Chrysler 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 Fiat Group Consolidated Financial Statements at D ecember 31, 2005 - N otes to the Consolidated Financial Statements

02 Fiat Group

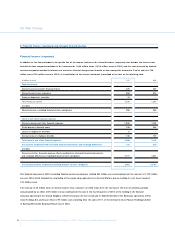

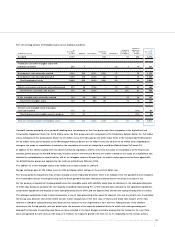

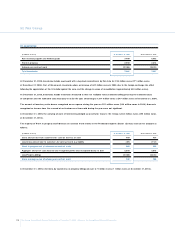

Additions of 2,275 million euros in 2005 mainly refer to the Automotive Sectors (Fiat Auto, Iveco, CN H) and to the Components Sector, and

do not include capitalised borrowing costs.The amount of 1,258 million euros shown as a Change in the scope of consolidation arises mainly

from the line-by-line consolidation of the Powertrain activities, previously included in the joint venture with General Motors, Fiat-GM

Powertrain, net of the reclassification to assets held for sale of certain plant and machinery of the subsidiary Atlanet S.p.A., for which a sales

agreement has been signed with the British Telecom group approved by the antitrust authorities in February 2006;translation gains of 422

million euros principally reflect changes in the euro/U.S. dollar rate.

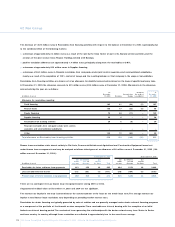

The Group has written down certain industrial buildings during the year whose carrying amount was considered not to be fully recoverable

either through use or by a possible sale.This write-down is included in selling, general and administrative costs.

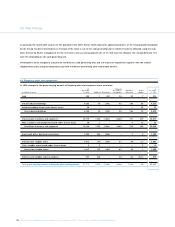

During the year the Group reviewed the recoverable amount of certain production plant in view of its reorganisation and restructuring

programmes for specific Sectors. In addition, the Group carried out a recoverability assessment for assets of businesses for which there were

indications that impairment may have occurred, using discounted cash flow methods.These assessments led to the recognition of impairment

losses of 59 million euros, of which 12 million euros is recognised in Trading profit and 47 million euros in the item Restructuring costs.

The recoverable amount of these assets was determined with reference to their value in use, calculated using a pre-tax discount rate varying

between 9.5% and 18%, as a function of the different business risks (these rates are unchanged from those used in 2004).

Additionally, at D ecember 31, 2005 the Group recognised a write-down to market value of goods sold with a buy-back commitment for a

total of 24 million euros.This write-down is recognised in Cost of sales.

The column O ther changes includes the reduction in Advances and tangible assets in progress, existing at the end of the prior year which was

reclassified to the appropriate categories at the time the assets were effectively acquired and put into operation.The column also includes an

amount of 32 million euros relating to the reclassification of certain properties and industrial buildings of CN H, no longer in use, to Assets held

for sale, as the consequence of the restructuring process taking place over the past few years following the acquisition of the Case group.

At December 31, 2005, land and industrial buildings of the Group pledged as security for debt amounted to 195 million euros (139 million

euros at D ecember 31, 2004);plant and machinery pledged as security for debt and other commitments amounted to 61 million euros (31

million euros at D ecember 31, 2004).

At December 31, 2005, the Group had contractual commitments for the acquisition of property, plant and equipment amounting to 418

million euros (407 million euros at D ecember 31, 2004).

