Chrysler 2005 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

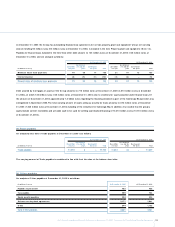

133

Fiat Group Consolidated Financial Statements at December 31, 2005 - N otes to the Consolidated Financial Statements

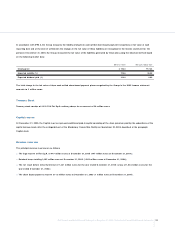

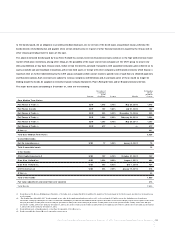

to the bonds issued, (iii) an obligation to provide periodical disclosure, (iv) for certain of the bond issues cross-default clauses, whereby the

bonds become immediately due and payable when certain defaults arise in respect of other financial instruments issued by the Group and (v)

other clauses generally present in issues of this type.

The above-mentioned bonds issued by Case N ew Holland Inc. contain, moreover, financial covenants common to the high yield American bond

market which place restrictions, among other things, on the possibility of the issuer and certain companies of the CN H group to secure new

debt, pay dividends or buy back treasury stock, realise certain investments, conclude transactions with associated companies, give collateral on its

assets, conclude sale and leaseback transactions, sell certain fixed assets or merge with other companies, and financial covenants which impose a

maximum limit on further indebtedness by the CN H group companies which cannot exceed a specific ratio of cash flows to dividend payments

and financial expenses. Such covenants are subject to various exceptions and limitations and, in particular, some of these would no longer be

binding should the bonds be assigned an investment grade rating by Standard & Poor’s Rating Services and/or Moody’s Investors Service.

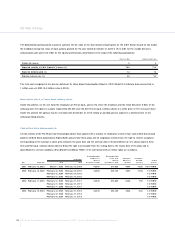

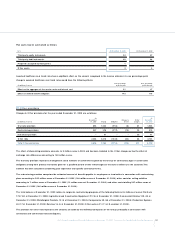

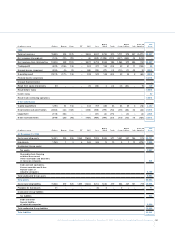

The major bond issues outstanding at D ecember 31, 2005 are the following:

Face value of O utstanding

outstanding amount

bonds (in millions

Currency (in millions) Coupon Maturity of euros)

Euro Medium Term N otes:

Fiat Finance & Trade (1) EUR 1,678 5.75% May 25, 2006 1,678

Fiat Finance Canada EUR 100 5.80% July 21, 2006 100

Fiat Finance & Trade (1) EUR 500 5.50% D ecember 13, 2006 500

Fiat Finance & Trade (1) EUR 1,000 6.25% February 24, 2010 1,000

Fiat Finance & Trade (1) EUR 1,300 6.75% May 25, 2011 1,300

Fiat Finance & Trade (1) EUR 617 (2) (2) 617

O thers (3) 331

Total Euro Medium Term N otes 5,526

Convertible bonds:

Fiat Fin. Luxembourg (4) USD 17 3.25% January 9, 2007 15

Total Convertible bonds 15

O ther bonds:

CN H Capital America LLC USD 127 6.75% O ctober 21, 2007 107

Case N ew Holland Inc. USD 1,050 9.25% August 1, 2011 890

Case N ew Holland Inc. USD 500 6.00% June 1, 2009 424

CN H America LLC USD 254 7.25% January 15, 2016 216

O thers (3) 43

Total O ther bonds 1,680

Fair value adjustments and amortised cost valuation 413

Total Bonds 7,634

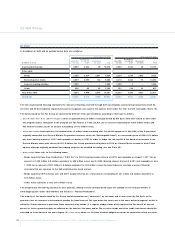

(1) Bonds listed on the Mercato O bbligazionario Telematico of the Italian stock exchange (EuroMot). In addition, the majority of the bonds issued by the Fiat Group are also listed on the Luxembourg

stock exchange.

(2) “Fiat Step-Up Amortizing 2001-2011” bonds repayable at face value in five equal annual instalments each for 20% of the total issued (617 million euros) due beginning from the sixth year

(N ovember 7, 2007) by reducing the face value of each bond outstanding by one-fifth.The last instalment will be repaid on N ovember 7, 2011.The bonds pay coupon interest equal to: 4.40% in the

first year (N ovember 7, 2002), 4.60% in the second year (N ovember 7, 2003), 4.80% in the third year (N ovember 7, 2004), 5.00% in the fourth year (N ovember 7, 2005), 5.20% in the fifth year

(N ovember 7, 2006), 5.40% in the sixth year (N ovember 7, 2007), 5.90% in the seventh year (N ovember 7, 2008), 6.40% in the eighth year (N ovember 7, 2009), 6.90% in the ninth year (N ovember

7, 2010), 7.40% in the tenth year (N ovember 7, 2011).

(3) Bonds with amounts outstanding equal to or less than the equivalent of 50 million euros.

(4) Bonds convertible into General Motors Corporation common stock.