Chrysler 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82 Fiat Group Consolidated Financial Statements at December 31, 2005 - N otes to the Consolidated Financial Statements

02 Fiat Group

Foreign currency transactions

Transactions in foreign currencies are recorded at the foreign exchange

rate prevailing at the date of the transaction. Monetary assets and

liabilities denominated in foreign currencies at the balance sheet date

are translated at the exchange rate prevailing at that date. Exchange

differences arising on the settlement of monetary items or on

reporting monetary items at rates different from those at which they

were initially recorded during the period or in previous financial

statements, are recognised in the income statement.

Consolidation of foreign entities

All assets and liabilities of foreign companies that are

consolidated are translated using the exchange rates in effect

at the balance sheet date. Income and expenses are translated at the

average exchange rate for the period.Translation differences resulting

from the application of this method are classified as equity until the

disposal of the investment.Average rates of exchange are used to

translate the cash flows of foreign subsidiaries in preparing the

consolidated statement of cash flows.

Goodwill and fair value adjustments arising on the acquisition

of a foreign entity are recorded in the relevant foreign

currency and are translated using the period end exchange rate.

In the context of IFRS First-time Adoption, the cumulative translation

difference arising from the consolidation of foreign operations was

set at nil as of January 1, 2004, as permitted by IFRS 1;gains or losses

on subsequent disposal of any foreign operation only include

accumulated translation differences arising after January 1, 2004.

Intangible assets

Goodwill

In the case of acquisitions of businesses, the acquired

identifiable assets, liabilities and contingent liabilities are recorded

at fair value at the date of acquisition. Any excess of the cost of

the business combination over the Group’s interest in the fair value

of those assets and liabilities is classified as goodwill and recorded

in the financial statement as an intangible asset. If this difference

is negative (negative goodwill), it is recognised in the income

statement at the time of acquisition.

Goodwill is not amortised, but is tested for impairment annually,

or more frequently if events or changes in circumstances indicate that

it might be impaired.After initial recognition, goodwill is measured at

cost less any accumulated impairment losses.

O n disposal of part or whole of a business which was

previously acquired and which gave rise to the recognition

of goodwill, the residual amount of the related goodwill is

included in the determination of the gain or loss on disposal.

In the context of IFRS First-time Adoption, the Group elected

not to apply IFRS 3 - Business Combinations retrospectively to the

business combinations that occurred before January 1, 2004;as a

consequence, goodwill arising on acquisitions before the date of

transition to IFRS has been retained at the previous Italian GAAP

amounts, subject to being tested for impairment at that date.

Development costs

Development costs for vehicle project production (cars, trucks,

buses, agricultural and construction equipment, related components,

engines, and production systems) are recognised as an asset if and

only if all of the following conditions are met: the development costs

can be measured reliably and the technical feasibility of the product,

volumes and pricing support the view that the development

expenditure will generate future economic benefits. Capitalised

development costs comprise only expenditures that can be

attributed directly to the development process.

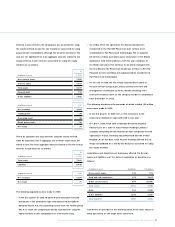

Capitalised development costs are amortised on a systematic basis

from the start of production of the related product over the

product’s estimated life, as follows:

N ° of years

Cars 4 - 5

Trucks and buses 8

Agricultural and construction equipment 5

Engines 8 - 10

Components 3 - 5

All other development costs are expensed as incurred.

Other intangible assets

O ther purchased and internally-generated intangible assets are

recognised as assets in accordance with IAS 38 - Intangible Assets, where

it is probable that the use of the asset will generate future economic

benefits and where the costs of the asset can be determined reliably.