Capital One 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

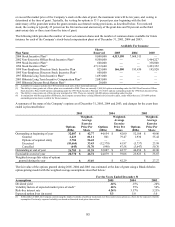

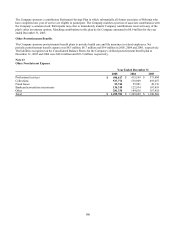

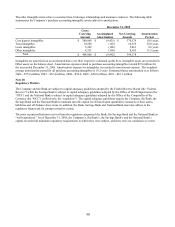

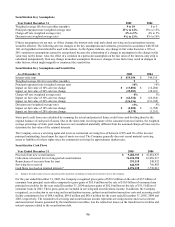

The other intangible items relate to customer lists, brokerage relationships and insurance contracts. The following table

mmarizes the Company’ s purchase accounting intangible assets subject to amortization. su

December 31, 2005

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Amortization

Period

Core deposit intangibles $ 380,000 $ (9,421) $ 370,579 10.0 years

Trust intangibles 10,500 (145) 10,355 18.0 years

Lease intangibles 5,209 (148) 5,061 9.6 years

Other intangibles 8,351 (168) 8,183 11.5 years

Total $ 404,060 $ (9,882) 394,178

Intangibles are amortized on an accelerated basis over their respective estimated useful lives. Intangible assets are recorded in

Other assets on the balance sheet. Amortization expense related to purchase accounting intangibles totaled $9.9 million for

the year ended December 31, 2005. Amortization expense for intangibles is recorded to non-interest expense. The weighted

average amortization period for all purchase accounting intangibles is 10.2 years. Estimated future amortization is as follows:

006—$75.0 million, 2007—$67.4 million, 2008—$59.4, 2009—$50.8 million, 2010—$43.1 million. 2

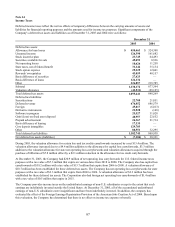

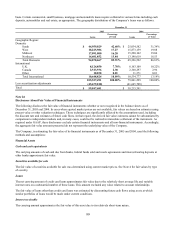

Note 18

Regulatory Matters

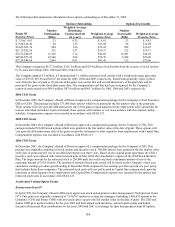

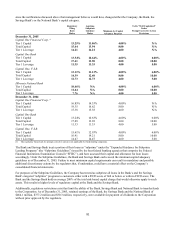

The Company and the Bank are subject to capital adequacy guidelines adopted by the Federal Reserve Board (the “Federal

Reserve”) while the Savings Bank is subject to capital adequacy guidelines adopted by the Office of Thrift Supervision (the

“OTS”) and the National Bank is subject to capital adequacy guidelines adopted by the Office of the Comptroller of the

Currency (the “OCC”) (collectively, the “regulators”). The capital adequacy guidelines require the Company, the Bank, the

Savings Bank and the National Bank to maintain specific capital levels based upon quantitative measures of their assets,

liabilities and off-balance sheet items. In addition, the Bank, Savings Bank and National Bank must also adhere to the

gulatory framework for prompt corrective action. re

The most recent notifications received from the regulators categorized the Bank, the Savings Bank and the National Bank as

“well-capitalized.” As of December 31, 2005, the Company’ s, the Bank’ s, the Savings Bank’ s and the National Bank’ s

capital exceeded all minimum regulatory requirements to which they were subject, and there were no conditions or events

90