Capital One 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

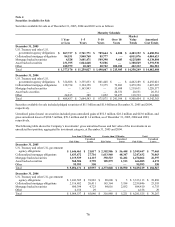

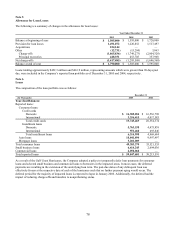

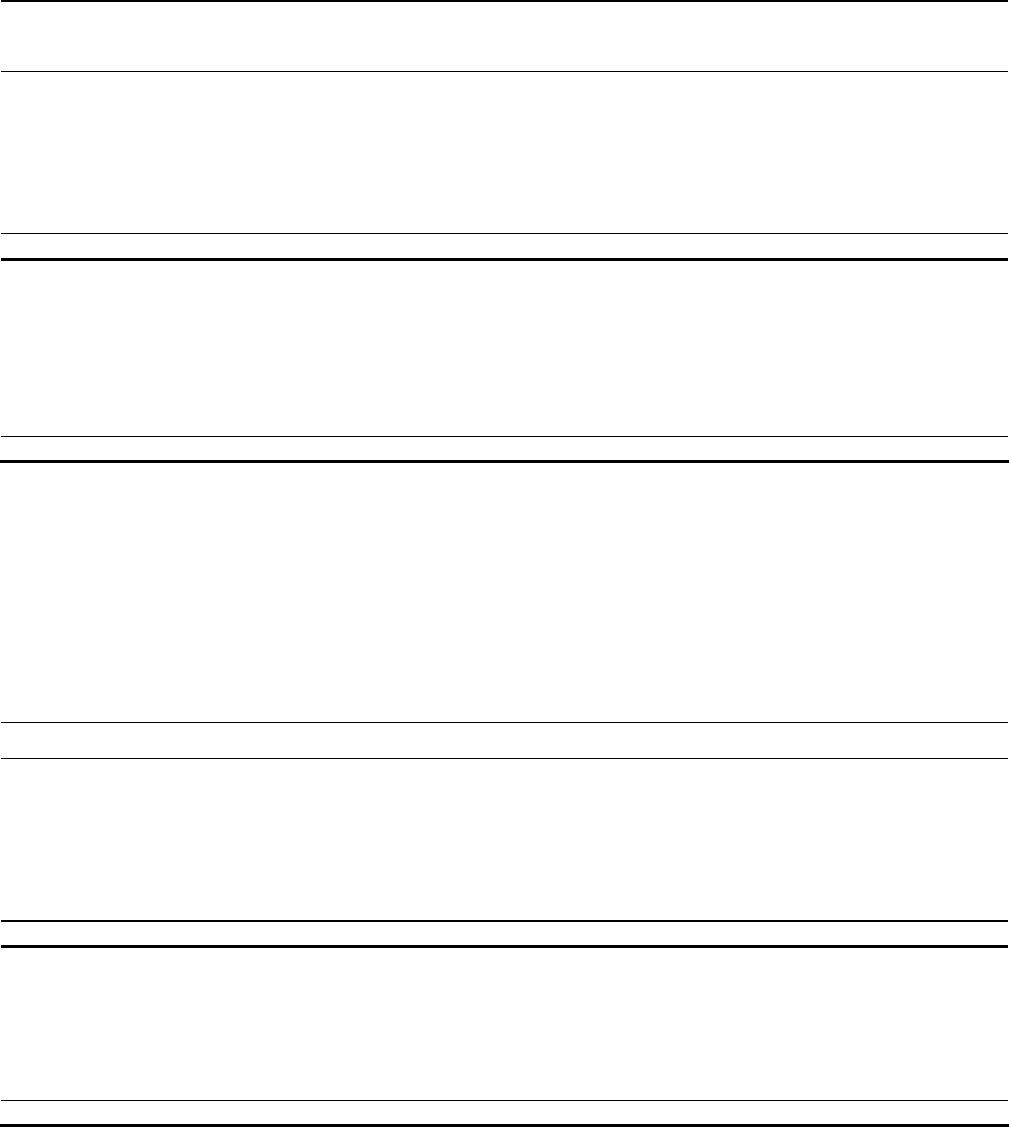

Note 4

S

ecurities Available for Sale

S

ecurities available for sale as of December 31, 2005, 2004 and 2003 were as follows:

