Chrysler 2005 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144 Fiat Group Consolidated Financial Statements at D ecember 31, 2005 - N otes to the Consolidated Financial Statements

02 Fiat Group

obtaining adequate credit lines;

monitoring future liquidity on the basis of business planning.

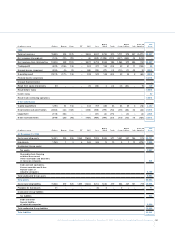

Details as to the repayment structure of the Group’s financial assets and debt are provided in N otes 19 and 28, which are entitled respectively

Current receivables and Debt.

Management believes that the funds and credit lines currently available, in addition to those funds that will be generated from operating and

funding activities, will enable the Group to satisfy its requirements resulting from its investing activities and its working capital needs and to fulfil

its obligations to repay its debts at their natural due date.

Exchange rate risk

The group is exposed to risk resulting from changes in exchange rates, which can affect its result and its equity. In particular:

W here a Group company incurs costs in a currency different from that of its revenues, any change in exchange rates can affect the

operating result of that company.

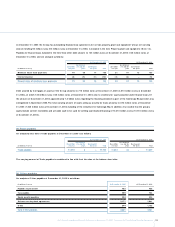

In 2005, the total trade flows exposed to exchange rate risk amounted to the equivalent of approximately 14% of the Group’s turnover.

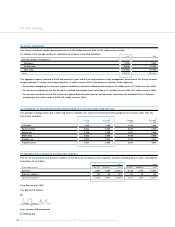

The principal exchange rates to which the Group is exposed are the following:

- EUR/USD, relating to sales in dollars made by Italian companies (in particular Ferrari and Maserati) to the N orth American market and to

other markets in which the dollar is the trading currency, and to the production and purchases of the CN H Sector in the euro area;

- EUR/GBP, principally in relation to sales by Fiat Auto and Iveco on the UK market;

- EUR/PLN , relating to local costs incurred in Poland regarding products sold in the euro area;

- USD /BRL and EUR/BRL, relating to Brazilian manufacturing operations and the related import and export flows, for which the company is

a net exporter in US dollars.

The trading flows exposed to changes in these exchange rates amounted in 2005 to about 75% of the total exchange rate risk from trading

transactions.

O ther significant exposures regard the exchange rates EUR/CHF, EUR/TRY, USD/CAD USD/AUD, USD /GBP and USD/JPY. N one of these

exposures, taken individually, exceeded 5% of the Group’s total transaction exchange risk exposure in 2005.

It is the Group’s policy to use derivative financial instruments to hedge a certain percentage, on average between 55% and 85%, of the

trading transaction exchange risk exposure forecast for the coming 12 months (including that going beyond that date where it is believed to

be appropriate in relation to the characteristics of the business) and to hedge completely the exposure resulting from certain contractual

commitments.

Group companies may find themselves with trade receivables or payables denominated in a currency different from the money of account

of the company itself. In addition, in a limited number of cases, it may be convenient from an economic point of view or it may be required

under local market conditions, for companies to obtain finance or use funds in a currency different from the money of account. Changes in

exchange rates may result in exchange gains or losses arising from these situations.

It is the Group’s policy to hedge fully, whenever possible, the exposure resulting from receivables, payables and securities denominated in

foreign currencies different from the company’s money of account.

Certain of the Group’s subsidiaries are located in countries which are not members of the European monetary union, in particular the United

States, Canada, United Kingdom, Switzerland, Brazil, Poland,Turkey, India and China.As the Group’s reference currency is the Euro, the income

statements of those countries are converted into euros using the average exchange rate for the period, and while revenues and margins are

unchanged in local currency, changes in exchange rates may lead to effects on the converted balances of revenues, costs and the result in Euros.

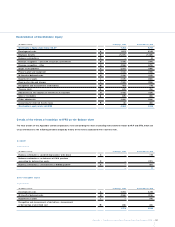

The assets and liabilities of consolidated companies whose money of account is different from the euro may acquire converted values in

euros which differ as a function of the variations in exchange rates.The effects of these changes are recognised directly in the item

“Cumulative translation differences” included in stockholders’ equity (see N ote 25).

The Group monitors its principal exposure to conversion exchange risk, although there was no specific hedging in this respect at the balance

sheet date.