Chrysler 2005 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

223

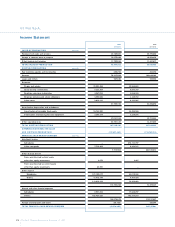

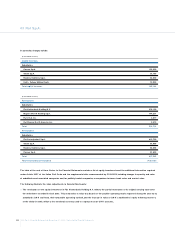

Fiat S.p.A. Financial Statements at D ecember 31, 2005 - N otes to the Financial Statements

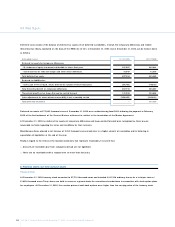

In consideration of the positive performance of Magneti Marelli Holding S.p.A. and its subsidiaries since 2004, and the favourable operating

outlook, it was concluded that the reasons for the impairment writedown in 2003 no longer existed. The original book value was

consequently restored.

Revaluation of the equity investments in Fiat U.S.A. Inc. and Fiat Finance N orth America Inc. constitute a partial restoration of their

respective carrying values, which had been written down in 2003 and 2004, mainly due to the devaluation of the dollar against the euro.

The impairment writedown of the equity investment in Fiat Partecipazioni S.p.A. originated from the losses recorded during the fiscal year by

some of its subsidiaries (principally Fiat Auto Holdings B.V. and its subsidiaries) net of the positive effects deriving from the sale of the equity

investment in Italenergia Bis to ED F and the higher value of the stake held in Fiat N etherlands Holding N .V., which was determined on the

basis of the above described criteria.

The impairment writedowns of the equity investments in Teksid S.p.A, Comau S.p.A., and Business Solutions S.p.A. reflect permanent losses in

value mainly determined in consideration of the negative operating performance during the fiscal year.

It is stated pursuant to Article 2426, Section 3 of the Italian Civil Code, that the book value of the investment in Fiat N etherlands Holding N .V.

at December 31, 2005 was 127 million euros higher than the portion of the company’s stockholders’ equity owned, determined after making

the adjustments required by the accounting principles used to draft the consolidated financial statements. In this context, it is recalled that on

January 1, 2005 the Fiat Group adopted IFRS for the preparation of its consolidated financial statements, pursuant to EU Regulation no. 1606

of July 19, 2002. Thus, the consolidated financial reporting prepared according to these principles was used for the comparison required

pursuant to the abovementioned article of the Italian Civil Code.

The foregoing difference stems principally from the fact that the stockholders’ equity of the subsidiary CN H was negatively impacted upon

adoption of the new accounting standards.This was due to the immediate recognition of the actuarial losses realised on employee benefit

plans that had previously been deferred under the “corridor approach” (which was formerly used to prepare the Fiat Group consolidated

financial statements under the previous accounting standards). Therefore if Italian GAAP had continued to be applied, this negative impact

would not have been recognised, and consequently this difference is not considered an impairment loss, also in view of the subsidiary’s positive

earnings prospects.

All the other equity investments in subsidiaries had a carrying value at D ecember 31, 2005 that was less than or equal to the value of

stockholders’ equity determined in accordance with the aforesaid principles.

Other securities

These consist of listed Italian government securities pledged to fund scholarship grants.

At December 31, 2005, they totalled 73 thousand euros (a value that is also in line with their quotations at December 30, 2005), compared

with 74 thousand euros at December 31, 2004.

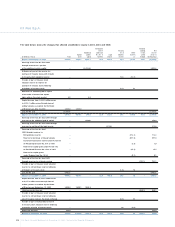

As regards fixed assets, the tables at the end of these N otes to the Financial Statements include the following:

the additional information on cost, upward adjustments, writedowns and amortisation and depreciation required under Article 2427 of the

Italian Civil Code;and

as required under Article 10 of Law N o. 72 of March 19, 1983, details of the assets held at December 31, 2005 which have been adjusted

for inflation pursuant to the relevant laws.