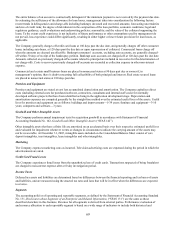

Maturity Schedule

1 Year

or Less

1–5

Years

5–10

Years

Over 10

Years

Market

Value

Totals

Amortized

Cost Totals

December 31, 2005

U.S. Treasury and other U.S.

government agency obligations $ 867,737 $ 2,741,771 $ 789,664 $ 4,020 $ 4,403,192 $ 4,480,536

Collateralized mortgage obligations 84,531 3,840,768 85,777 — 4,011,076 4,084,633

Mortgage backed securities 4,528 3,601,471 509,398 9,683 4,125,080 4,138,804

Asset backed securities 231,395 1,064,668 92,506 — 1,388,569 1,391,930

Other 188,979 10,349 20,722 202,282 422,332 386,581

Total $ 1,377,170 $ 11,259,027 $ 1,498,067 $ 215,985 $ 14,350,249 $ 14,482,484

December 31, 2004

U.S. Treasury and other U.S.

government agency obligations $ 324,888 $ 3,335,853 $ 801,448 $ — $ 4,462,189 $ 4,492,021

138,734 3,194,358 73,375 72,883 3,479,350 3,495,207

Mortgage backed securities — 1,163,943 — 55,688 1,219,631 1,220,577

Asset back securities — — — 20,551 20,551 20,532

Other 24,815 389 1,052 92,477 118,733 114,026

Total $ 488,437 $ 7,694,543 $ 875,875 $ 241,599 $ 9,300,454 $ 9,342,363

Securities available for sale included pledged securities of $5.1 billion and $1.6 billion at December 31, 2005 and 2004,

spectively. re

Unrealized gains (losses) on securities included gross unrealized gains of $52.3 million, $28.2 million and $43.0 million, and

gross unrealized losses of $184.5 million, $70.3 million and $11.6 million, as of December 31, 2005, 2004 and 2003,

spectively. re

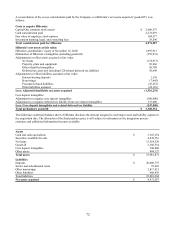

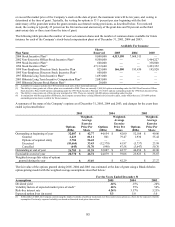

The following table shows the Company’ s investments’ gross unrealized losses and fair value of the investments in an

nrealized loss position, aggregated by investment category, at December 31, 2005 and 2004. u

Less than 12 Months Greater than 12 Months Total

Fair Value Unrealized

Losses Fair Value Unrealized

Losses Fair Value Unrealized

Losses

December 31, 2005

U.S. Treasury and other U.S. government

agency obligations $ 1,646,461 $ 21,017 $ 2,302,986 $ 56,448 $ 3,949,447 $ 77,465

Collateralized mortgage obligations 1,633,672 27,716 1,613,960 48,347 3,247,632 76,063

Mortgage backed securities 1,119,539 14,115 350,523 12,282 1,470,062 26,397

Asset backed securities 560,506 2,759 105,579 1,513 666,085 4,272

Other 95,993 350 — — 95,993 350

Total $ 5,056,171 $ 65,957 $ 4,373,048 $ 118,590 $ 9,429,219 $ 184,547

December 31, 2004

U.S. Treasury and other U.S. government

agency obligations $ 3,243,505 $ 39,883 $ 89,608 $ 5 $ 3,333,113 $ 39,888

Collateralized mortgage obligations 2,116,482 20,411 143,364 3,184 2,259,846 23,595

Mortgage backed securities 600,394 4,723 84,016 2,032 684,410 6,755

Other 4,156 29 — — 4,156 29

Total $ 5,964,537 $ 65,046 $ 316,988 $ 5,221 $ 6,281,525 $ 70,267

76

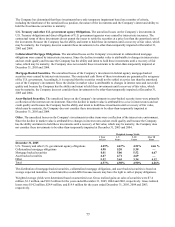

obligations

Collateralized mortgage