Chrysler 2005 Annual Report Download - page 209

Download and view the complete annual report

Please find page 209 of the 2005 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

208 Transition to International Financial Reporting Standards (IFRS) by Fiat S.p.A.

03 Fiat S.p.A.

(investments in subsidiaries and in other companies) are stated at

historical cost, which is written down in the event of an impairment

loss;the impairment loss is reversed if in subsequent years the

reasons for the write-down no longer apply.

Under IFRS, IAS 27 requires that investments in subsidiaries be either

recorded at cost or at their fair value. If there are reasons to believe

that all or part of the cost cannot be recovered, the carrying amount

must be reduced to the recoverable amount of the investment in

accordance with IAS 36. If this loss is subsequently reduced or is

entirely recovered, the carrying amount is increased back up to the

newly estimated recoverable amount, which may not exceed the

amount that would have been determined if no impairment loss had

been recorded.Any restoration of the carrying amount is recorded

immediately in the income statement.

O n the basis of current analyses, the measurement of the carrying

amount of subsidiaries using the cost method as stated in IAS 27

is not expected to lead to the recognition of significant differences

in the preparation of the IFRS opening balance sheet.

In accordance with IAS 39, investments in other companies

represented by available-for-sale financial assets, are measured at their

fair value, if this can be determined, and the gains and losses resulting

from changes in the fair value are recognised directly in stockholders’

equity until the financial assets are disposed of or determined to be

impaired. At that time, all gains and losses previously recognised

in equity are included in the income statement for the period.

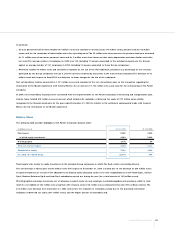

The investment held by Fiat S.p.A. in Mediobanca S.p.A. satisfies these

requirements, with its fair value being determined as its stock market

quotation at the date of the financial statements.The adoption of

IFRS on January 1, 2005 will therefore lead to the recognition of the

excess of the stock market price of the investment over its carrying

value at that date, with a net positive impact on stockholders’ equity.

3. Contract work in progress

As permittted under Italian GAAP, Fiat S.p.A. accounts for contract

work in progress at its production cost. This refers in particular to the

execution of long-term agreements (contracts signed between Fiat and

Treno Alta Velocità – T.A.V. S.p.A.).As a result, revenue is recognised

after delivery and when accepted by the customer on a final basis,

that is, income is recognised only when the contract is completed.

Amounts received from the customer during the performance of

the contract are treated as financial advances and accounted for as

a liability under advances from customers, while any amounts paid

to subcontractors are booked as advances under inventories.

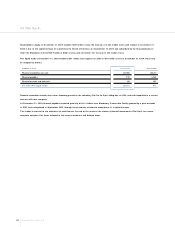

Under IFRS (IAS 11), when the outcome of a construction

contract can be estimated reliably, revenue and expenses regarding

construction contracts must be accounted by reference to the

percentage of work completed, in this way recognising margins for

the contract activity performed up to the balance sheet date.The

terms and conditions regarding the legal transfer of title are irrelevant

to the reporting of these amounts in the financial statements. Thus,

any advances received are deducted from the value of inventories

(contract work in progress and advances to suppliers).

Consequently, the adoption of IFRS will entail recognition of

the margins earned on contracts, with a positive net impact

on stockholders’ equity at January 1, 2005.

4.Treasury stock

In accordance with Italian GAAP, Fiat S.p.A. accounts for treasury

stock as an asset and records any related value adjustments and gains

or losses on disposal in the income statement.

Under IFRS, treasury stock is deducted from stockholders’ equity and

all movements in treasury stock are recorded in stockholders’ equity

rather than in the income statement.

5. Sale of receivables

Fiat S.p.A. sells a significant part of its trade and tax receivables

through factoring transactions.

Factoring transactions may be with or without recourse to the seller;

certain factoring agreements without recourse include deferred purchase

price clauses (i.e. the payment of a minority portion of the purchase

price is conditional upon the full collection of the receivables), require

a first loss guarantee of the seller up to a limited amount or imply a

continuing significant exposure to the cash flows from receivables sold.

Under Italian GAAP, all receivables sold through factoring transactions

(both with and without recourse) have been derecognised.