Capital One 2005 Annual Report Download - page 60

Download and view the complete annual report

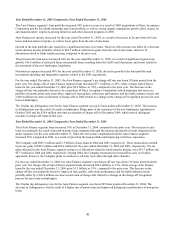

Please find page 60 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.its marketing capabilities and credit risk management will enable it to originate new credit card accounts that exceed the

ompany’ s return on investment requirements. C

A

uto Finance Segment

The Company’ s Auto Finance segment consisted of $16.4 billion of managed U.S. auto loans as of December 31, 2005,

marketed across the full credit spectrum, via direct and dealer marketing channels.

The 2005 acquisitions of Onyx Acceptance Corporation, the Key Bank non-prime portfolio, and the National Bank, along

with its auto lending business, have strengthened the Auto Finance segment’ s competitive position. The acquisitions have

enhanced our ability to lend across the entire credit spectrum and provided operating scale. The Company expects to integrate

these businesses more fully in 2006, and realize cost efficiencies and marketing synergies that will drive originations growth.

The Company believes that its strong risk management skills, increasing operating scale, full credit spectrum product

offerings and multi-channel marketing approach will enable it to continue to increase market share in the Auto Finance

industry.

Global Financial Services Segment

The Global Financial Services segment consisted of $23.4 billion of managed loans as of December 31, 2005, including

international lending activities, small business lending, installment loans, home loans, point of sale financing and other

consumer financial service activities.

The Company expects continued loan, credit and profit pressure from a deteriorating credit environment in its U.K. business.

Despite this pressure, the Company continues to expect profitable long term growth from its U.K. business and is

xperiencing strong results from its North American business. e

B

anking

With the acquisition of the National Bank on November 16, 2005, Capital One entered the branch banking market. Because

the transaction closed in the middle of the quarter, Hibernia’ s results were not separately reported as a segment in the fourth

quarter results. Beginning in the first quarter of 2006, a new banking segment will be disclosed, but it will not have the same

mix of business as the former National Bank.

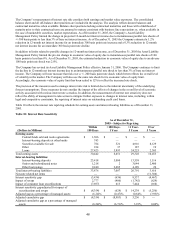

Hibernia has experienced a significant increase in deposits since the Gulf Coast Hurricanes in August 2005. The increase is

partially due to customers receiving federal funds and insurance payments relating to the hurricanes. The Company expects

that some of these incremental deposits will permanently remain with Hibernia, while others will be withdrawn and used for

building or reinvestment in the Gulf Coast area. re

The Company expects integration costs of around $90 million in 2006, and continues to expect total integration costs and

operating synergies to be broadly in line with original estimates when the Hibernia transaction was announced in March

2005.

51