Chrysler 2005 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143

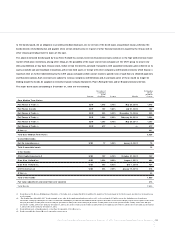

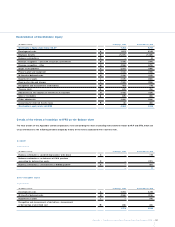

Fiat Group Consolidated Financial Statements at December 31, 2005 - N otes to the Consolidated Financial Statements

34. Information on financial risks

The Group is exposed to financial risks connected with its operations:

credit risk, regarding its normal business relations with customers and dealers, and its financing activities;

liquidity risk, with particular reference to the availability of funds and access to the credit market and to financial instruments in general;

market risk (principally relating to exchange rates, interest rates), since the Group operates at an international level in different currencies

and uses financial instruments which generate interest.

As described in the section “Risk management”, the Fiat Group constantly monitors the financial risks to which it is exposed, in order to detect

those risks in advance and take the necessary action to mitigate them.

The following section provides qualitative and quantitative disclosures on the effect that these risks may have upon the Group.

The quantitative data reported in the following do not have any value of a prospective nature, in particular the sensitivity analysis on market

risks, is unable to reflect the complexity of the market and its related reaction which may result from every change which may occur.

Credit risk

The maximum credit risk to which the Group is theoretically exposed at D ecember 31, 2005 is represented by the carrying amounts stated

for financial assets in the balance sheet and the nominal value of the guarantees provided on liabilities or commitments to third parties as

discussed in N ote 32.

Dealers and final customers are subject to specific assessments of their creditworthiness under a detailed scoring system; in addition to

carrying out this screening process, the Group also obtains financial and non-financial guarantees for credit granted for the sale of cars,

commercial vehicles and agricultural and construction equipment.These guarantees are further strengthened by reserve of title clauses on

financed vehicle sales to the sales network and on vehicles assigned under finance leasing agreements.

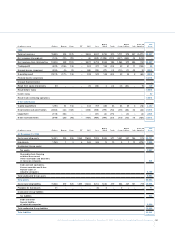

O f Receivables from financing activities amounting to 15,973 million euros at D ecember 31, 2005, balances totalling 205 million euros have

been written down on an individual basis;of the remainder, balances totalling 226 million euros are past due up to one month, while balances

totalling 408 million euros are past due beyond one month. In the event of instalment payments, even if only one instalment is overdue, the

whole amount of the receivable is classified as overdue.

O f Trade receivables and O ther receivables totalling 8,053 million euros at D ecember 31, 2005, balances totalling 119 million euros have been

written down on an individual basis;of the remainder, balances totalling 400 million euros are past due up to one month, while balances

totalling 613 million euros are past due beyond one month.

Balances which are objectively uncollectible either in part or for the whole amount, are written down on a specific basis if they are individually

significant.The amount of the write-down takes into account an estimate of the recoverable cash flows and the date of receipt, the costs of

recovery and the fair value of any guarantees received. General provisions are made for receivables which are not written down on a specific

basis, determined on the basis of historical experience and statistical information.

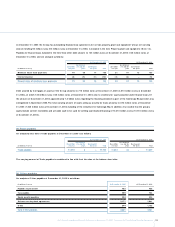

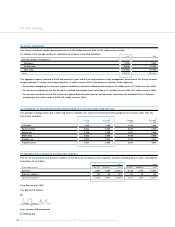

Liquidity risk

Liquidity risk arises if the Group is unable to obtain under economic conditions the funds needed to carry out its operations.

The two main factors that determine the Group’s liquidity situation are on one side the funds generated or absorbed by operating and

investing activities and on the other the term of debt and its renewal conditions or the liquidity of funds employed.

As described in the Risk management section, the Group has adopted a series of policies and procedures whose purpose is to optimise the

management of funds and to reduce the liquidity risk, as follows:

centralising the management of receipts and payments, where it may be economical in the context of the local civil, currency and fiscal

regulations of the countries in which the Group is present;

maintaining an adequate level of available liquidity;

diversifying the means by which funds are obtained and maintaining a continuous and active presence on the capital markets;