Chrysler 2005 Annual Report Download - page 273

Download and view the complete annual report

Please find page 273 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

272 Other Items on the Agenda and Related Reports and Motions

Stockholders,

The mandate of Deloitte & Touche S.p.A., formerly Deloitte &

Touche Italia S.p.A., as the auditing firm for 2003, 2004, and 2005

expires on the date of the stockholders meeting that approves

the 2005 statutory financial statements.

In compliance with Article 159 of Legislative Decree no. 58/1998,

as amended by Law no. 262 of December 28, 2005, we propose

that since it has reached the end of its second three-year term as

external auditors, it be engaged for a six year term, i.e. for fiscal

years 2006-2011.

Having deemed it opportune to exploit its familiarity with auditing

procedures, on the one hand, and accounting techniques,

administrative procedures, and the internal control system, on the

other, and also in view of realizing synergies and savings, we have

asked Deloitte & Touche S.p.A. to make a proposal for the renewal

of the audit engagement. This solution also offers the advantage of

continuing the work performed thus far on compliance with the new

obligations imposed by the Sarbanes Oxley Act, which the Company

must comply with starting in 2006.

We also propose that Deloitte & Touche S.p.A. be engaged to audit

the entire Group, and thus including Magneti Marelli Holding and the

group of companies that it heads, in order to maximize the synergies

that can be realized with respect to compliance with United States

regulations and at the same time align the Group to international

best practices, which favor having a single auditor for individual groups.

As customary, the auditor’s activity consists of:

– the activities envisaged in Articles 155 and 156 of the

Consolidated Law on Financial Intermediation, and thus proper

bookkeeping and reporting of operations in the accounting

records, the consistency of the statutory and consolidated financial

statements with the accounting records and audits that are

performed, as well as their compliance with applicable regulations;

– limited audits of the first-half reports and the audit procedures

approved for auditing of the quarterly reports,

– additional audits of the Form 20-F consolidated financial

statements that are prepared for submission to the United

States Securities and Exchange Commission.

The estimated annual fee is 170,000 euros. It may change if

exceptional or unexpected events occur or if the structure of

the Company or the Group changes. Beginning in 2007, it will be

adjusted according to the increase in the ISTAT cost of living index.

As part of the Group auditing plan, which is attached to the motion

for the engagement of the auditing firm that we are submitting for

you approval, Deloitte & Touche S.p.A. and its foreign partners are

engaged to audit Italian and foreign subsidiaries, as illustrated in the

following outline.

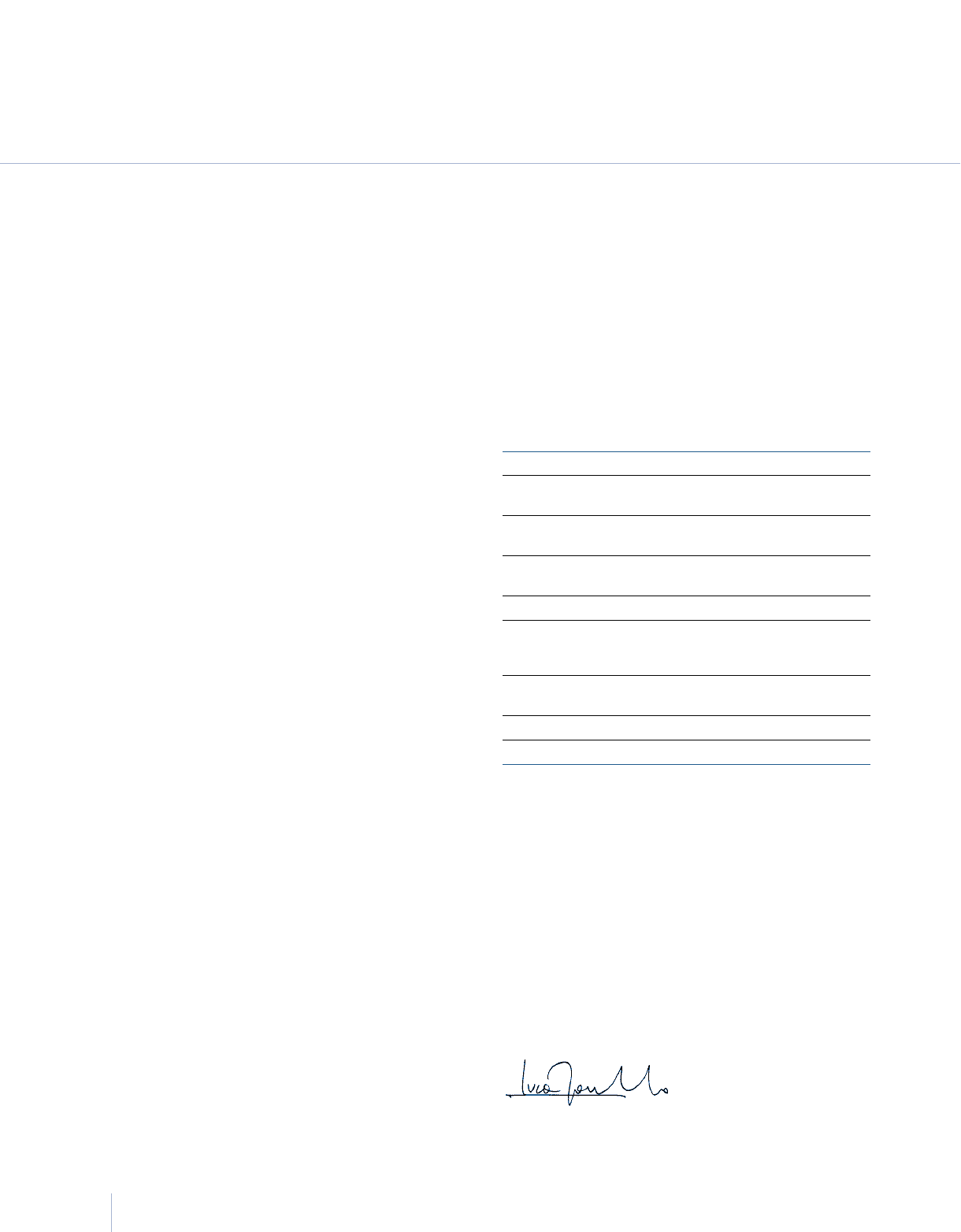

Euro

Fiat S.p.A. 170,000

Italian subsidiaries subject to complete audits pursuant

to Article 165 of Legislative Decree no. 58/1998. 4,301,810

Italian subsidiaries subject to complete audits as part

of the audit of the consolidated financial statements. 78,950

Italian subsidiaries subject to limited audits as part

of the audit of the consolidated financial statements. 52,900

Total Italian subsidiaries 4,433,660

Foreign subsidiaries subject to complete

audits pursuant to local laws and Article 150

of Consob Regulation no. 11971/1999. 10,725,414

Foreign subsidiaries subject to limited audits as part

of the audit of the consolidated financial statements. 370,926

Total foreign subsidiaries 11,096,340

GRAND TOTAL 15,700,000

Therefore, we propose that Deloitte & Touche S.p.A. be engaged

as auditing firm for the six fiscal years from 2006 to 2011, setting

its annual fee for activities performed on behalf of your Company

in the amount of 170,000 euros.

Turin, February 28, 2006

Board of Directors

By:

Luca Cordero di Montezemolo

Chairman

Engagement of the External Auditors