRS stockholders’ equity at January 1, 2004 includes a

negative impact of 180 million euros mainly representing the portion

of the margin accounted for under Italian GAAP on vehicles sold

with a buy-back commitment prior to January 1, 2004, that will be

recognised under IFRS over the remaining buy-back period, net of

the effects due to the adjustments to the provisions for vehicle sales

with a buy-back commitment recognised under Italian GAAP.

This accounting treatment results in increases in the tangible assets

reported in the balance sheet (1,001 million euros at January 1, 2004

and 1,106 million euros at December 31, 2004), in inventory

(608 million euros at January 1, 2004 and 695 million euros at

December 31, 2004), in advances from customers (equal to the

operating lease rentals prepaid at the date of initial sale and

recognised in the item O ther payables), as well as in Trade payables,

for the amount of the buy-back price, payable to the customer when

the vehicle is bought back. In the income statement, a significant

impact is generated on revenues (reduced by 1,103 million euros in

2004) and on cost of sales (reduced by 1,090 million euros in 2004),

while no significant impact is generated on the net operating result;

furthermore, the amount of these impacts in future years will depend

on the changes in the volume and characteristics of these contracts

year-over-year. N otwithstanding this, these changes are not expected

to have a particularly significant impact on Group reported earnings

in the coming years.

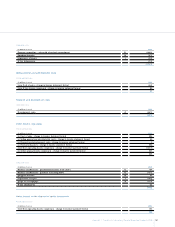

E. Revenue recognition – Other

Under Italian GAAP the recognition of disposals is based primarily

on legal and contractual form (transfer of legal title).

Under IFRS, when risks and rewards are not substantially

transferred to the buyer and the seller maintains a continuous

involvement in the operations or assets being sold, the transaction

is not recognized as a sale.

Consequently, certain disposal transactions, such as the disposal of

the 14% interest in Italenergia Bis and certain minor real estate

transactions, have been reversed retrospectively:the related asset has

been recognised in the IFRS balance sheet, the initial gain recorded

under Italian GAAP has been reversed and the cash received at the

moment of the sale has been accounted for as a financial liability.

In particular, in 2001 the Group acquired a 38.6% shareholding in

Italenergia S.p.A., now Italenergia Bis S.p.A. (“Italenergia”), a company

formed between Fiat, Electricité de France (“EDF”) and certain

financial investors for the purpose of acquiring control of the

Montedison - Edison (“Edison”) group through tender offers.

Italenergia assumed effective control of Edison at the end of the third

quarter of that year and consolidated Edison from O ctober 1, 2001.

In 2002 the shareholders of Italenergia entered into agreements

which resulted, among other things, in the transfer of a 14% interest

in Italenergia from Fiat to other shareholders (with a put option that

would require Fiat to repurchase the shares transferred in certain

circumstances) and the assignment to Fiat of a put option to sell its