Chrysler 2005 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122 Fiat Group Consolidated Financial Statements at D ecember 31, 2005 - N otes to the Consolidated Financial Statements

02 Fiat Group

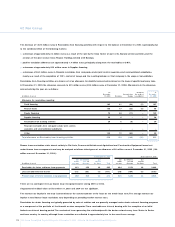

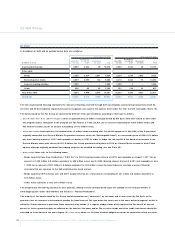

As discussed under Significant accounting policies, in the case of share-based payments the Group applies IFRS 2 to all stock options granted

after N ovember 7, 2002 which had not yet vested at January 1, 2005. In practice, this means that by D ecember 31, 2005, IFRS 2 had been

applied only to the stock options granted to Mr. Marchionne, for which the estimated fair value is 2.440 euros at D ecember 31, 2005.A

binomial pricing model is used to calculated the fair value of the options.The assumptions used under this model are as follows:

Average price of Fiat S.p.A. ordinary shares (euros) 6.466

Historical volatility of Fiat S.p.A. ordinary shares (%) 29.37

Expected dividend yield historical data (years 2003-2005) (%) 0.00

Risk-free interest rate (%) 4.021

The expected volatility of the Fiat S.p.A. ordinary share in the table is its historical volatility, in line with market practice.

The total cost recognised in the income statement for share-based payments linked to Fiat S.p.A. ordinary shares amounts to 10 million euros

in 2005 (0.3 million euros in 2004, stated net of the effect of 5.8 million euros for the options which expired during the year).

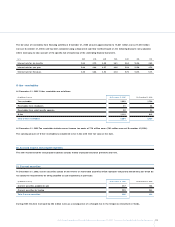

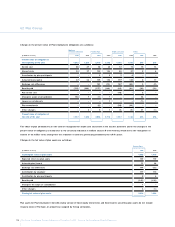

Stock Option plans linked to CN H Global N .V. ordinary shares

Certain entities of the Agricultural and Industrial Equipment Sector have granted share-based compensation to officers, employees and

directors which is linked to CN H Global N .V. (“CN H”) shares and whose terms are as follows:

The CN H Global N .V. Outside Directors’ Compensation Plan (“CN H Directors’ Plan”): this plan, established in 1999, as last amended on May 3,

2005, provides the following benefits for only the independent outside members of the Board of CN H Global N .V.:

- the payment of an annual retainer fee of USD 65,000 and a committee chair fee of USD 5,000 (collectively the “Annual Fees”) in the form

of common shares of CN H by way of quarterly stock grants at the end of each Plan Year Q uarter, unless otherwise elected (cash or stock

options);

- the payment of a meeting fee of USD 1,250 for each Board or Committee meeting attended;

- an annual grant of 4,000 options to purchase common shares of CN H that vest on the third anniversary of the grant date (“Annual

Automatic Stock O ption”);

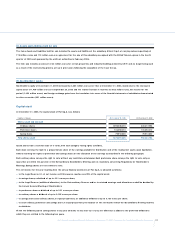

The Stock O ption election gives the independent outside directors the option to purchase common shares at a purchase price equal to the

fair market value of the common shares on the date that the Annual Fees would otherwise have been paid to the director. The number of

shares subject to such an option will be equal to the amount of Annual Fees that the director elected to forego, multiplied by four and

divided by the fair market value determined as indicated in the next paragraph. Stock options granted vest immediately upon grant, but the

shares purchased under the option cannot be sold for six months following the date of grant. N o directors receive benefits upon

termination of their service as directors.

The CN H Equity Incentive Plan (the “CN H EIP”):this plan provides share-based compensation to officers and employees of CN H Global N .V.

and its subsidiaries. Certain options vest rateably over four years from the grant date, while certain performance-based options vest subject to

the attainment of specified performance criteria but no later than seven years from the grant date.All options expire after ten years. Except as

noted below, the exercise prices of all option granted under the CN H EIP are equal to or greater than the fair market value of CN H Global

N .V. common shares on the respective grant dates. D uring 2001, CN H granted stock option with an exercise price less than the quoted

market price of its common shares at the date of grant. Under this plan, options may also be granted on restricted shares. Certain restricted

shares vest over time, while certain performance-based restricted shares vest subject to the attainment of specified performance criteria.