Chrysler 2005 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

237

Fiat S.p.A. Financial Statements at D ecember 31, 2005 - N otes to the Financial Statements

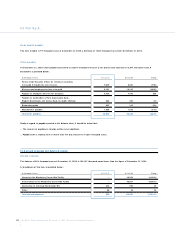

period of the contract the Fiat shares perform positively, the positive fair value of the instrument is not recorded in the income statement;if,

instead, the performance is negative, the negative fair value of the instrument is recorded as a cost under financial expenses. At D ecember 31,

2005, the Equity Swap had a positive fair value of 8,002 thousand euros that was not therefore recorded in the financial statements.

At December 31, 2004, commitments for derivate financial instruments amounted to 90,398 thousand euros and referred to the Equity Swap

on Fiat shares for 65,830 thousand euros and for 24,568 thousand euros to Forward Rate Agreements made to cover the risks connected

with changes in the rate of the Mandatory Convertible Facility.

O ther commitments

This item totalled 6,972 thousand euros at December 31, 2005, with respect to 9,296 thousand euros at D ecember 31, 2004, and represents

the residuary amount of the commitment, undertaken by Fiat on the occasion of its centennial under a resolution adopted by the

Stockholders Meeting on June 22, 1998, to defer, over a ten-year period, the costs incurred to provide courses for a D egree in Automotive

Engineering and pay for the renovation of the respective building.The decrease of 2,324 thousand euros from D ecember 31, 2004 reflects the

outlays incurred in the year for the management of degree courses.

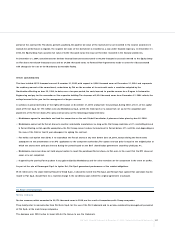

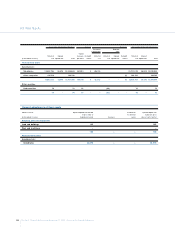

A summary is presented below of the rights still in place at D ecember 31, 2005 arising from the purchase, during 2002, of 34% of the capital

stock of Ferrari S.p.A. for 775 million euros by Mediobanca S.p.A., within the framework of a consortium set up for the acquisition and

placement of the Ferrari shares.The sales contract sets out the following principal elements:

Mediobanca agreed to coordinate and lead the consortium as the sole Global Coordinator, if placement takes place by June 30, 2006.

Mediobanca cannot sell its Ferrari shares to another automobile manufacturer as long as the Fiat Group maintains a 51% controlling interest

in Ferrari. Barring certain specific assumptions, the Fiat Group cannot reduce its investment in Ferrari below 51% until the end, depending on

the case, of the third or fourth year subsequent to signing the contract.

Fiat holds a call option that allows it to repurchase the Ferrari shares at any time before June 30, 2006, except during the five months

subsequent to the presentation of an IPO application to the competent authorities.The option exercise price is equal to the original price at

which the shares were sold plus interest during the period based on the BOT (listed Italian government securities) yield plus 4%.

Mediobanca, moreover, does not hold any put option to resell the purchased Ferrari shares to Fiat, even in the event that the IPO does not

occur or is not completed.

If agreed by the parties, Fiat may share in any gain realised by Mediobanca and the other members of the consortium in the event of an IPO.

As part of the sale of Piemongest S.p.A. to Iupiter S.r.l., Fiat S.p.A. guaranteed performance of the residual obligations.

W ith reference to the stake held by Renault in Teksid S.p.A., it should be noted that Fiat S.p.A. and Renault have agreed that said stake may be

resold to Fiat S.p.A. should there be a material change in the conditions upon which the original agreement was based.

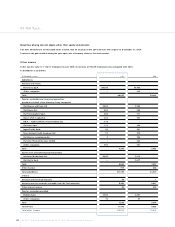

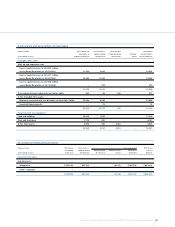

15.Value of production

Service revenues

Service revenues, which amounted to 20,170 thousand euros in 2005, are the result of transactions with Group companies.

They mainly refer to amounts due from Fiat Auto S.p.A. for the use of the Fiat trademark and to services rendered by management personnel

of Fiat S.p.A. at the main Group companies.

The decrease over 2004 is due to lower bills for the license to use the trademark.