Chrysler 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Fiat Group Consolidated Financial Statements at December 31, 2005 - N otes to the Consolidated Financial Statements

02 Fiat Group

N otes to the Consolidated

Financial Statements

PRIN CIPAL ACTIVITIES

Fiat S.p.A. is a corporation organised under the laws of the

Republic of Italy. Fiat S.p.A. and its subsidiaries (the “Group”) operate

in more than 190 countries.The Group is engaged principally in the

manufacture and sale of automobiles, agricultural and construction

equipment and commercial vehicles. It also manufactures other

products and systems, principally automotive-related components,

metallurgical products and production systems. In addition, it is

involved in certain other sectors, including publishing and

communications and service operations, which represent a

marginal portion of its activities.The head office of the Group

is located in Turin, Italy.

The consolidated financial statements are presented in euros, the

Group’s functional currency.

SIGN IFICAN T ACCO UN TIN G PO LICIES

Basis of preparation

The 2005 consolidated financial statements have been prepared in

accordance with the International Financial Reporting Standards (the

“IFRS”) issued by the International Accounting Standards Board

(“IASB”) and endorsed by the European Union.The designation

“IFRS” also includes all valid International Accounting Standards

(“IAS”), as well as all interpretations of the International Financial

Reporting Interpretations Committee (“IFRIC”), formerly the

Standing Interpretations Committee (“SIC”).

The Fiat Group adopted IFRS on January 1, 2005 on the coming into

effect of European Union Regulation N o. 1606 of July 19, 2002. In

this context, the accounting policies applied in these financial

statements are consistent with those adopted in preparing the IFRS

opening consolidated balance sheet at January 1, 2004, as well the

consolidated financial statements at December 31, 2004, as restated

in accordance with IFRS and presented in the Appendix attached

to these notes to which reference should be made. Reconciliations

between profit or loss and equity under previous GAAP (Italian

GAAP) to profit or loss and equity under IFRS for the periods shown

as comparatives, as required by IFRS 1 - First-time Adoption of IFRS,

together with related explanatory notes, are included in this Appendix.

Certain changes, however, have been made to the classification of the

figures reported in the Appendix to the Q uarterly Report at March

31, 2005, and the comparative data for prior periods have been

reclassified accordingly.These changes have no effect on Trading

profit, O perating result, N et result or Consolidated stockholders’

equity and regard in particular:

Vehicles sold with a buy-back commitment are accounted for

as Inventory if they regard the Fiat Auto business (agreements

with normally a short-term buy-back commitment) and as

Property, plant and equipment if they regard the Commercial

Vehicles business (agreements with normally a long-term

buy-back commitment). In the balance sheet included in

the Appendix to the Q uarterly Report at March 31, 2005,

these vehicles were accounted for as either Inventory

or Property, plant and equipment depending on the term of

the buy-back commitment (less or more than twelve months,

respectively).

In order to achieve a better presentation, more consistent

between the various Sectors, certain costs, previously classified by

some Sectors as O ther income (expenses) and by others as Cost

of sales or Selling, general and administrative costs, have been

recorded in the same manner by all Sectors.

The item Accrued income and prepaid expenses is included in

Current assets.

The financial statements are prepared under the historical cost

convention, modified as required for the valuation of certain financial

instruments.

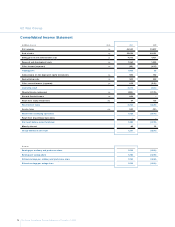

Format of the financial statements

The Fiat Group presents an income statement using a

classification based on the function of expenses within the Group

(otherwise known as the “cost of sales” method), rather than based

on their nature, as this is believed to provide information that is

more relevant.The format selected is that used for managing the

business and for management reporting purposes and is coherent

with international practice in the automotive sector.

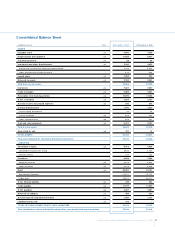

For the balance sheet, a mixed format has been selected to present

current and non-current assets and liabilities, as permitted by

paragraph 51 and following of IAS 1. In more detail, both companies

carrying out industrial activities and those carrying out financial

activities are consolidated in the Group’s financial statements,

including certain entities performing banking activities.The investment