Chrysler 2005 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 Fiat Group Consolidated Financial Statements at D ecember 31, 2005 - N otes to the Consolidated Financial Statements

02 Fiat Group

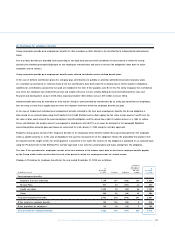

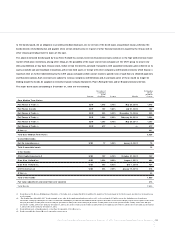

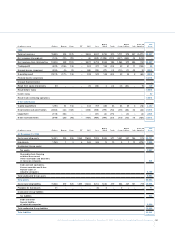

An analysis of O ther payables by due date is as follows:

At December 31, 2005 At December 31, 2004

Due between Due between

Due within one and five Due beyond D ue within one and five D ue beyond

(in millions of euros) one year years five years Total one year years five years Total

O ther payables 3,819 879 123 4,821 3,749 723 89 4,561

Tax payables includes current income tax liabilities for 388 million euros (334 million euros at December 31, 2004)

The item Advances on buy-back agreements refers to agreements entered into by the Group during the year or which still remain effective at

the balance sheet date.An amount of 1,334 million euros regards assets included in Property, plant and equipment, with the balance of 837

million euros relating to inventories.

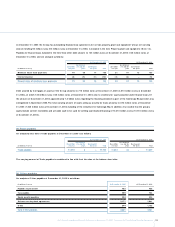

The item Advances on buy-back agreements represents the following:

at the date of the sale, the price received for the product is recognised as an advance in liabilities;

subsequently, since the difference between the original sales price and the repurchase price is recognised in the income statement as

operating lease instalments on a straight line basis over the lease term, the balance represents the remaining lease instalments yet to be

recognised in income plus the repurchase price.

The carrying amount of O ther payables is considered in line with their fair value at the balance sheet date.

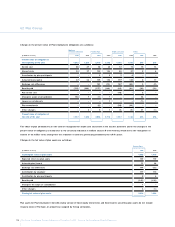

31.Accrued liabilities and deferred income

The item Accrued liabilities and deferred income includes public investment grants recognised as income over the useful lives of the assets to

which they relate. Furthermore, the item comprises deferred income relating to service contracts, as well as accrued liabilities for costs that will

be settled in the following year.

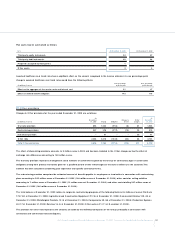

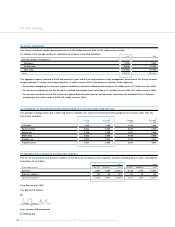

32. Guarantees granted, commitments and contingent liabilities

Guarantees granted

At December 31, 2005 the Group had granted guarantees on the debt or commitments of third parties or associated entities totalling 1,198

million euros (2,360 million euros at December 31, 2004).An amount of 598 million euros of the decrease of 1,162 million euros is due to

lower guarantees granted on behalf of Sava S.p.A. for the bonds it has issued.

O ther commitments and important contractual rights

The Fiat Group has important commitments and rights deriving from outstanding agreements, summarised in the following.

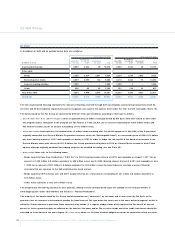

Fidis Retail Italia (FRI)

The associated company Fidis Retail Italia S.p.A. (“FRI”) was set up to take over the European activities of the Automobile Sector in the area of

consumer financing for retail automobile purchases.To this end, the activities performed by various companies operating in different countries

in Europe were gradually sold to FRI after obtaining the necessary authorisations from the local regulatory agencies.As envisaged by the

Framework Agreement signed on May 27, 2002 by Fiat and the “Money Lending Banks” (Capitalia, Banca Intesa, SanPaolo IMI and later

Unicredit Banca), on May 27, 2003, the Fiat Group sold 51% of FRI’s shares and, as a result, the relative control, to Synesis Finanziaria S.p.A., an

Italian company held equally by the four Banks, at the price of 370 million euros, based upon the binding agreements signed by the parties at

that time.The sale contract calls for Put and Call options that can be summarised as follows: