Chrysler 2005 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

163

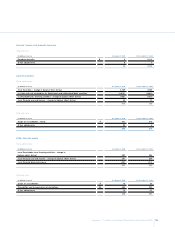

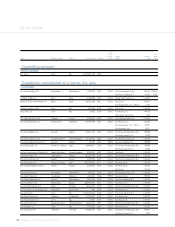

Appendix 1 Transition to International Financial Reporting Standards (IFRS)

Description of main differences between italian GAAP

and IFRS

The following paragraphs provide a description of the main

differences between Italian GAAP and IFRS that have had effects on

Fiat’s consolidated balance sheet and income statement.Amounts are

shown pre-tax and the related tax effects are separately summarised

in the item R.Accounting for deferred income taxes.

A. Development costs

Under Italian GAAP applied research and development costs may

alternatively be capitalised or charged to operations when incurred.

Fiat Group has mainly expensed R&D costs when incurred. IAS 38 –

Intangible Assets requires that research costs be expensed, whereas

development costs that meet the criteria for capitalisation must be

capitalised and then amortised from the start of production over the

economic life of the related products.

Under IFRS, the Group has capitalised development costs in the Fiat

Auto, Ferrari-Maserati,Agricultural and Construction Equipment,

Commercial Vehicle and Components Sectors, using the retrospective

approach in compliance with IFRS 1.

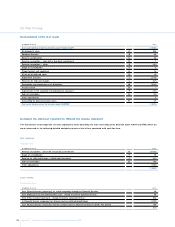

The positive impact of 1,876 million euros on the opening IFRS

stockholders’ equity at January 1, 2004, corresponds to the cumulative

amount of qualifying development expenditures incurred in prior years

by the Group, net of accumulated amortisation. Consistently, intangible

assets show an increase of 2,090 million euros and of 2,499 million

euros at January 1, 2004 and at December 31, 2004, respectively.

The 2004 net result was positively impacted by 436 million euros in the

year, reflecting the combined effect of the capitalisation of development

costs incurred in the period that had been expensed under Italian

GAAP, and the amortisation of the amount that had been capitalised in

the opening IFRS balance sheet at January 1, 2004.This positive impact

has been accounted for in Research and development costs.

In accordance with IAS 36 – Impairment of Assets, development costs

capitalized as intangible assets shall be tested for impairment and an

impairment loss shall be recognised if the recoverable amount of an

asset is less than its carrying amount, as further described in the

paragraph I. Impairment of assets.

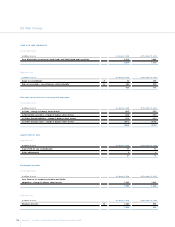

B. Employee benefits

The Group sponsors funded and unfunded defined benefit pension

plans, as well as other long term benefits to employees.

Under Italian GAAP, these benefits, with the exception of the

Reserve for Employee Severance Indemnities (“TFR”) that is

accounted for in compliance with a specific Italian law, are mainly

recorded in accordance with IAS 19 – Employee Benefits, applying

the corridor approach, which consists of amortising over the

remaining service lives of active employees only the portion of net

cumulative actuarial gains and losses that exceeds the greater of

10% of either the defined benefit obligation or the fair value of

the plan assets, while the portion included in the 10% remains

unrecognised.

W ith the adoption of IFRS,TFR is considered a defined benefit

obligation to be accounted for in accordance with IAS 19 and

consequently has been recalculated applying the Projected Unit

Credit Method.

Furthermore, as mentioned in the paragraph “O ptional

exemptions”, the Group elected to recognise all cumulative

actuarial gains and losses that existed at January 1, 2004, with a

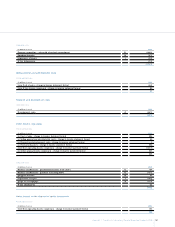

negative impact on opening stockholders’ equity at that date of

1,247 million euros.

Consequently pension and other post-employment benefit costs

recorded in the 2004 IFRS income statement do not include any

amortisation of unrecognised actuarial gains and losses deferred in

previous years in the IFRS financial statements under the corridor

approach, and recognised in the 2004 income statement under Italian

GAAP, resulting in a benefit of 94 million euros.

The Group has elected to use the corridor approach for actuarial

gains and losses arising after January 1, 2004.

Furthermore, the Group elected to state the expense related to the

reversal of discounting on defined benefit plans without plan assets

separately as Financial expenses, with a corresponding increase in

Financial expenses of 127 million euros in 2004.

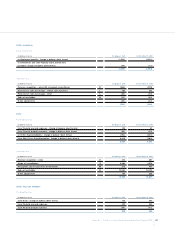

C. Business combinations

As mentioned above, the Group elected not to apply IFRS 3 -

Business Combinations retrospectively to business combinations that

occurred before the date of transition to IFRS.

As prescribed in IFRS 3, starting from January 1, 2004, the IFRS

income statement no longer includes goodwill amortization charges,

resulting in a positive impact on O ther operating income and

expense of 162 million euros in 2004.