Chrysler 2005 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134 Fiat Group Consolidated Financial Statements at D ecember 31, 2005 - N otes to the Consolidated Financial Statements

02 Fiat Group

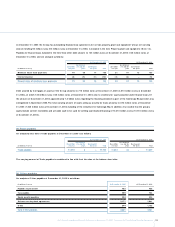

The Fiat Group intends to repay the issued bonds in cash at due date by utilising available liquid resources.At D ecember 31, 2005, the Fiat

Group also had unused committed credit lines of 1 billion euros.

In addition, the companies in the Fiat Group may from time to time buy back bonds on the market that have been issued by the Group, also

for purposes of their cancellation. Such buybacks, if made, depend upon market conditions, the financial situation of the Group and other

factors which could affect such decisions.

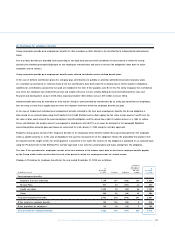

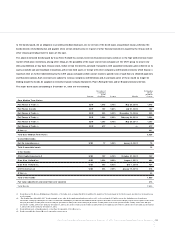

The item Borrowings from banks at December 31, 2004 included the 3 billion euros Mandatory Convertible Facility stipulated in execution of

the Framework Agreement dated May 27, 2002 with Capitalia, Banca Intesa, SanPaolo IMI and later Unicredit Banca (the “Lending Banks”),

for the purpose of providing the Fiat Group with the financial support needed to implement its strategic and industrial plans. As described in

N otes 9 and 25, the extinguishment of the Mandatory Convertible Facility and its conversion to capital stock, through the subscription by the

Lending Banks of an increase in capital stock for consideration, took place on September 20, 2005. Capital stock increased in this manner from

4,918,113,540 euros to 6,377,257,130 euros.

At December 31, 2004 the item also included 1,147 million euros of financing secured from Citigroup and a small group of banks that was

guaranteed by the EDF Put option (reference should be made to details of the ED F Put option described in N ote 3 of the Consolidated

Financial Statements at December 31, 2004) held by the Fiat Group on its residual interest of 24.6% in Italenergia Bis and the shares in

Italenergia Bis pledged by Fiat. In addition, the item included 603 million euros due to the other (bank) stockholders of Italenergia Bis, who

acquired 14% of Fiat’s interest in Italenergia Bis in 2002, subject to a series of options expiring in 2005. Given the existence of these options,

the sale of the 14% interest did not previously satisfy the revenue recognition requirements of IAS18. As described in N ote 6, Fiat repaid the

mentioned loans during the period with the proceeds of the sale of its interest of 24.6% carried out through the exercise of the Put option,

and as a result, the possibility that Fiat will be required to repurchase the 14% holding from these stockholders has been eliminated.

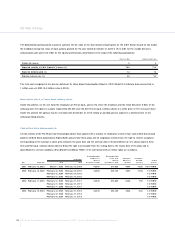

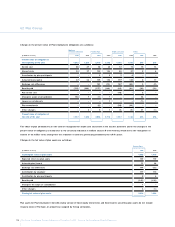

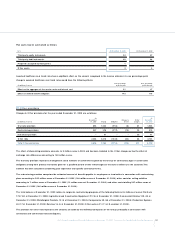

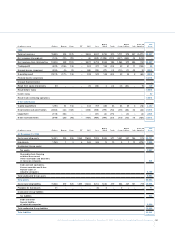

The annual interest rates and the nominal currencies of debt are as follows:

Interest rate

less from 5% from 7.5% from 10% greater

(in millions of euros) than 5%s to 7.5% to 10% to 12.5% than 12.5% Total

Euro and euro-zone currencies 7,602 5,575 341 – – 13,518

U.S. dollar 5,686 1,522 928 3 – 8,139

Japanese yen 11 – – – – 11

Brazilian real 195 4 1,088 67 442 1,796

British pound 78 44 – – – 122

Canadian dollar 937 – – – – 937

O ther 489 672 73 4 - 1,238

Total Debt 14,998 7,817 2,430 74 442 25,761

Financial payables with annual nominal interest rates in excess of 12.5% relate principally to Group’s subsidiaries operating in Brazil.

For further information on the management of interest rate and exchange rate risk reference should be made to the previous section Risk

Management and to N ote 34.

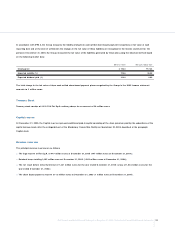

The fair value of debt at December 31, 2005 amounts to approximately to 25,624 million euros (approximately 31,989 million euros at

December 31, 2004), determined using the quoted market price of financial instruments, if available, or the related future cash flows.The

amount is calculated using the interest rates stated in N ote 19, suitably adjusted to take account of the Group’s current creditworthiness.