Chrysler 2005 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278

|

|

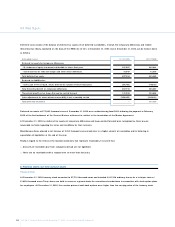

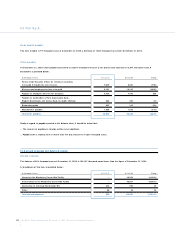

228 Fiat S.p.A. Financial Statements at December 31, 2005 - N otes to the Financial Statements

03 Fiat S.p.A.

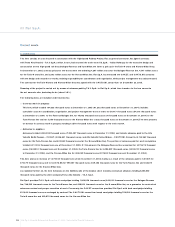

Prepaid expenses

These totalled 2,743 thousand euros at D ecember 31, 2005, for a net decrease of 1,785 thousand euros compared with D ecember 31, 2004,

mainly connected with the fees contractually due to TO RO C for sponsorship of the XX W inter O lympic Games, applicable to fiscal 2006.

9. Stockholders’ Equity

Capital stock

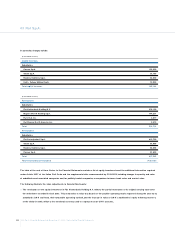

Fully paid-in capital amounted to 6,377,257,130 euros at December 31, 2005 and consisted of 1,275,451,426 shares as follows:

1,092,246,316 ordinary shares;

103,292,310 preference shares;

79,912,800 savings shares;

all with a par value of 5 euros each.

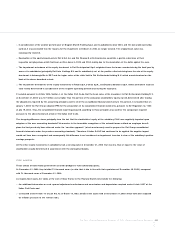

W ith reference to the capital stock, it should be mentioned that:

O n September 24, 2002 a pool of banks (see N ote 12) extended a Mandatory Convertible Facility to Fiat S.p.A. for 3 billion euros due on

September 20, 2005. According to the conditions of the facility agreement, the facility could be reimbursed by means of conversion into

ordinary Fiat shares, which the banks would be required to subscribe.

O n September 12, 2002, the Extraordinary Stockholders meeting authorised the Board of D irectors, pursuant to Article 2443 of the Italian

Civil Code, to resolve a capital increase servicing the banks’ subscription commitment as envisaged in the Mandatory Convertible Facility

agreement.

O n September 20, 2005, the facility was converted in accordance with the agreement and by previous arrangement amongst the parties.

This involved offsetting the 3 billion euros in principal owed to the banks by having them subscribe the rights offering resolved by the Board

of D irectors on September 15, 2005.

As a result of this capital increase, for 1,459,143,590 euros (from 4,918,113,540 euros to 6,377,257,130 euros), 291,828,718 ordinary shares

with a par value of 5 euros each were issued with the same characteristics as those already outstanding (including dividend rights at January

1, 2005). These newly issued shares were reserved for subscription pursuant to Article 2441, Section 7, of the Italian Civil Code to the

subscribing banks at the price of 10.28 euros each, with 5.28 euros as a share premium. Pursuant to the facility agreement, the price of

10.28 euros per newly issued share was determined as the average of 14.4409 euros (the stock market quotation of Fiat ordinary stock at

the facility date, which was subsequently adjusted) and the weighted average of official market prices for Fiat ordinary stock during the six

months preceding the due date of the facility.

Pursuant to the first three sections of Article 2441 of the Italian Civil Code and Article 134, Section 1, Legislative D ecree no. 58/98

(Consolidated Law on Financial Intermediation), the banks subsequently offered these shares to Fiat shareholders at the price of 10.28 euros

per share, at the ratio of 149 new shares for every 500 shares owned in any class.

W ith reference to the capital stock, for completeness of information it is noted that:

Pursuant to resolutions approved by the Board of D irectors on December 10, 2001 and June 26, 2003, capital may be increased through

rights offerings for a maximum of 81,886,460 euros, with the issuance of a maximum of 16,377,292 ordinary shares at a par value of 5 euros