Chrysler 2005 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

138 Fiat Group Consolidated Financial Statements at D ecember 31, 2005 - N otes to the Consolidated Financial Statements

02 Fiat Group

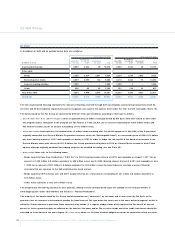

It should be pointed out that at present the conditions that would give rise to the strategic deadlock are considered to be quite remote.

Fiat S.p.A. is subject to a put contract with Renault (in reference to the original investment of 33.5% in Teksid, now 15.2%).

In particular, Renault would acquire the right to exercise a sale option on the treasury stock to Fiat, in the following cases:

in the event of nonfulfilment in the application of the protocol of the agreement and admission to receivership or any other redressment

procedure;

in the event Renault’s investment in Teksid falls below 15% or Teksid decides to invest in a structural manner outside the foundry sector;

should Fiat be the object of the acquisition of control by another car manufacturer.

The exercise price of the option is established as follows:

for 6.5% of the capital stock of Teksid, the initial investment price increased pro rata temporis;

for the remaining amount of capital stock of Teksid, the share of the accounting net equity at the exercise date.

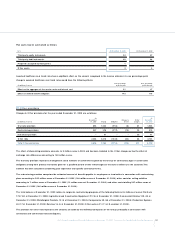

Sales of receivables

The Group has discounted receivables and bills without recourse having due dates after December 31, 2005 amounting to 2,463 million euros

(1,623 million euros at D ecember 31, 2004, with due dates after that date), which refer to trade receivables and other receivables for 2,007

million euros (1,325 million euros at December 31, 2004) and receivables from financing for 456 million euros (298 million euros at December

31, 2004).The increase during the period is mainly connected with the sales of receivables to companies of the Iveco Finance H oldings Limited

group, which from June 1, 2005 are no longer consolidated on a line-by-line basis.

