Chrysler 2005 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148 Appendix 1 Transition to International Financial Reporting Standards (IFRS)

02 Fiat Group

Following the coming into force of European Regulation N o. 1606

dated July 19, 2002, starting from January 1, 2005, the Fiat Group

adopted International Financial Reporting Standards (IFRS) issued by

the International Accounting Standards Board (“IASB”).This Appendix

provides the IFRS reconciliations of balance sheet data as of January

1 and D ecember 31, 2004, and of income statement data for the

year ended D ecember 31, 2004 as required by IFRS 1 – First-time

Adoption of IFRS, together with the related explanatory notes.

This information has been prepared as part of the Group’s

conversion to IFRS and in connection with the preparation of its

2005 consolidated financial statements in accordance with IFRS, as

adopted by the European Union.

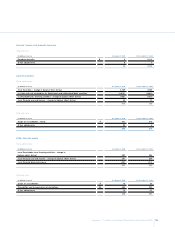

RECON CILIATIO N S REQ UIRED BY IFRS 1

As required by IFRS 1, this note describes the polices adopted in

preparing the IFRS opening consolidated balance sheet at January 1,

2004, the main differences in relation to Italian GAAP used to

prepare the consolidated financial statements until December 31,

2004, as well as the consequent reconciliations between the figures

already published, prepared in accordance with Italian GAAP, and the

corresponding figures remeasured in accordance with IFRS.

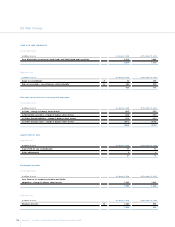

The 2004 restated IFRS consolidated balance sheet and income

statement have been prepared in accordance with IFRS 1 – First-time

Adoption of IFRS. In particular, the IFRS applicable from January 1,

2005, as published as of D ecember 31, 2004, have been adopted,

including the following:

IAS 39 – Financial Instruments: Recognition and M easurement in

its entirety. In particular, the Group adopted derecognition

requirements retrospectively from the date on which financial assets

and financial liabilities had been derecognized under Italian GAAP.

IFRS 2 – Share-based Payment, which was published by the IASB on

February 19, 2004 and adopted by the European Commission on

February 7, 2005.

FIRST-TIME ADO PTION O F IFRS

General principle

The Group applied the accounting standards in force at D ecember

31, 2004 retrospectively to all periods presented, and to the opening

balance sheet except for certain exemptions adopted by the Group

in accordance with IFRS 1, as described in the following paragraph.

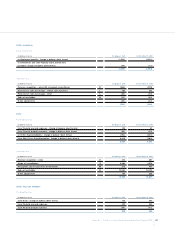

The opening balance sheet at January 1, 2004 reflects the

following differences as compared to the consolidated balance sheet

prepared at December 31, 2003 in accordance with Italian GAAP:

all assets and liabilities qualifying for recognition under IFRS,

including assets and liabilities that were not recognized under

Italian GAAP, have been recognized and measured in accordance

with IFRS;

all assets and liabilities recognized under Italian GAAP that do not

qualify for recognition under IFRS have been eliminated;

certain balance sheet items have been reclassified in accordance

with IFRS.

The impact of these adjustments is recognised directly in opening

equity at the date of transition to IFRS (January 1, 2004).

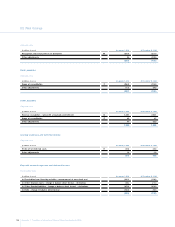

Optional exemptions adopted by the Group

Business combinations:The Group elected not to apply IFRS 3 -

Business Combinations retrospectively to the business combinations

that occurred before the date of transition to IFRS.

Employee benefits:The Group elected to recognise all cumulative

actuarial gains and losses that existed at January 1, 2004, even though it

decided to use the corridor approach for later actuarial gains and losses.

Cumulative translation differences:The cumulative translation

differences arising from the consolidation of foreign operations have

been set at nil as at January 1, 2004;gains or losses on subsequent

disposal of any foreign operation shall only include accumulated

translation differences after January 1, 2004.