Chrysler 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278

|

|

46 Reporton Operations Stock Options Plans

01 Report on Operations

Stock Options Plans

Thus far, the Board has approved Stock Option Plans offered to

about 900 managers of the Group’s Italian and foreign companies

who are qualified as “Direttore” or have been included in the

Management Development Program for high-potential managers.

Plan regulations share these common features:

Options are granted to individual managers on the basis of

objectiveparametersthat take into account the level of

responsibility assigned to each person and his or her performance.

If employment is terminated or an employee’s relationship with the

Group is otherwise severed, options that are not exercisable

become null and void. However, vested options may be exercised

within 30 days from the date of termination, with certain

exceptions.

The option exercise price, which is determined on the basis of the

average stock market price for the month preceding the option

grant, can vary as a result of transactions affecting the Company’s

capital stock. It must be paid in cash upon the purchase of the

underlying shares.

The options are normallyexercisable starting one year after they

are granted and for the following eight years, but during the first

four years, exercise is limited to annual tranches, which may be

accumulated, of no more than 25% of the total granted.

In consideration of the options previously granted under the aforesaid

plans and that have since expired upon termination of employment, a

total of 7,749,500 option rights corresponding to the same number of

shares represent treasury stock to be assigned to the holders of options

pursuant to the conditions envisaged in the specific Regulations.

In addition, the Board of Directors granted Mr. Sergio Marchionne,

as a portion of his variable compensation as Chief Executive Officer,

options for the purchase of 10,670,000 Fiat ordinaryshares at the

price of 6.583 euros per share, exercisable from June 1, 2008 to

January 1, 2011. In each of the first three years since the grant, he

accrues the right to purchase, from June 1, 2008, a maximum of

2,370,000 shares per year and on June 1, 2008 he accrues the right

to purchase, effective that date, the residual portion amounting to

3,560,000 shares. The right to exercise the options related to this

last portion of shares is subject to certain predetermined profitability

targets that should be reached during the reference period.

Ferrari S.p.A. granted its Chairman and Chief Executive Officer, Luca

Cordero di Montezemolo, options for the purchase of 184,000

Ferrarishares at the price of 175 euros per share, exercisable until

December 31, 2010.The exercise of 80,000 of said shares is subject

to the placement of Ferrari shares on the stock market.

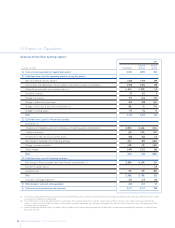

Options granted as part of Stock Options Plans on Fiat shares

and outstanding at December 31, 2005 are shown in the next page.

Options granted to Board Members are instead shown in a specific

table in the Notes to the Financial Statements.