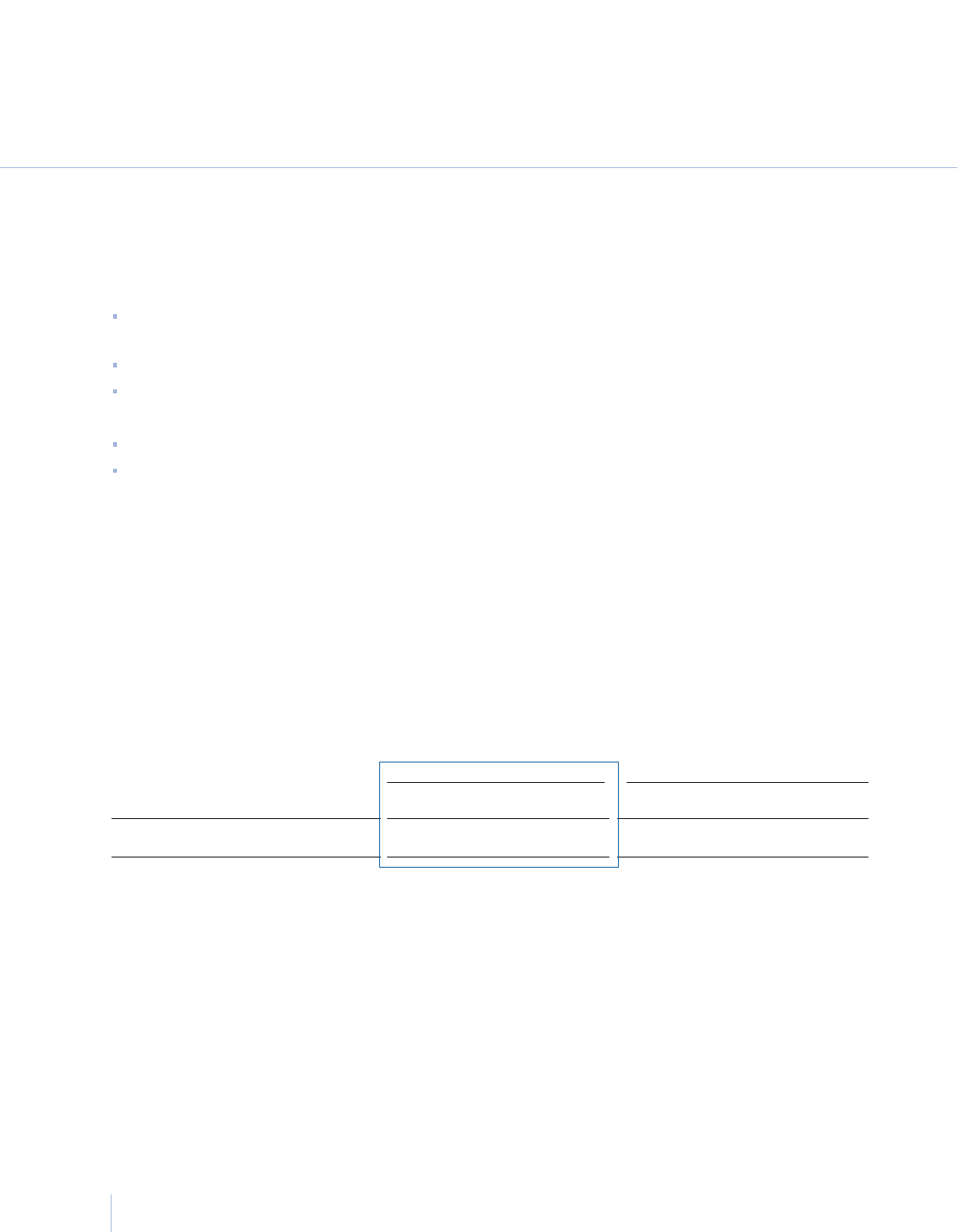

O perating lease contracts

The Group enters into operating lease contracts for the right to use industrial buildings and equipments with an average term of 10-20 years

and 3-5 years, respectively,At December 31, 2005 the total future minimum lease payments under non-cancellable lease contracts are as follows.

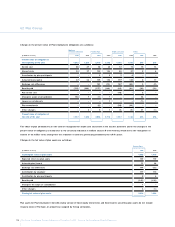

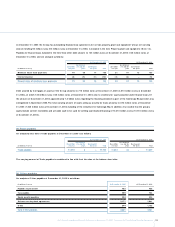

At December 31, 2005 At December 31, 2004

Due between Due between

Due within one and five Due beyond D ue within one and five D ue beyond

(in millions of euros) one year years five years Total one year years five years Total

Future minimum lease payments under

operating lease agreements 71 171 161 403 75 177 160 412

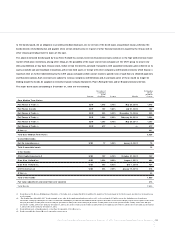

Contingent liabilities

As a global company with a diverse business portfolio, the Fiat Group is exposed to numerous legal risks, particularly in the areas of product

liability, competition and antitrust law, environmental risks and tax matters.The outcome of any current or future proceedings cannot be

predicted with certainty. It is therefore possible that legal judgments could give rise to expenses that are not covered, or fully covered, by

insurers’ compensation payments and could affect the Group financial condition and results.At December 31, 2005, contingent liabilities

estimated by the Group amount to approximately 200 million euros, for which no provisions have been recognised since an outflow of

resources is not considered to be probable. Furthermore, contingent assets and expected reimbursement in connection with these contingent

liabilities for approximately 30 million euros have been estimated but not recognised.

Instead, when it is probable that an outflow of resources embodying economic benefits will be required to settle obligations and this amount

can be reliably estimated, the Group recognises specific provision for this purpose.

Furthermore, in connection with significant asset divestitures carried out in 2005 and in prior years, the Group provided indemnities to

purchasers with the maximum amount of potential liability under these contracts generally capped at a percentage of the purchase price.These