Capital One 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

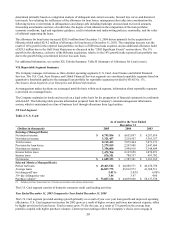

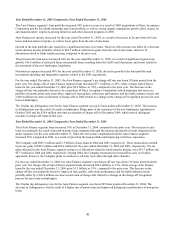

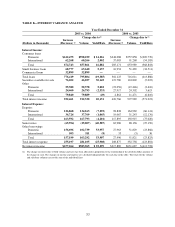

T

able 7: Deposit Composition and Average Deposit Rates

Year Ended December 31, 2005

Average

Balance % of

Deposits

Average

Deposit

Rate

Non-interest bearing—domestic $ 628,648 2.17% N/A

NOW accounts 63,889 0.22 2.02%

Money market deposit accounts 3,941,591 13.58 3.02

Savings Accounts 408,781 1.41 2.22

Other consumer time deposits 11,759,791 40.52 2.90

Total core deposits 16,802,700 57.90 2.91

Public fund certificate of deposits of $100,000 or more 202,568 0.70 3.45

Certificates of deposit of $100,000 or more 9,350,957 32.22 6.01

Foreign time deposits 2,663,427 9.18 5.04

Total deposits $ 29,019,652 100.00% 4.13%

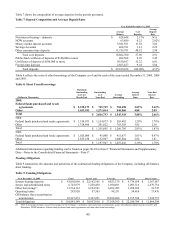

Table 8 reflects the costs of other borrowings of the Company as of and for each of the years ended December 31, 2005, 2004

and 2003.

Table 8: Short Term Borrowings

(Dollars in Thousands)

Maximum

Outstanding

as of any

Month-End

Outstanding

as of

Year-End Average

Outstanding

Average

Interest

Rate

Year-End

Interest

Rate

2005:

Federal funds purchased and resale

agreements $ 2,332,173 $ 745,719 $ 704,458 2.69% 3.62%

Other 1,453,181 1,271,014 840,860 4.88 2.09

Total $ 2,016,733 $ 1,545,318 3.88% 2.66%

2004:

Federal funds purchased and resale agreements $ 1,154,073 $ 1,154,073 $ 503,482 1.29% 1.78%

Other 1,318,404 201,622 763,303 3.85 2.10

Total $ 1,355,695 $ 1,266,785 2.83% 1.83%

2003:

Federal funds purchased and resale agreements $ 1,025,000 $ 45,000 $ 412,637 1.01% 0.97%

Other 1,835,238 1,152,947 1,006,804 2.82 1.81

Total $ 1,197,947 $ 1,419,441 2.30% 1.78%

Data—Notes to the Consolidated Financial Statements—Note 9”.

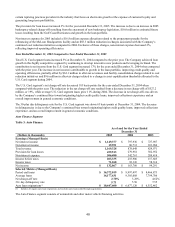

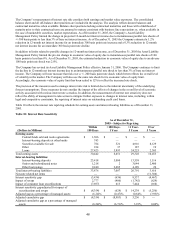

Funding Obligations

Table 9 summarizes the amounts and maturities of the contractual funding obligations of the Company, including off-balance

eet funding. sh

Table 9: Funding Obligations

As of December 31, 2005 Total Up to 1 year 1-3 years 4-5 years After 5 years

Interest-bearing deposits $ 43,092,096 $ 22,162,105 $ 9,823,370 $ 9,739,034 $ 1,367,587

Senior and subordinated notes 6,743,979 1,220,438 1,950,491 1,093,316 2,479,734

Other borrowings(1) 15,534,161 6,194,521 6,262,285 3,058,620 18,735

Operating leases 283,920 57,503 98,531 54,410 73,476

Off-balance sheet securitization

amortization 45,227,433 9,323,251 19,824,086 8,155,324 7,924,772

Total obligations $ 110,881,589 $ 38,957,818 $ 37,958,763 $ 22,100,704 $ 11,864,304

(1) Other borrowings includes secured borrowings for the Company’ s on-balance sheet auto loan securitizations, junior subordinated capital income securities and

debentures, FHLB advances, federal funds purchased and resale agreements and other short-term borrowings.

45

Table 7 shows the composition of average deposits for the periods presented.

Additional information regarding funding can be found on pages 80-82 in Item 8 “Financial Statements and Supplementary