Capital One 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

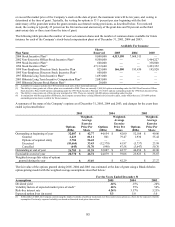

The National Bank is required to maintain cash on hand or non-interest bearing balances with the Federal Reserve to meet

reserve requirements. The National Bank’ s non-interest bearing balance with the Federal Reserve was $57.6 million as of

ecember 31, 2005. D

Note 19

Commitments, Contingencies and Guarantees

L

etters of Credit and Financial Guarantees

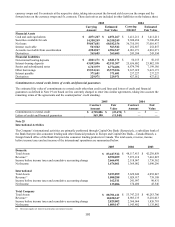

As a result of the acquisition of Hibernia, the Company issues letters of credit and financial guarantees (“standby letters of

credit”) whereby it agrees to honor certain financial commitments in the event its customers are unable to perform. The

majority of the standby letters of credit consist of financial guarantees. Collateral requirements are similar to those for funded

transactions and are established based on management’ s credit assessment of the customer. Management conducts regular

reviews of all outstanding standby letters of credit and customer acceptances, and the results of these reviews are considered

in assessing the adequacy of the Company’ s allowance for loan losses.

The Company had contractual amounts of standby letters of credit of $569.2 million at December 31, 2005. As of

December 31, 2005, standby letters of credit had expiration dates ranging from 2006 to 2010. The fair value of the guarantees

outstanding at December 31, 2005 that have been issued since January 1, 2003, was $4.7 million and was included in other

abilities. li

L

oan and Line of Credit Commitments

As of December 31, 2005, the Company had approximately $156.8 billion of unused credit card lines. While this amount

represented the total unused available credit card lines, the Company has not experienced, and does not anticipate, that all of

its customers will exercise their entire available line at any given point in time. The Company generally has the right to

i crease, reduce, cancel, alter or amend the terms of these available lines of credit at any time. n

As a result of the acquisition of Hibernia, the Company enters into commitments to extend credit that are legally binding

conditional agreements having fixed expirations or termination dates and specified interest rates and purposes. These

commitments generally require customers to maintain certain credit standards. Collateral requirements and loan-to-value

ratios are the same as those for funded transactions and are established based on management’ s credit assessment of the

customer. Commitments may expire without being drawn upon. Therefore, the total commitment amount does not necessarily

represent future requirements. The outstanding unfunded commitments to extend credit other than credit card lines were

pproximately $4.7 billion as of December 31, 2005. a

L

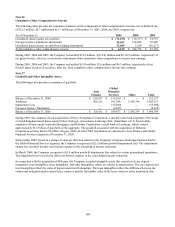

ease Commitments

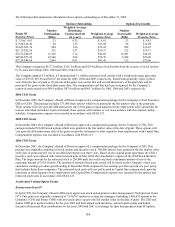

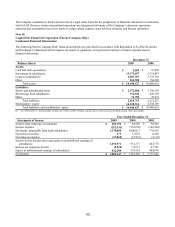

Certain premises and equipment are leased under agreements that expire at various dates through 2035, without taking into

consideration available renewal options. Many of these leases provide for payment by the lessee of property taxes, insurance

premiums, cost of maintenance and other costs. In some cases, rentals are subject to increases in relation to a cost of living

index. Total rent expenses amounted to approximately $68.1 million, $38.5 million, and $63.7 million for the years ended

ecember 31, 2005, 2004 and 2003, respectively. D

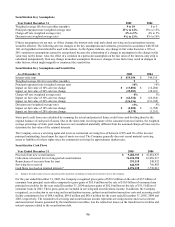

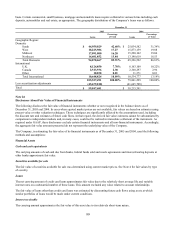

Future minimum rental commitments as of December 31, 2005, for all non-cancelable operating leases with initial or

maining terms of one year or more are as follows: re

2006

$ 57,503

2007 53,132

2008 45,399

2009 34,437

2010 19,973

Thereafter 73,476

Total $ 283,920

Minimum sublease rental income of $7.4 million, due in future years under noncancelable leases, has not been included in the

table above as a reduction to minimum lease payments.

92