Chrysler 2005 Annual Report Download - page 240

Download and view the complete annual report

Please find page 240 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278

|

|

239

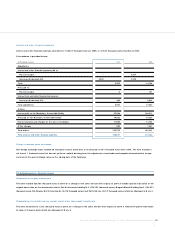

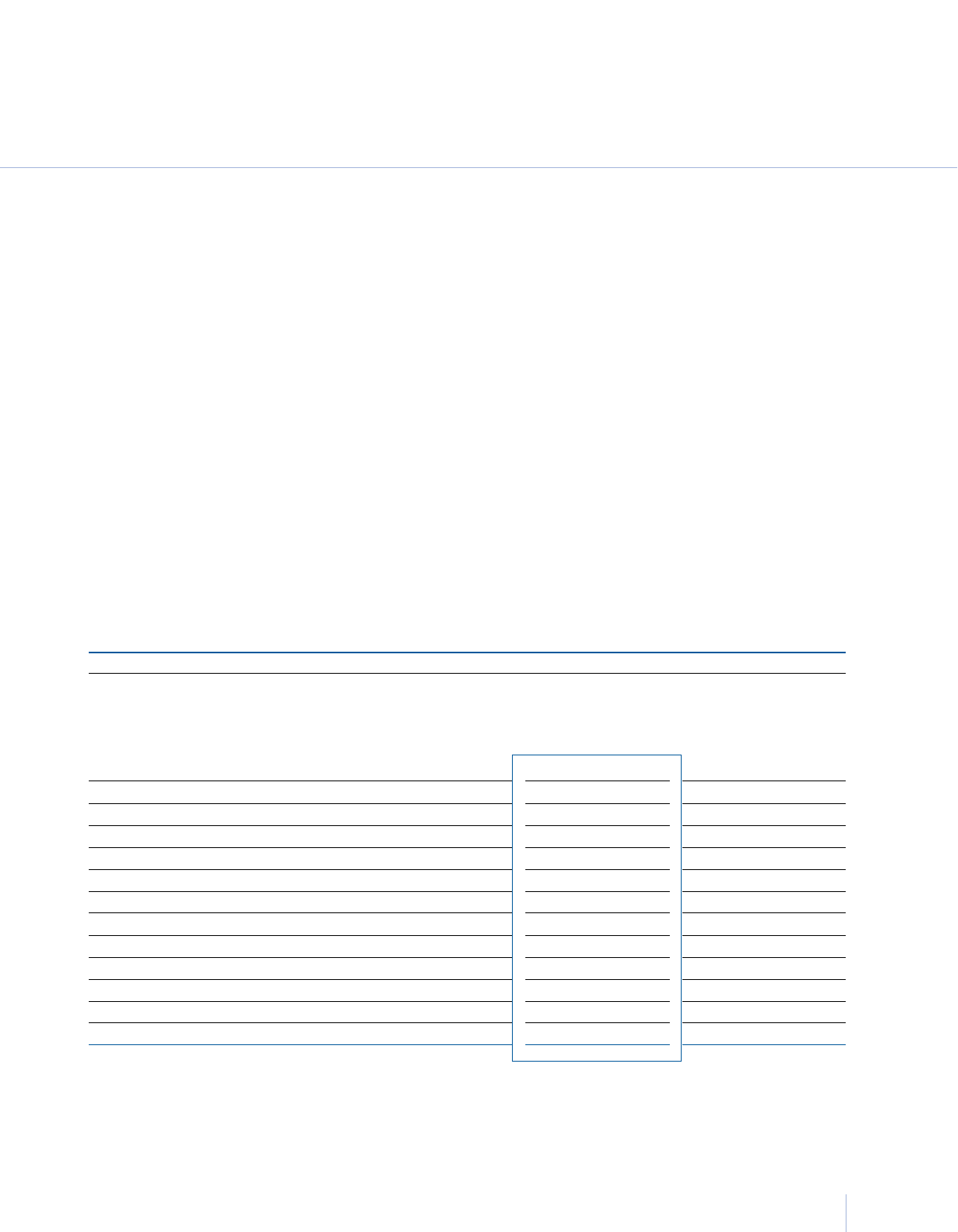

Fiat S.p.A. Financial Statements at D ecember 31, 2005 - N otes to the Financial Statements

of 11,174 thousand euros with respect to 2004 mainly due to lower wage and salary and social security contributions and lower provisions set

aside for employee bonuses.The Company’s average number of staff decreased from 151 employees in 2004 (83 managers, 63 clerical staff,

and 5 blue collar workers) to 133 employees in 2005 (63 managers, 65 clerical staff and 5 blue collar workers).

During 2005, 11 managers were seconded to the Group’s main subsidiaries (12 in 2004), which were billed for the respective costs.

Amortisation and depreciation

This item totalled 27,031 thousand euros in 2005 and refers for 23,746 thousand euros to the amortisation of intangible fixed assets and for

3,285 thousand euros to the depreciation of property, plant and equipment.The 2,686 thousand euro decrease with respect to 2004 is mainly

due to the lower depreciation rate, with respect to 2004, connected to commissions and costs for organisation of the Mandatory Convertible

Facility, which was extinguished in 2005.

Other operating costs

These costs totalled 40,701 thousand euros in 2005.The increase over 2004 is mainly due to the indemnity paid for the unwinding

of the agreements with IBM and to contributions made to Group companies for initiatives to enhance the image of the Group.

The item includes fees paid to the D irectors, Statutory Auditors and External Auditors. D irectors’ fees included compensation awarded

by the Stockholders Meeting as well as fees set by the Board of D irectors for D irectors vested with particular offices.

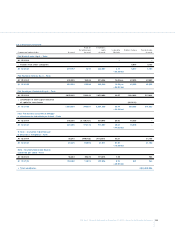

17. Financial income and expenses

Investment income

Income from investments came to 7,714 thousand euros in 2005, a decrease of 674,843 thousand euros compared with 2004.

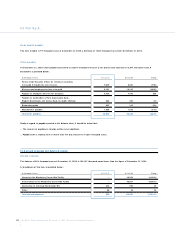

A breakdown is as follows:

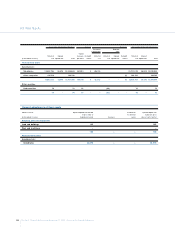

(in thousands of euros) 2005 2004

Subsidiaries

Dividends distributed by:

Fiat Ge.Va. S.p.A. –70,000

Reimbursements of capital (portion in excess of the reduction of the book value)

IHF-Internazionale Holding Fiat S.A. –606,124

Total subsidiaries –676,124

O ther companies

Dividends distributed by:

Mediobanca S.p.A. 6,777 5,647

Fin. Priv. S.r.l. 937 786

Total other companies 7,714 6,433

Total investment income 7,714 682,557

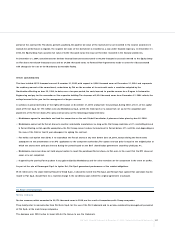

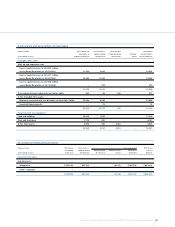

Other financial income

From securities held as fixed assets other than equity investments

This item consists of interest earned on securities pledged to fund scholarship grants.

Income from these securities totalled 2 thousand euros in 2005, in line with 2004.