Chrysler 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

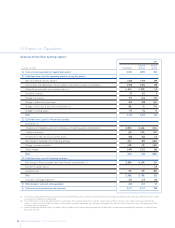

48 Reporton Operations Transactions among Group Companies and with Related Parties

01 Report on Operations

Transactions among Group

Companies and with Related Parties

Transactions among Group companies, whether they are made to

support vertical manufacturing integration or to provide services, are

carried out at terms that, considering the quality of the goods or

services involved, are competitive with those available in the

marketplace.

The main transactions that took place during 2005 between the

Parent Company, Fiat S.p.A., and its subsidiaries and associated

companies are summarized below:

Subscription to capital increases of subsidiaries as described

in the Notes to the financial statements of Fiat S.p.A.;

Licensing of the right to use the Fiat trademark, for a consideration

based on a percentage of sales, to Fiat Auto S.p.A.;

Contributions provided to Group companies for initiatives

to enhance the Group’s image;

Services provided byFiat S.p.A. managersto Fiat Auto S.p.A., Iveco

S.p.A.,Teksid S.p.A., Magneti Marelli Holding S.p.A., Comau S.p.A.,

Business Solutions S.p.A., Itedi S.p.A. and other minor Group

companies;

Grant of suretyships and guarantees in connection with the

issuance of bonds (essentially Fiat Finance and Trade Ltd.), loans

provided by banks (Fiat Finance S.p.A. - formerly Fiat Ge.Va. S.p.A.,

FMA - Fabbrica MotoriAutomobilistici S.r.l., Banco CNH Capital

S.A., CNH America LLC, Fiat Automoveis S.A. and other minor

companies), the issuance of “billets de tresorerie” (Fiat Finance and

Trade Ltd.), credit lines (CNH Global N.V., CNH Capital America

LLC, CNH Capital Canada Ltd., NH Credit CompanyLLC and

other minor companies) and payment obligations under building

rental contracts (Fiat Auto S.p.A. and its subsidiaries). In addition,

a $1 billion direct credit line is in place between Fiat S.p.A. and

CNH Global N.V.;

Rental of buildings to Ingest Facility S.p.A.;

Current accounts and short-term financings management (Fiat

Finance S.p.A.), purchase of administrative, fiscal, corporate affairs

and consulting services (Fiat Gesco S.p.A.), payroll and other

general services (Fiat Servizi per l’Industria S.c.p.A.);

Purchase of inspection and internal auditing services from

Fiat-Revisione Interna S.c.r.l.;

Purchase of information technology services provided by PDL

Service S.r.l. and eSPIN S.p.A.;

Purchase of external relations services provided by Fiat

Information & Communication Services società consortile per

azioni;

Office space and real property maintenance services provided

by Ingest Facility S.p.A.;

Security services and other services provided by Consorzio

Orione and Sirio S.c.p.A.;

Purchase of automobiles from Fiat Auto S.p.A.

Fiat S.p.A., as consolidating company, and almost all its Italian

subsidiaries decided to comply with the national tax consolidation

program according to articles 177/129 of T.U.I.R. (Consolidated

Law on Income Tax).

Relationships with related parties, whose definition was extended in

accordance with IAS 24, include not only normal business relationships

with listed groups or other major groups in which the directors of the

Companyor its parent companies hold a significant position, but also

purchases of Group products at normal market prices or, in the case

of individuals, the prices that are usually charged to employees.

Transactions with related parties to be mentioned include professional

services rendered by Mr. Franzo Grande Stevens (consultancies and

activities performed in his capacity as secretary of the Board of

Directors) to Fiat S.p.A. for a total of 940 thousand euros.

Based on the information received from the various Group companies,

there were no atypical or unusual transactions during the year.

Extraordinary transactions among Group companies or with related

parties that occurred during the year are as follows:

Ferrari S.p.A.: an entity comprising the group of companies that

manufacture and sell Maserati cars was transferred to a company

that simultaneously assumed the name Maserati S.p.A. and was

sold to Fiat Partecipazioni S.p.A;

Within the framework of the reorganization of central activities

in France, aimed at transferring the role of national company to

the main operating company, Fiat France S.A. was merged into

Fiat Auto France S.A. which took its name. Before the merger,

Fiat France S.A. had been sold byFiat Partecipazioni S.p.A. to

Fiat Finance Netherlands B.V.; concurrently, Fiat France S.A. sold

its 100% interest in La Stampa Europe SAS to Itedi S.p.A.