Chrysler 2005 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

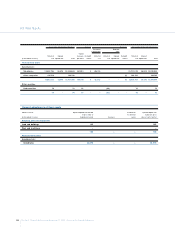

236 Fiat S.p.A. Financial Statements at December 31, 2005 - N otes to the Financial Statements

03 Fiat S.p.A.

A new three-year credit line was granted to Fiat Ge.Va. S.p.A. and other Fiat Group subsidiaries as part of an agreement signed on June 22,

2005 with a pool of Italian and international banks coordinated by Citibank International. Under this agreement, Fiat S.p.A. guaranteed use

of this credit line by its subsidiaries. At D ecember 31, 2005 this credit line had not been used. It is also pointed out that Fiat S.p.A. granted

its subsidiary CN H Global N .V. and its subsidiaries a 1 billion dollar revolving credit line, due at the end of January 2007, which may be

drawn by Fiat Group cash management companies.

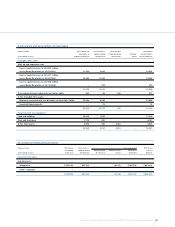

In 2005, Fiat Partecipazioni S.p.A. collected the balance from the sale of Fiat Group interest in aviation activities ahead of schedule.

Consequently, Fiat S.p.A. assumed a joint obligation with Fiat Partecipazioni S.p.A. towards the purchaser Avio Holding S.p.A. if Fiat

Partecipazioni S.p.A. does not satisfy obligations to pay compensation (either in consequence of an arbitration award or a settlement

agreement) deriving from the sale agreement signed in 2003 with the seller. Likewise, on the occasion of the sale of the Fiat Group interest

in rolling stock and railway systems activities, Fiat S.p.A. assumed obligations to compensate Alstom N .V. if the seller (now Fiat Partecipazioni

S.p.A.) of railway activities defaulted on compensation obligations under the sale agreement. A review of these obligations leads us to

believe that there is no reasonable likelihood Fiat S.p.A. will incur direct costs for these commitments.

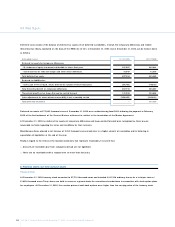

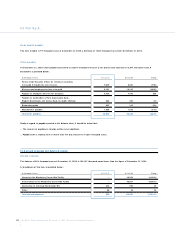

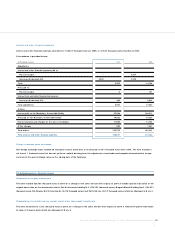

Commitments

Commitments related to supply contracts

This item totalled 10,906,320 thousand euros at D ecember 31, 2005. O f this amount, 4,296,833 thousand euros represent the commitment

(corresponding to the contractual amounts) stemming from the agreement executed on May 7, 1996 and the supplemental agreements signed

by Fiat S.p.A. and Treno Alta Velocità – T.A.V. S.p.A. for the design and construction of the Bologna-Florence high-speed rail line, 4,547,205

thousand euros for the commitment undertaken pursuant to the agreement of February 14, 2002 and subsequent supplement agreements for

the design and construction of the Turin-N ovara line, and 2,062,282 thousand euros for the commitment undertaken pursuant to the

agreement of July 21, 2004 for the design and construction of the N ovara-Milan line.The increase of 645,173 thousand euros compared with

December 31, 2004 includes agreements reached during 2005 regarding the Florence-Bologna line, specifically alterations (422,625 thousand

euros), and monetary adjustments (49,495 thousand euros), agreements regarding the Turin-N ovara line, specifically relating to alterations

(38,953 thousand euros) and monetary adjustments (52,343 thousand euros), and the N ovara-Milan line, specifically relating to alterations

(53,659 thousand euros) and monetary adjustments (28,098 thousand euros).

Fiat S.p.A. has subcontracted design and construction of the works to the CAV.E.T. and CAV.TO.MI. consortia.

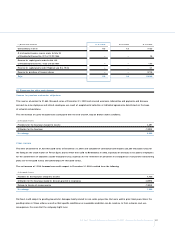

Fiat S.p.A. provided T.A.V. S.p.A. with bank suretyships totalling 1,904,058 thousand euros as guarantee for contractual advances received and

proper execution of work.These guarantees are not recorded under memorandum accounts since advances are included under Liabilities –

Advances. Likewise, the CAV.E.T. and CAV.TO.MI consortia provided Fiat S.p.A. with the contractually envisaged bank suretyships totalling

621,646 thousand euros and 1,210,029 thousand euros, respectively.

Commitments for derivative financial instruments

These totalled 70,241 thousand euros at D ecember 31, 2005, reflecting a decrease of 20,157 thousand euros with respect to D ecember 31, 2004.

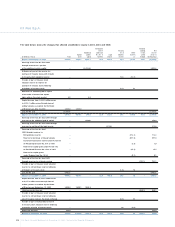

The amount at D ecember 31, 2005 represents the notional amount of the equity swap on Fiat shares made to hedge the risk of an increase in

the share price above the exercise price of the 10,670,000 stock options granted to Mr. Marchionne.The risk of a significant increase in the Fiat

share price above the exercise price for these options (6.583 euros) has been covered through the aforementioned “Total Return Equity

Swap” agreement with a reference price of 6.583 euros per share and expiring on O ctober 30, 2006. In accordance with accounting principles,

the aforementioned Equity Swap, despite the fact that it was entered into for hedging purposes, cannot be treated in hedge accounting and

accordingly is defined as a trading derivative financial instrument. It follows that, in accordance with the principle of prudence, if during the