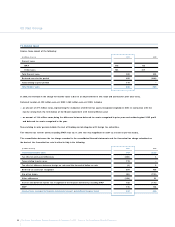

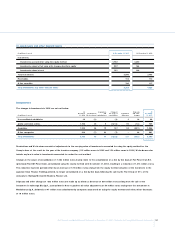

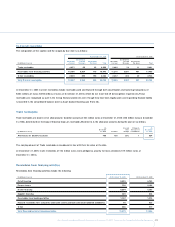

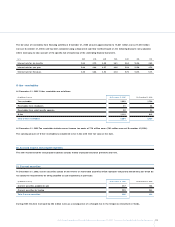

15. Investment property

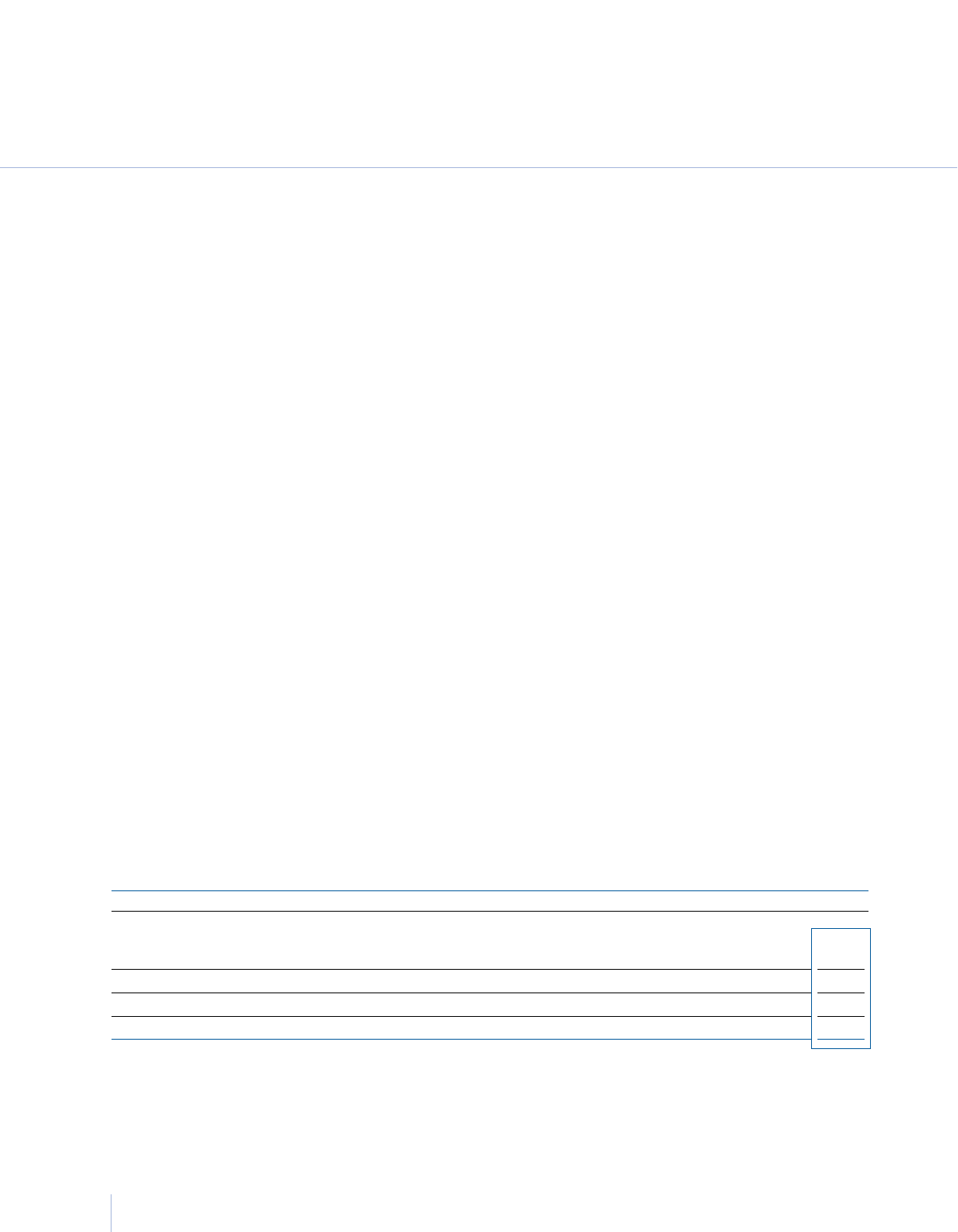

At Change in Divestitures At

December the scope of Translation and other D ecember

(in millions of euros) 31, 2004 Additions D epreciation consolidation differences changes 31, 2005

Gross carrying amount 63 – – – – (27) 36

Less:D epreciation and impairment (17) – (1) – – 8 (10)

N et carrying amount of Investment property 46 – (1) – – (19) 26

The Group holds interests in certain property to earn rental income.This investment property is carried at cost.

Rental income from investment property in 2005 amounted to 2 million euros, essentially in line with the 2004 amount.