Capital One 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 1

S

ignificant Accounting Policies

B

usiness

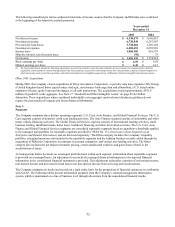

The Consolidated Financial Statements include the accounts of Capital One Financial Corporation (the “Corporation”) and its

subsidiaries. The Corporation is a diversified financial services company whose subsidiaries market a variety of financial

products and services to consumers. The principal subsidiaries are Capital One Bank (the “Bank”), which offers credit card

products and deposit products, Capital One, F.S.B. (the “Savings Bank”), which offers consumer and commercial lending and

consumer deposit products, Capital One Auto Finance, Inc. (“COAF”), which offers automobile and other motor vehicle

financing products and Hibernia National Bank (the “National Bank”) which offers a broad spectrum of financial products

and services to consumers, small businesses and commercial clients. Capital One Services, Inc. (“COSI”), another subsidiary

of the Corporation, provides various operating, administrative and other services to the Corporation and its subsidiaries. The

orporation and its subsidiaries are collectively referred to as the “Company.” C

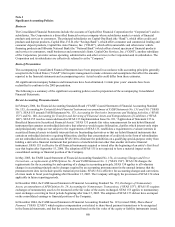

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared in accordance with accounting principles generally

accepted in the United States (“GAAP”) that require management to make estimates and assumptions that affect the amounts

reported in the financial statements and accompanying notes. Actual results could differ from these estimates.

All significant intercompany balances and transactions have been eliminated. Certain prior years’ amounts have been

classified to conform to the 2005 presentation. re

The following is a summary of the significant accounting policies used in preparation of the accompanying Consolidated

Financial Statements.

R

ecent Accounting Pronouncements

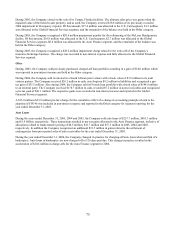

In February 2006, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standard

No. 155, Accounting for Certain Hybrid Financial Instruments-an amendment of FASB Statements No. 133 and 140, (“SFAS

155”). SFAS 155 amends FASB Statements No. 133, Accounting for Derivative Instruments and Hedging Activities, (“SFAS

133”) and No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities, (“SFAS

140”). SFAS 155 resolves issues addressed in SFAS 133 Implementation Issue No. D1, “Application of Statement 133 to

Beneficial Interests in Securitized Financial Assets.” SFAS 155 permits fair value remeasurement for any hybrid financial

instrument that contains an embedded derivative that otherwise would require bifurcation, clarifies which interest-only strips

and principal-only strips are not subject to the requirements of SFAS 133, establishes a requirement to evaluate interests in

securitized financial assets to identify interests that are freestanding derivatives or that are hybrid financial instruments that

contain an embedded derivative requiring bifurcation, clarifies that concentrations of credit risk in the form of subordination

are not embedded derivatives, and amends SFAS 140 to eliminate the prohibition on a qualifying special-purpose entity from

holding a derivative financial instrument that pertains to a beneficial interest other than another derivative financial

instrument. SFAS 155 is effective for all financial instruments acquired or issued after the beginning of an entity’ s first fiscal

year that begins after September 15, 2006. The adoption of SFAS 155 is not expected to have a material impact on the

onsolidated earnings or financial position of the Company. c

In May 2005, the FASB issued Statement of Financial Accounting Standard No. 154, Accounting Changes and Error

Corrections—a replacement of APB Opinion No. 20 and FASB Statement No. 3, (“SFAS 154”). SFAS 154 changes the

requirements for the accounting for and reporting of a change in accounting principle. SFAS 154 applies to all voluntary

changes in accounting principle and to changes required by an accounting pronouncement in the unusual instance that the

pronouncement does not include specific transition provisions. SFAS 154 is effective for accounting changes and corrections

of errors made in fiscal years beginning after December 15, 2005. The Company will apply the provisions of SFAS 154 when

pplicable in future reporting periods. a

In December 2004, the FASB issued Statement of Financial Accounting Standard No. 153, Exchanges of Nonmonetary

Assets, an amendment of APB Opinion No. 29, Accounting for Nonmonetary Transactions, (“SFAS 153”). SFAS 153 requires

exchanges of nonmonetary assets to be measured at the fair value of the assets exchanged. SFAS 153 applies to nonmonetary

asset exchanges occurring in fiscal periods beginning after June 15, 2005. The adoption of SFAS 153 did not have an impact

n the consolidated earnings or financial position of the Company. o

In December 2004, the FASB issued Statement of Financial Accounting Standard No. 123 (revised 2004), Share-Based

Payment, (“SFAS 123(R)”) which requires compensation cost related to share-based payment transactions to be recognized

in the financial statements, and that the cost be measured based on the fair value of the equity or liability instruments issued.

66