Chrysler 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

Fiat Group Consolidated Financial Statements at December 31, 2005 - N otes to the Consolidated Financial Statements

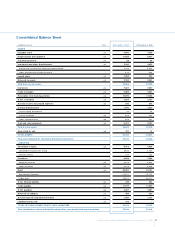

portfolios of financial services companies are included in current

assets, as the investments will be realised in their normal operating

cycle. Financial services companies, though, obtain funds only partially

from the market:the remaining are obtained from Fiat S.p.A. through

the Group’s treasury companies (included in industrial companies),

which lend funds both to industrial Group companies and to financial

services companies as the need arises.This financial service structure

within the Group means that any attempt to separate current and

non-current debt in the consolidated balance sheet cannot be

meaningful. Suitable disclosure on the due dates of liabilities is

moreover provided in the notes.

Basis of consolidation

Subsidiaries

Subsidiaries are enterprises controlled by the Group, as defined

in IAS 27 - Consolidated and Separate Financial Statements.

Control exists when the Group has the power, directly or indirectly,

to govern the financial and operating policies of an enterprise so as

to obtain benefits from its activities.The financial statements of

subsidiaries are included in the consolidated financial statements from

the date that control commences until the date that control ceases.

The equity and net result attributable to minority stockholders’

interests are shown separately in the consolidated balance sheet

and income statement, respectively.W hen losses in a consolidated

subsidiary pertaining to the minority exceed the minority interest

in the subsidiary’s equity, the excess is charged against the Group’s

interest, unless the minority stockholders have a binding obligation to

reimburse the losses and are able to make an additional investment

to cover the losses, in which case the excess is recorded as an asset

in the consolidated financial statements. If no such obligation exists,

should profits be realised in the future, the minority interests’ share of

those profits is attributed to the Group, up to the amount necessary

to recover the losses previously absorbed by the Group.

Subsidiaries either dormant or generating a negligible volume

of business are not included in the consolidated financial statements.

Their influence on the Group’s assets, liabilities, financial position and

earnings is immaterial.

Jointly controlled entities

Jointly controlled entities are enterprises over whose activities the

Group has joint control, as defined in IAS 31 - Interests in Joint

Ventures.The consolidated financial statements include the Group’s

share of the earnings of jointly controlled entities using the equity

method, from the date that joint control commences until the date

that joint control ceases.

Associates

Associates are enterprises over which the Group has

significant influence, but no control or joint control, over the

financial and operating policies, as defined in IAS 28 - Investments

in Associates.The consolidated financial statements include

the Group’s share of the earnings of associates using the equity

method, from the date that significant influence commences

until the date that significant influence ceases.W hen the Group’s

share of losses of an associate, if any, exceeds the carrying

amount of the associate in the Group’s balance sheet, the

carrying amount is reduced to nil and recognition of further

losses is discontinued except to the extent that the Group

has incurred obligations in respect of the associate.

Investments in other companies

Equity investments in other companies that are available-for-

sale financial assets are measured at fair value, when this can be

reliably determined. Gains or losses arising from changes in fair

value are recognised directly in equity until the assets are sold or

are impaired, when the cumulative gains and losses previously

recognised in equity are recognised in the income statement

of the period.

Investments in other companies for which fair value is not available

are stated at cost less any impairment losses.

Dividends received from these investments are included in Result

from equity investments.

Transactions eliminated on consolidation

All significant intragroup balances and transactions and any

unrealised gains and losses arising from intragroup transactions, are

eliminated in preparing the consolidated financial statements.

Unrealised gains and losses arising from transactions with associates

and jointly controlled entities are eliminated to the extent of the

Group’s interest in those entities.