Chrysler 2005 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

165

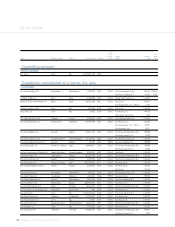

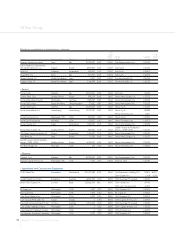

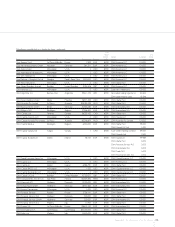

Appendix 1 Transition to International Financial Reporting Standards (IFRS)

shares in Italenergia to ED F in 2005, based on market values at that

date, but subject to a contractually agreed minimum price in excess

of book value.

Under Italian GAAP, Fiat accounted for its investments in Italenergia

under the equity method, based on a 38.6% shareholding through

September 30, 2002 and a 24.6% shareholding from O ctober 1,

2002; in addition it recorded a gain of 189 million euros before taxes

on the sale of its 14% interest in the investee to other shareholders

effective September 30, 2002.

Under IFRS, the transfer of the 14% interest in Italenergia to the

other shareholders was not considered to meet the requirements

for revenue recognition set out in IAS 18, mainly due to the

existence of the put options granted to the transferees and de facto

constraints on the transferees’ ability to pledge or exchange the

transferred assets in the period from the sale through 2005.

Accordingly, the gain recorded in 2002 for the sale was reversed, and

the results of applying the equity method of accounting to the

investment in Italenergia was recomputed to reflect a 38.6% interest

in the net results and stockholders’ equity of the investee, as adjusted

for the differences between Italian GAAP and IFRS applicable

to Italenergia.

This adjustment decreased the stockholders’ equity at January 1,

2004 and at December 31, 2004 by an amount of 153 million euros

and 237 million euros, respectively. Furthermore this adjustment

increased the investment for an amount of 291 million euros at

January 1, 2004 and of 341 million euros at D ecember 31, 2004 and

financial debt for amounts of 572 million euros at January 1, 2004

and of 593 million euros at D ecember 31, 2004, as a consequence of

the non-recognition of the transfer of the 14% interest in Italenergia.

F. Scope of consolidation

Under Italian GAAP, the subsidiary B.U.C. – Banca Unione di Credito,

as required by law,was excluded from the scope of consolidation as it

had dissimilar activities, and was accounted for using the equity method.

IFRS does not permit this kind of exclusion:consequently, B.U.C. is

included in the IFRS scope of consolidation.

Furthermore, under Italian GAAP investments that are not controlled

on a legal basis or a de facto basis determined considering voting

rights were excluded from the scope of consolidation.

Under IFRS, in accordance with SIC 12 – Consolidation – Special

Purpose Entities, a Special Purpose Entity (“SPE”) shall be

consolidated when the substance of the relationship between an

entity and the SPE indicates that the SPE is controlled by that entity.

This standard has been applied to all receivables securitisation

transactions entered into by the Group (see the paragraph Q . Sales

of receivables below), to a real estate securitisation transaction

entered into in 1998 and to the sale of the Fiat Auto Spare Parts

business to “Società di Commercializzazione e D istribuzione Ricambi

S.p.A.” (“SCD R”) in 2001.

In particular, in 1998 the Group entered in a real estate

securitisation and, under Italian GAAP, the related revenue was

recognised at the date of the legal transfer of the assets involved.

In the IFRS balance sheet at January 1, 2004, these assets have been

written back at their historical cost, net of revaluations accounted

before the sale, if any. Cash received at the time of the transaction

has been accounted for in financial debt for an amount of 188 million

euros at January 1, 2004.

The IFRS stockholders’ equity at January 1, 2004 was negatively

impacted for 105 million euros by the cumulative effect of the

reversal of the capital gain on the initial disposal and of the

revaluation previously recognised under Italian GAAP, net of the

related effect of asset depreciation, as well as the recognition of

financial charges on related debt, net of the reversal of rental fees

paid, if any.The impact on the 2004 net result is not material.

Furthermore, in 2001 the Group participated with a specialist

logistics operator and other financial investors in the formation of

“Società di Commercializzazione e Distribuzione Ricambi S.p.A.”

(“SCD R”), a company whose principal activity is the purchase of

spare parts from Fiat Auto for resale to end customers.At that date

Fiat Auto and its subsidiaries sold their spare parts inventory to

SCDR recording a gain of 300 million euros.The Group’s investment

in SCD R represents 19% of SCD R’s stock capital and was accounted

for under the equity method for Italian GAAP.

Under IFRS, SCD R qualifies as a Special Purpose Entity (SPE) as

defined by SIC 12 due to the continuing involvement of Fiat Auto in

SCDR operations. Consequently, SCDR has been consolidated on a

line by line basis in the IFRS consolidated financial statements, with a

consequent increase in financial debt of 237 million euros and of 471

million euros at January 1, 2004 and at D ecember 31, 2004,

respectively. O pening stockholders’ equity at January 1, 2004 was