Chrysler 2005 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

Fiat Group Consolidated Financial Statements at December 31, 2005 - N otes to the Consolidated Financial Statements

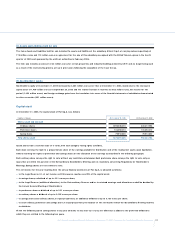

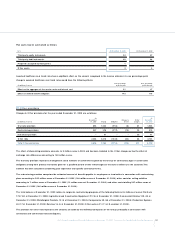

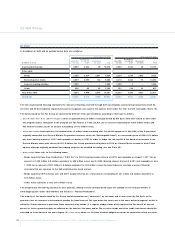

26. Provisions for employee benefits

Group companies provide post-employment benefits for their employees, either directly or by contributing to independently administered

funds.

The way these benefits are provided varies according to the legal, fiscal and economic conditions of each country in which the Group

operates, the benefits generally being based on the employees’ remuneration and years of service.The obligations relate both to active

employees and to retirees.

Group companies provide post-employment benefits under defined contribution and/or defined benefit plans.

In the case of defined contribution plans, the company pays contributions to publicly or privately administered pension insurance plans

on a mandatory, contractual or voluntary basis. O nce the contributions have been paid, the company has no further payment obligations.

Liabilities for contributions accrued but not paid are included in the item O ther payables (see N ote 30).The entity recognise the contribution

cost when the employee has rendered his service and includes this cost in Cost of Sales, Selling, General and Administrative costs and

Research and development costs. In 2005, these expenses totalled 1,080 million euros (1,070 million euros in 2004).

Defined benefit plans may be unfunded, or they may be wholly or partly funded by contributions by an entity, and sometimes its employees,

into an entity, or fund, that is legally separate from the employer and from which the employee benefits are paid.

In the case of funded and unfunded post employment benefits, included in the item post-employment benefits, the Group obligation is

determined on an actuarial basis, using the Projected Unit Credit Method and is offset against the fair value of plan assets, if any.W here the

fair value of plan assets exceed the post-employment benefits obligation, and the group has a right of reimbursement or a right to reduce

future contributions, the surplus amount is recognised in accordance with IAS 19 as an asset.As discussed in the paragraph Significant

accounting policies, actuarial gains and losses are accounted for from January 1, 2004 using the corridor approach.

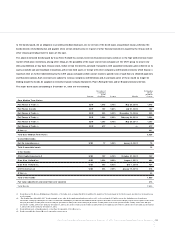

Finally, the Group grants certain O ther long-term benefits to its employees; these benefits include those generally paid when the employee

attains a specific seniority or in the case of disability. In this case the measurement of the obligation reflects the probability that payment will

be required and the length of time for which payment is expected to be made.The amount of this obligation is calculated on an actuarial basis

using the Projected Unit Credit Method.The corridor approach is not used for actuarial gains and losses arising from this obligation.

The item O ther provisions for employees consists of the best estimate at the balance sheet date of short-term employee benefits payable

by the Group within twelve months after the end of the period in which the employees render the related service.

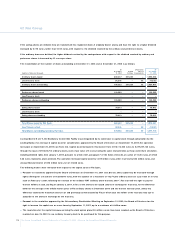

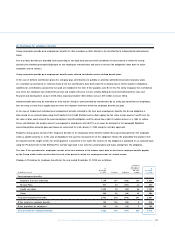

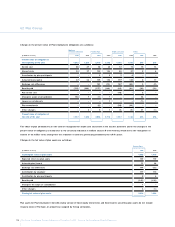

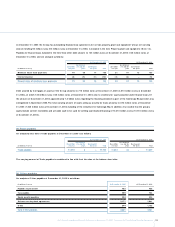

Changes in Provisions for employee benefits for the year ended D ecember 31, 2005 are as follows:

Change in

the scope of

At consolidation At

December and other December

(in millions of euros) 31, 2004 Provision Utilisation changes 31, 2005

Post-employment benefits:

Employee severance indemnity 1,179 121 (150) 133 1,283

Pension Plans 977 55 (157) (3) 872

Health care plans 1,024 76 (64) 66 1,102

O ther 262 26 (39) 45 294

Total post-employment benefits 3,442 278 (410) 241 3,551

O ther long-term employee benefits 100 136 (28) 8 216

O ther provisions for employees 140 18 (13) 7 152

Total provision for employee benefits 3,682 432 (451) 256 3,919