Capital One 2005 Annual Report Download - page 79

Download and view the complete annual report

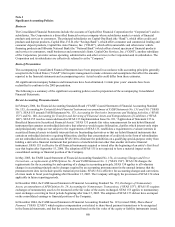

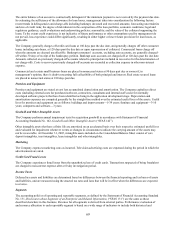

Please find page 79 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.forecasted operating results. See Note 3, Segments, for further discussion of the Company’ s operating and reportable

gments. se

D

erivative Instruments and Hedging Activities

The Company recognizes all of its derivative instruments as either assets or liabilities in the balance sheet at fair value. These

instruments are recorded in other assets or other liabilities on the balance sheet and in the operating section of the statement

of cash flows as increases (decreases) of other assets and other liabilities. The accounting for changes in the fair value (i.e.,

gains and losses) of a derivative instrument depends on whether it has been designated and qualifies as part of a hedging

relationship and, further, on the type of hedging relationship. For those derivative instruments that are designated and qualify

as hedging instruments, a company must designate the hedging instrument, based upon the exposure being hedged, as a fair

alue hedge, a cash flow hedge or a hedge of a net investment in a foreign operation. v

For derivative instruments that are designated and qualify as fair value hedges (i.e., hedging the exposure to changes in the

fair value of an asset or a liability or an identified portion thereof that is attributable to a particular risk), the gain or loss on

the derivative instrument as well as the offsetting loss or gain on the hedged item attributable to the hedged risk is recognized

in current earnings during the period of the change in fair values. For derivative instruments that are designated and qualify

as cash flow hedges (i.e., hedging the exposure to variability in expected future cash flows that is attributable to a particular

risk), the effective portion of the gain or loss on the derivative instrument is reported as a component of other comprehensive

income and reclassified into earnings in the same period or periods during which the hedged transaction affects earnings. The

remaining gain or loss on the derivative instrument in excess of the cumulative change in the present value of future cash

flows of the hedged item, if any, is recognized in current earnings during the period of change. For derivative instruments

that are designated and qualify as hedges of a net investment in a foreign operation, the gain or loss is reported in other

comprehensive income as part of the cumulative translation adjustment to the extent it is effective. For derivative instruments

not designated as hedging instruments, the gain or loss is recognized in current earnings during the period of change in the

fair value.

The Company formally documents all hedging relationships, as well as its risk management objective and strategy for

undertaking the hedge transaction. The hedge instrument and the hedged item are designated at the execution of the hedge

instrument or upon re-designation during the life of the hedge. At inception, at least quarterly or upon re-designation, the

Company also formally assesses whether the derivatives that are used in hedging transactions have been highly effective in

offsetting changes in the hedged items to which they are designated and whether those derivatives may be expected to remain

highly effective in future periods. Hedge effectiveness is assessed and measured under identical time periods. To the extent

that hedges qualify under paragraph 68 of SFAS 133, the Company uses the short-cut method to assess effectiveness.

Otherwise, the Company utilizes the dollar-offset method or matches the significant terms of the derivative and hedge item to

determine that the hedging transactions are/or have been highly effective. Changes in fair value of the hedged item and the

hedge instrument are maintained over the life of the hedge and are recorded as of the last day of the month or quarter. The

Company will discontinue hedge accounting prospectively when it is determined that a derivative has ceased to be highly

ffective as a hedge. e

S

tock-Based Compensation

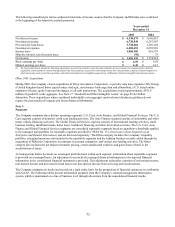

Prior to 2003, the Company applied Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees

(“APB 25”) and related Interpretations in accounting for its stock-based compensation plans. No compensation cost has been

recognized for the Company’ s fixed stock options for years prior to 2003, as the exercise price of all such options equals or

exceeds the market value of the underlying common stock on the date of grant. Effective January 1, 2003, the Company

adopted the expense recognition provisions of SFAS No. 123, prospectively to all awards granted, modified, or settled after

January 1, 2003. Typically, awards under the Company’ s plans vest over a three year period. Therefore, cost related to stock-

based compensation included in net income for 2005, 2004 and 2003 is less than that which would have been recognized if

70