Chrysler 2005 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278

|

|

235

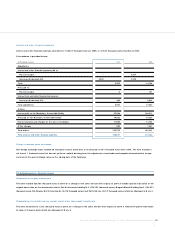

Fiat S.p.A. Financial Statements at D ecember 31, 2005 - N otes to the Financial Statements

Deferred income

Deferred income amounted to 19 thousand euros at D ecember 31, 2005, unchanged with respect to the figure reported at December 31,

2004. D eferred income refers to income to be recognised in 2006.

14. Memorandum accounts

Guarantees granted

Unsecured guarantees

Suretyships

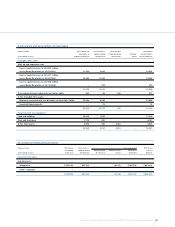

Suretyships totalled 1,257,760 thousand euros at D ecember 31, 2005.

They include suretyships provided on behalf of FiatSava S.p.A. to secure a debenture issue (410,303 thousand euros) and to secure Billets de

Trésorerie issued by Group companies and third parties (totalling 314,000 thousand euros), bank loans (344,359 thousand euros), and rental

obligations for buildings in relation to real estate securitisation operations carried out in previous years (189,098 thousand euros).

The net decrease of 530,900 thousand euros from D ecember 31, 2004 is mainly due to lower guarantees provided to secure Sava debentures

(598,064 thousand euros) and rental obligations for buildings (218,834 thousand euros), partially offset by higher guarantees for financings

(171,998 thousand euros) and the issuance of Billets de Trésorerie (114,000 thousand euros).

O ther unsecured guarantees

This item totalled 7,220,706 thousand euros at D ecember 31, 2005.

It includes the following:

7,100,924 thousand euros in guarantees provided on behalf of subsidiaries to secure loans (Banco CN H Capital S.A. 651,973 thousand

euros, CN H America LLC 130,103 thousand euros, Fiat Automoveis S.A. 78,040 thousand euros, Iveco Fiat Brasil Ltda 14,724 thousand

euros, Magneti Marelli Controle Motor Ltda 3,248 thousand euros, Iveco Latin America Ltda 2,178 thousand euros), bond issues (Fiat

Finance and Trade Ltd 5,426,621 thousand euros, Fiat Finance Canada Ltd. 100,000 thousand euros, Fiat Finance Luxembourg S.A. 14,571

thousand euros), credit lines (CN H Capital America LLC 127,130 thousand euros, CN H Capital Canada Ltd. 39,738 thousand euros, N ew

Holland Credit Company LLC 32,920 thousand euros, CN H Capital Australia Pty Ltd 12,057 thousand euros, Fiat India Private Limited 6,686

thousand euros, Comau India Private Limited 201 thousand euros, N ew Holland Tractors (India) Pty Ltd 73 thousand euros),VAT credits

under the Group consolidation process (278,260 thousand euros), as provided under Ministerial D ecree of 12/13/79 as amended, and

sundry guarantees (182,401 thousand euros);

119,782 thousand euros in miscellaneous guarantees.

The net decrease of 2,547,542 thousand euros with respect to D ecember 31, 2004 is due mainly to fewer guarantees on behalf of subsidiaries

following the reimbursement of bonds and the extinguishment of financings.

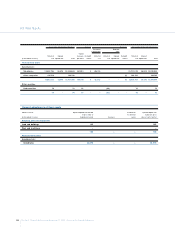

Although they are not included in memorandum accounts, mention is made of the following:

At December 31, 2005, outstanding trade and other receivables sold without recourse and due after that date totalled 688 million euros

(415 million euros in 2004 due after December 31, 2004). The turnover of discounting without recourse totalled 1,537 million euros in

2005 (843 million euros in 2004).At December 31, 2005, there was no risk of recourse against sold receivables as there were no

receivables sold with recourse outstanding at that date.