Chrysler 2005 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

207

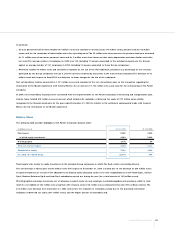

Transition to International Financial Reporting Standards (IFRS) by Fiat S.p.A.

Transition to International Financial

Reporting Standards (IFRS) by Fiat S.p.A.

As a result of the implementation of European Regulation no. 1606

of July 19, 2002, the Fiat Group has adopted International Financial

Reporting Standards (IFRS) for the preparation of its consolidated

financial statements with effect from January 1, 2005. O n the basis

of Italian law implementing this regulation, the statutory financial

statements of the Parent Company Fiat S.p.A. will be prepared

in accordance with these standards from fiscal 2006.

As a consequence, Fiat is currently making the transition to IFRS

for its statutory financial statements and will report its 2006 first

half results and prior year comparatives in accordance with IFRS.

This note describes the policies that Fiat has adopted in preparing

its IFRS opening balance sheet at January 1, 2005, as well as the main

differences in relation to Italian GAAP used to prepare its statutory

financial statements up until D ecember 31, 2005.

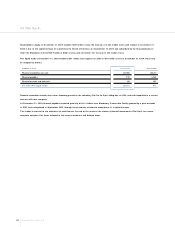

As part of this transition programme, an opening balance sheet

of Fiat S.p.A. at January 1, 2005 will be prepared in accordance

with IFRS 1 – First-time Adoption of International Financial Reporting

Standards, on the basis of the IFRS applicable from January 1, 2006,

as published at December 31, 2005. In particular, the amendments

to IFRS 4 and IAS 39 issued in 2005 and effective from January 1,

2006 will be applied, which regard the measurement and recognition

of financial guarantee contracts in the financial statements of the

guarantor and the limitation in the use of the “fair value option”

to financial instruments satisfying specific conditions.

FIRST-TIME ADO PTION O F IFRS

General principle

In accordance with IFRS 1, the Parent Company Fiat S.p.A. is

required to apply the accounting standards in force at the reporting

date for its first IFRS financial statements retrospectively to all periods

presented, except for one permitted exemption adopted by Fiat S.p.A.

and described in the following paragraph.

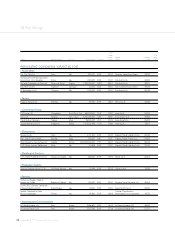

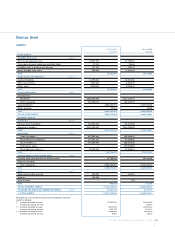

The opening IFRS balance sheet at January 1, 2005 will therefore

reflect the following differences with the statutory balance sheet

prepared at December 31, 2004 in accordance with Italian GAAP:

all assets and liabilities qualifying for recognition under IFRS,

including assets and liabilities that were not recognised under Italian

GAAP, will be recognised and measured in accordance with IFRS;

all assets and liabilities recognised under Italian GAAP that do

not qualify for recognition under IFRS will be eliminated;

certain balance sheet items will be reclassified in accordance with IFRS.

The impact of these adjustments will be recognised directly in

opening equity at January 1, 2005, the date of transition to IFRS.

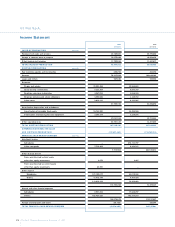

In summary, the assets and liabilities to be included in the statutory

financial statements of the Parent Company Fiat S.p.A. prepared

in accordance with IFRS will be recognised and measured in the

same manner as that used to prepare the financial statements drafted

for inclusion in the Group’s consolidated financial statements, in

accordance with IFRS 1, with the exception of consolidation entries.

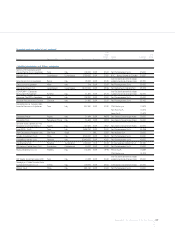

O PTION AL EXEMPTIO N ADO PTED BY FIAT S.P.A.

Employee benefits:Fiat S.p.A. has elected to recognise all cumulative

actuarial gains and losses that existed at January 1, 2005, but will use

the corridor approach for those arising after that date.

DESCRIPTIO N O F THE MAIN D IFFEREN CES

BETW EEN ITALIAN GAAP AN D IFRS

The following paragraphs provide a description of the main differences

between Italian GAAP and IFRS that will have effect on the statutory

financial statements of Fiat S.p.A.

1.W rite-off of deferred costs

Under Italian GAAP, Fiat S.p.A. defers and amortises certain costs

(mainly start-up and expansion costs). IFRS require these to be

expensed when incurred.

In particular, costs incurred in connection with share capital increases

which are deferred and amortised under Italian GAAP are deducted

directly from the proceeds of the increase and debited to stockholders’

equity under IFRS.

2.Valuation of investments in other companies not held

as current assets

In the financial statements of Fiat S.p.A. prepared in accordance with

Italian GAAP, equity investments included under financial fixed assets