Chrysler 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278

|

|

Operating Performance

Demand in Western Europe in the automobile market was

substantially in line (-0.2%) with the previous year.The largest declines

occurred in Italy (-1.3%) and the United Kingdom (-5.0%), offset in

part bygains in France (+2.6%), Germany (+1.6%) and Spain (+0.9%).

Outside WesternEurope,demand was off sharplyin Poland (-26.5%),

while the Brazilian market continued on its growth track, with

demand rising by 9.1%.

The Western European market for light commercial vehicles posted

an overall increase of 2.8% over 2004.This increase was the net

result of gains of 13.4% in Spain, 3.4% in France and 3.1% in Germany

and decreases of 1.8% in Italy and 1.3% in the United Kingdom.

Fiat Auto’s share of the automobile market held at 28.0% in Italy

(about the same as in 2004), but declined to 6.5% for Western

Europe as a whole (0.7 percentage points less than in 2004).

The Sector’s share of the market for light commercial vehicles was

virtually unchanged, registering 10.4% for all of Western Europe

(-0.2 percentage points compared with 2004) and 42.3% for Italy

(in line with 2004).

In Brazil, Fiat Auto’s share of the automobile and light commercial

vehicle markets increased to 24.4% (+0.9 percentage points) and

28.8% (+4.5 percentage points), respectively.

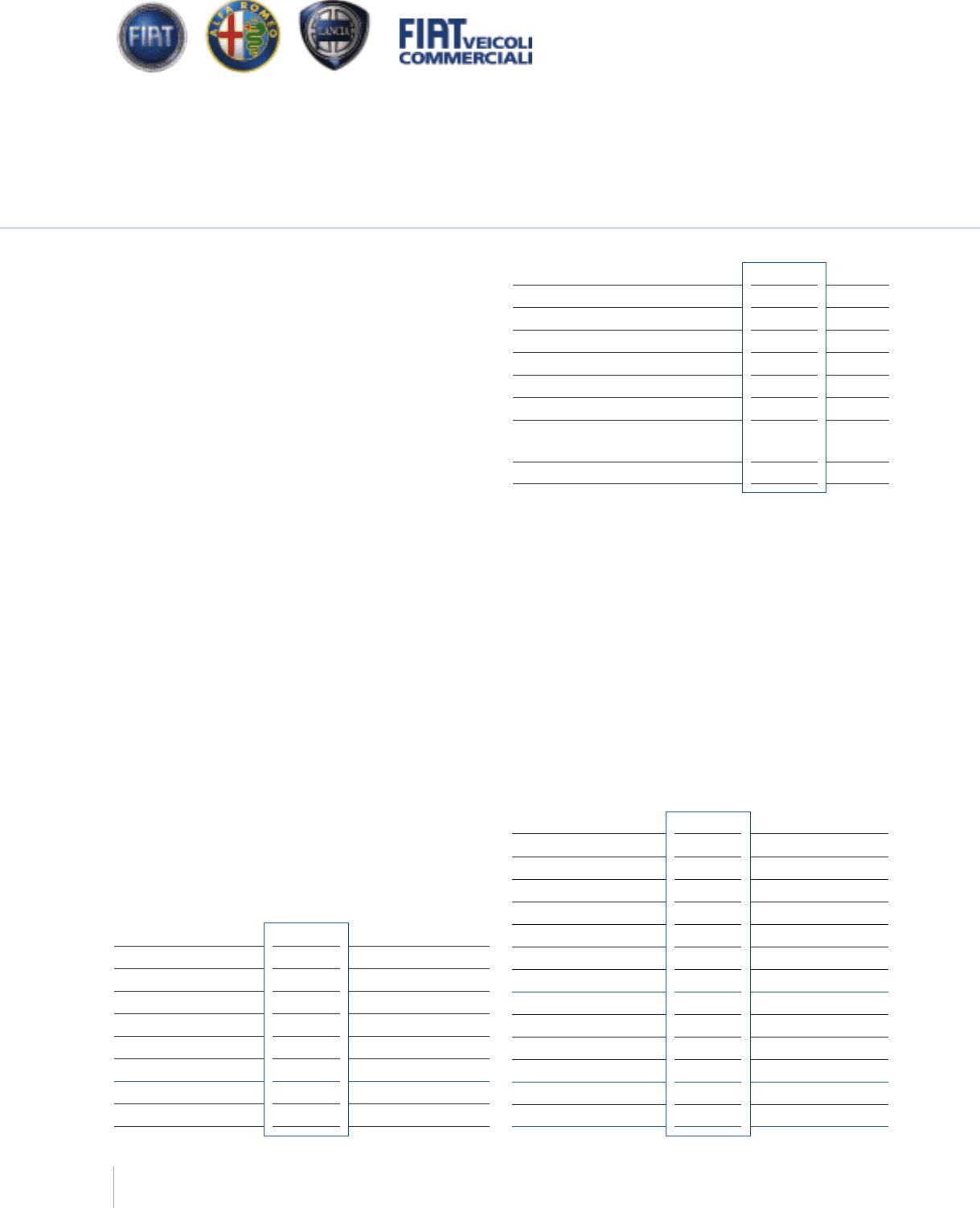

Fiat Auto

Fiat, Alfa Romeo, Lancia

and Fiat Veicoli Commerciali

Highlights

(in millions of euros) 2005 2004

Net revenues 19,533 19,695

Trading profit/(loss) (281) (822)

Operating result (*) (818) (1,412)

Investments in tangible and intangible assets

1,582 1,792

-of which capitalised R&D costs 310 500

Total R&D expenses (**) 665 952

Automobiles and light commercial

vehicles delivered (number) 1,697,300 1,766,000

Employees at year-end (number) 46,099 45,122

(*) Including restructuring costs and unusual income (expenses).

(**) Including R&D capitalised and charged to operations.

Sales Performance

Automobiles and Light Commercial Vehicles

(in thousands of units) 2005 2004 %change

France 79.3 73.2 8.3

Germany 90.8 107.8 -15.8

United Kingdom 53.3 86.7 -38.5

Italy 687.7 704.3 -2.4

Spain 70.3 72.4 -3.0

Rest of Western Europe 118.5 148.8 -20.3

Western Europe 1,099.9 1,193.2 -7.8

Poland 33.8 60.6 -44.3

Brazil 404.3 358.1 12.9

Rest of the world 159.3 154.1 3.3

Total sales 1,697.3 1,766.0 -3.9

Associated companies 107.3 90.7 18.3

Grand total 1,804.6 1,856.7 -2.8

54 Reporton Operations Fiat Auto

01 Report on Operations

Automobile Market

(in thousands of units) 2005 2004 % change

France 2,058.1 2,005.3 2.6

Germany 3,250.1 3,198.3 1.6

United Kingdom 2,443.5 2,572.8 -5.0

Italy 2,234.2 2,264.7 -1.3

Spain 1,527.3 1,514.1 0.9

Western Europe 14,415.8 14,449.2 -0.2

Poland 234.2 318.5 -26.5

Brazil 1,414.8 1,297.3 9.1

In 2005, Fiat Auto sold a total of 1,697,300 vehicles, or 3.9% less

than in 2004. In Western Europe, shipments were down 7.8% to

1,100,000 units. Strong competitive pressure and, early in the year,

the expected launch of new models account for the reduction in

unit sales. Once new models became available, sales rebounded

both in Italy and Europe as a whole, particularly in the fourth quarter.

In 2005, Fiat Auto’s sales volume was down 2.4% in Italy (but

increased by 14.7% in the fourth quarter of 2005) and 3% in Spain.