Chrysler 2005 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

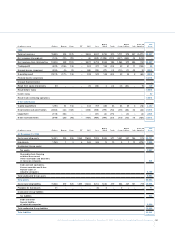

Fiat Group Consolidated Financial Statements at December 31, 2005 - N otes to the Consolidated Financial Statements

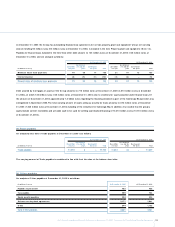

Sensitivity analysis

The potential loss in fair value of derivative financial instruments held by the Group at December 31, 2005 for managing exchange risk

(currency swaps forward, currency options and interest rate and currency swaps), which would arise in the case of a hypothetical and

unfavourable change of 10% in the exchange rates of the major foreign currencies with the euro, would amount to approximately 273 million

euros. Receivables, payables and future trade flows for which detailed hedging operations have been carried out are not included in this

analysis. It is reasonable to expect that future changes in exchange rates would produce an opposite economic impact, of an equal or higher

amount, on the underlying hedged transactions.

This analysis assumes that, in general terms, an unfavourable and instantaneous fluctuation of 10% in exchange rates compared with the Euro.

For currency options sensitivity analysis models have been employed which presuppose unchanged market volatility at the end of the year.

Interest rate risk

The manufacturing companies and treasuries of the Group make use of external funds obtained in the form of financing and invest in

monetary and financial market instruments. In addition, Group companies make sales of receivables resulting from their trading activities on a

continuing basis. Changes in market interest rates can affect the cost of the various forms of financing, including the sale of receivables, or the

return on investments, and the employment of funds, causing an impact on the level of net financial expenses incurred by the Group.

In addition, the financial services companies provide loans (mainly to customers and dealers), financing themselves using various forms of direct

debt or asset-backed financing (e.g. securitisation of receivables).W here the characteristics of the variability of the interest rate applied to loans

granted differ from those of the variability of the cost of the financing obtained, changes in the current level of interest rates can influence the

operating result of those companies and the Group as a whole.

In order to manage these risks, the Group uses interest rate derivative financial instruments, mainly interest rate swaps and forward rate

agreements, with the object of mitigating the variability of interest rates on the net result, ensuring the correct interest rate matching for

financial services companies.

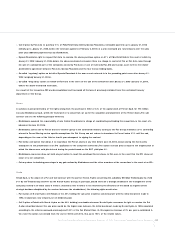

Sensitivity analysis

In assessing the potential impact of changes in interest rates, the Group separates out fixed rate financial instruments (for which the impact is

assessed in terms of fair value) from floating rate financial instruments (for which the impact is assessed in terms of cash flows).

The fixed rate financial instruments used by the Group consist principally of part of the portfolio of the financial services companies (basically

customer financing and financial leases) and part of debt (including subsidised loans and bonds).

The potential loss in fair value of fixed rate financial instruments (including the effect of interest rate derivative financial instruments) held at

December 31, 2005, resulting from a hypothetical, unfavourable and instantaneous change of 10% in market interest rates, would have been

approximately 33 million euros.

Floating rate financial instruments include principally cash and cash equivalents, loans provided by the financial services companies to the sales

network and part of debt.The sensitivity analysis considers also the effect of the sale of receivables.

A hypothetical, unfavourable and instantaneous change of 10% in short-term interest rates at December 31, 2005, applied to floating rate

financial assets and liabilities, operations for the sale of receivables and derivatives financial instruments, would have caused increased net

expenses before taxes, on an annual basis, of approximately 17 million euros.

This analysis is based on the assumption that there is a general and instantaneous change of 10% in interest rates across homogeneous

categories.A homogeneous category is defined on the basis of the currency in which the financial assets and liabilities are denominated.